Indian solar will be “hit hard” by coronavirus-triggered disruption due to the industry’s 80% dependence on PV equipment imports from China as well as labour shortages, according to a report from Wood Mackenzie.

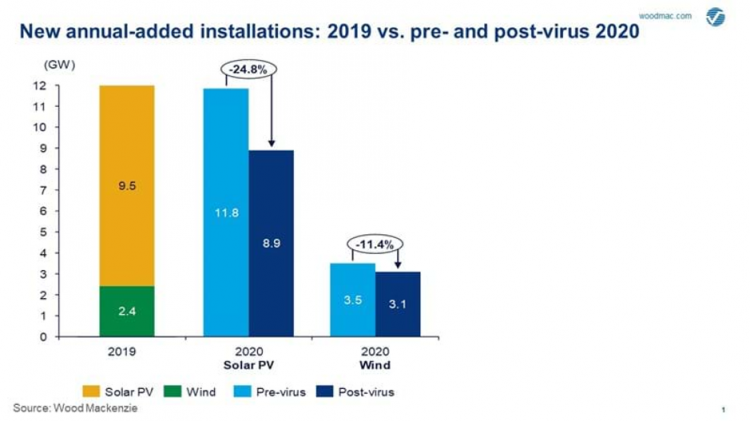

The consultancy predicted solar deployment will drop by 2.9GW in the Asian nation this year, a 24.8% reduction on original forecasts. The decline means just 8.9GW in new installations are now expected over the year, a 0.6GW drop on the capacity added over 2019.

“Current supply and labour disruptions will have an outsized negative impact on 2020 installations,” said Wood Mackenzie senior analyst Rishab Shrestha.

“Q1 is expected to be strongly impacted with a potential 60% year-on-year quarterly downgrade, or 1.2GW, down from about 3GW in Q1 2019. We remain cautious on the outlook for the second half of the year as supply and logistics bottlenecks linger,” he added.

While the lockdown measures in India are intended to halt the spread of COVID-19, Wood Mackenzie analysts warned that an extension of the shutdown would cause a severe financial impact on India's distribution companies (Discoms). This would then hit wind and solar developer cashflows, while corporate bank loans for new project development “could slow to a trickle”.

last week that the hit on Discom finances could, on the other hand, indirectly boost the business case for commercial and industrial (C&I) solar providers, as Discoms would likely raise industrial grid tariffs to mitigate their financial woes.

The wind sector’s busiest period for installations is typically in Q1, said Wood Mackenzie principal analyst Robert Liew. As a result, the pan-India lockdown will result in many projects being delayed to the summer, or even into the monsoon season if restrictions on movement are maintained past April. With weather tricky during the monsoon, this is also typically the least busy period for wind.

Of the 3GW of wind scheduled for completion in 2020, 400MW are now expected to be delayed into 2021, again due to labour and supply bottlenecks.

Adding to the misfortune, Wood Mackenzie identified a correspondence between states with the highest coronavirus infection rates and the areas that are most favourable to wind and solar development.

The top three solar states in 2019 were Karnataka (2GW), Tamil Nadu (1.6GW) and Rajasthan (1.7GW), all of which are in the top ten worst-hit states.

Gujarat, which added 58% (1.4GW) of all new Indian wind capacity last year, is also in the top 10 ranking of states most affected by the virus so far.