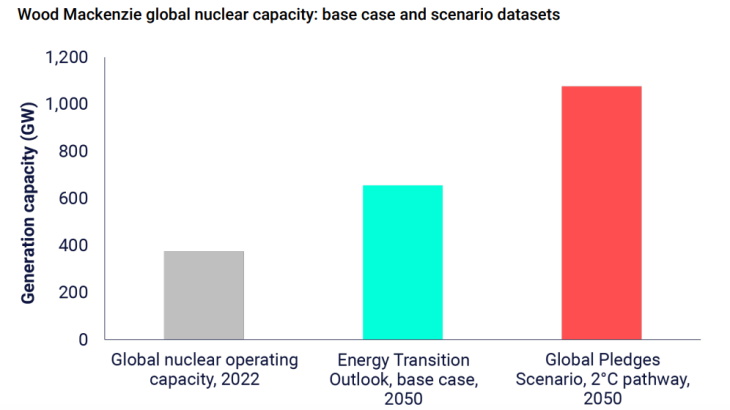

With nuclear generating capacity set to increase by 280 GWe by 2050, the biggest economic hurdle to the uptake of the latest large reactors and small modular reactors (SMRs) is cost, according to independent energy research consultancy Wood Mackenzie.

(Image: Wood Mackenzie)

"Wood Mackenzie believes nuclear should play a central role in decarbonisation for many countries," the company said. "Under our base case, nuclear capacity expands 280 GW by 2050. Under our Global Pledges Scenario, consistent with a 2°C warming pathway, a tripling of nuclear capacity is required."

However, in its new report - titled The nuclear option: Making new nuclear power viable in the energy transition - Wood Mackenzie says that high costs are "arguably the biggest impediment to a nuclear renaissance".

According to its estimates, conventional nuclear power currently has a levelised cost of electricity (LCOE) "at least four times that of wind and solar".

"Investors and policymakers need to think holistically in evaluating and comparing nuclear costs with those of other technologies," the report says. "LCOE is just one metric for quantifying the competitiveness of generation technologies. Typically, LCOE does not take into account additional grid costs and these can often increase the relative cost of wind and solar compared with baseload energy sources, including nuclear.

"Even so, the nuclear industry will have to address the cost challenge with urgency if it is to participate in the huge growth opportunity that low-carbon power presents. At current levels, the cost gap is just too great for nuclear to grow rapidly".

(Image: Wood Mackenzie Energy Transition Service)

Wood Mackenzie says SMRs will play a small part in the power market through to 2030, "largely because high costs are holding back deployment, the decade is already passing by, and construction timelines mean at best only a few plants will be built". It notes industry estimates of first of a kind (FOAK) SMR costs of USD6000-8000 per kilowatt. "Wood Mackenzie analysts expect that FOAK costs will be at the high end of this range, and could be even higher, as developers build out early-stage projects," according to the report.

There are only six potential FOAK SMR projects in the pipeline between 2023-2030, ranging in size from 80 MW to about 450 MW, it notes. The amount of FOAK SMR investment remains uncertain and will be influenced by multiple factors, such as financing terms, commodity costs, uranium availability and the political will to see projects succeed.

According to Wood Mackenzie, at least 10-15 projects - between 3000 and 4500 MW of capacity for a standard 300 MW SMR - need to be under development between 2030 and 2040 to support lower SMR costs.

The report says there are four key aspects of expanding nuclear that need greater focus: policymakers need to set out clear rules for planning, permitting, regulation and safety; expanding uranium supply and processing would help promote long-term price stability and availability; developers need to establish and refine their skillset; and offtake agreements will need to be more creative than ever.

"Governments, developers and investors must work collaboratively to establish a new ecosystem for nuclear to flourish," the report says. "Expanding public support for nuclear will be critical to expanding investment; voters will need to embrace the value proposition of nuclear for it to have a social licence to operate. This is not as unrealistic as it sounds: today's nuclear industry grew out of the energy security concerns and high commodity prices of the 1970s - similar market dynamics to those we face today."

David Brown, Director, Energy Transition Service at Wood Mackenzie, and lead author of the report, said: "The nuclear industry will have to address the cost challenge with urgency if it is to participate in the huge growth opportunity that low-carbon power presents. At current levels, the cost gap is just too great for nuclear to grow rapidly."