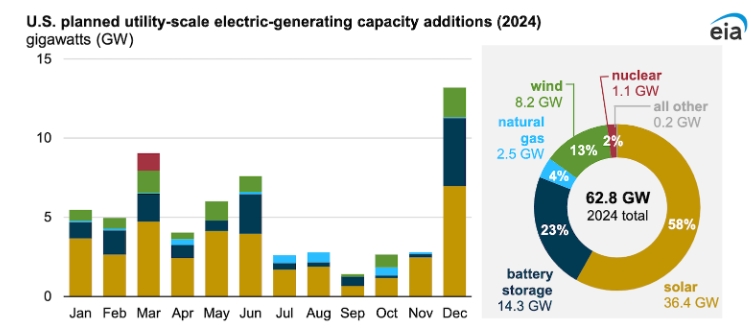

That 62.8 GW of new electricity capacity planned for this year will be 55 percent more than the 40.4 GW of electricity that was added in 2023. The vast majority — 36.4 GW, or 58 percent — will come from new utility-scale solar installations. Last year, only 18.4 GW of solar capacity was added to the grid as supply chain and permitting issues continued to impact the solar industry. In addition, another 14.3 GW, or 23 percent, will be provided by new battery storage facilities, 23 percent of the total. In all, solar and battery storage will be responsible for more than 80 percent of all new electricity capacity in the US this year.

New Electricity From Solar Highest In Texas

Three states — Texas, California, and Florida — will account for more than half of new solar installations this year. Texas will see by far the largest part of the total — 35 percent — while California will be responsible for 10 percent and Florida another 6 percent. Elsewhere, the Gemini solar facility in Nevada plans to begin operating in 2024. With a planned photovoltaic capacity of 690 megawatts (MW) and battery storage of 380 MW, it is expected to be the largest solar project in the United States when fully operational.

In 2023, 6.4 GW of new battery storage capacity for electricity were added to the US grid, a 70 percent annual increase. The EIA says it expects US battery storage capacity to nearly double in 2024 as developers report plans to add 14.3 GW of battery storage this year. At the end of 2023, total battery storage capacity in the US was 15.5 GW. Texas, with an expected 6.4 GW, and California, with an expected 5.2 GW, will account for 82% of the new US battery storage capacity.

Developers have scheduled the Menifee Power Bank (460.0 MW) at the site of the former Inland Empire Energy Center methane gas-fired power plant in Riverside, California, to come online in 2024. With the rise of solar and wind capacity in the United States, demand for electricity from battery storage continues to increase. The Inflation Reduction Act has also accelerated the development of energy storage by introducing investment tax credits for stand alone storage. Prior to the IRA, batteries qualified for federal tax credits only if they were co-located with solar.

Operators report another 8.2 GW of electricity generation capacity from wind turbines is scheduled to come online in 2024. Following the record additions of more than 14 GW in both 2020 and 2021, wind capacity additions have slowed in the last two years. Two large offshore wind plants scheduled to come online this year are the 800 MW Vineyard Wind 1 off the coast of Massachusetts and the 130 MW South Fork Wind off the coast of New York. South Fork Wind, which developers expected to begin commercial operation last year, is now scheduled to come online in March 2024.

Electricity from Methane Tumbles

For 2024, developers report 2.5 GW of new electricity capacity is planned from thermal generation powered by methane gas, the least amount of new gas capacity in 25 years, but there is more to that story. This year, 79 percent of new methane gas capacity will come from simple-cycle methane gas turbine (SCGT) plants. This will mark the first time since 2001 that combined cycle capacity was not the predominant methane gas-fired technology. SCGT power plants provide effective grid support because they can start up, ramp up, and ramp down relatively quickly. In other words, they are peaker plants only.

The message there is that the role of gas-fired generation is changing. Whereas once it was the preferred method for generating electricity, now it has transitioned to a supporting role in which it evens out the natural fluctuations in electricity from renewables. The EIA explains the differences in thermal generation methods the following way.

In general, power plants do not generate electricity at their full capacity every hour of the day. Three major types of generating units vary by intended usage:

Base load generating units normally supply all or part of the minimum, or base, demand (load) on the electric power grid. A base load generating unit runs continuously, producing electricity at a nearly constant rate throughout most of the day. Nuclear power plants generally operate as base load service because of their low fuel costs and the technical limitations on load responsive operation. Geothermal and biomass units are also often operated in base load because of their low fuel costs. Many of the large hydro facilities, several coal plants, and an increasing number of natural gas-fired generators, particularly those in combined power applications, also supply base load power.

Peak load generating units help to meet electricity demand when demand is at its highest, or peak, such as in the late afternoon when electricity use for air conditioning increases during hot weather. These so-called peaking units are generally natural gas- or petroleum-fueled generators. In general, these generators are relatively inefficient and are costly to operate but provide high- value service during peak demand periods. In some cases, pumped storage hydropower and conventional hydropower units also support grid operations by providing power during peak demand.

Intermediate load generating units make up the largest generating sector and provide load responsive operation between base load and peaking service. The demand profile varies over time and intermediate sources are in general technically and economically suited for following the changes in demand. Many energy sources and technologies are used in intermediate operation. Natural gas-fired combined-cycle units, which currently provide more generation than any other technology, generally operate as intermediate sources.

The Dead Last But Finished Category

The fourth reactor (1.1 GW) at Georgia’s Vogtle nuclear power plant, originally scheduled to come online last year, has been moved to March 2024. Vogtle Unit 3 began commercial operation at the end of July in 2023. There are no other new nuclear facilities planned in the US, and no wonder. A dozen years ago, senior editor Zachary Shahan reported the Vogtle project was already more than a billion dollars over budget.

Vogtle is a monument to why nuclear is not the answer to America’s need for electricity and an object lesson to anyone who cares to listen about why the dream of clean, inexpensive nuclear energy is a nightmare in reality. The cruel truth is that, because of how the utility industry is organized in America, the utility’s customers and the federal government will bear the brunt of this colossal mistake.

Even though the project has been a boondoggle of epic proportions, the ratepayers who get electricity from Vogtle are on the hook to pay for this mess for the next 30 years or more. In addition, there are more than $8 billion in federal loan guarantees that have to be paid off as well. This hot mess is brought to us by a regulatory system that makes it necessary for utilities to invest in new capacity in order to increase their earnings. The investors and executives will be handsomely rewarded for pursuing this boneheaded scheme, while ratepayers will feel the knives in their backs every month when they get their utility bills.

As far as new coal capacity goes, it is somewhere in that “All Other” category at 0.2 GW or 0.32 percent. So much for the “war on coal.”

The Takeaway

The IEA report is good news for clean electricity in America, but there is a subtext here that needs mentioning — China. Most of the solar panels that will provide that new electricity capacity will be manufactured in China in an area of that country that is suspected of using forced labor in its factories. The Biden administration has granted a two-year tariff reprieve even though it is clear that supplies from China are undercutting US suppliers. Politics is a messy business.

Second, many of those battery storage facilities we are happy to see added to the grid use battery cells manufactured in China. The Marine Corps has just disconnected a year-old BESS facility because the batteries were supplied by CATL. Is anyone under the illusion that only US-made battery cells are being used in all 14.3 GW of new storage capacity the EIA thinks will come online this year? If the Marine Corps is concerned Xi Jinping is monitoring data from our energy storage facilities, why are we not similarly concerned about all those other BESS installations that use Chinese-made batteries?

These are troubling questions. On the one hand, we desperately need all the renewable electricity we can get. On the other hand, our energy security shouldn’t be dependent on a foreign power that may not have our best interests at heart. If you have a solution to this dilemma, please share it with us in the comments section.