The global ammonia market currently stands at 200 Mt per annum. Ammonia is used in everything from fertilizers and cleaning products to processes such as water purification and refrigeration. With such a broad use also comes major carbon impact, and a huge decarbonization potential that could affect many sectors.

Direct carbon dioxide emissions from the ammonia industry are an estimated 450 Mt CO2e per year: about 0.9% of total global greenhouse gas emissions. A shift to low-carbon ammonia, therefore, has a vital role to play in a net-zero-emissions economy.

“Ammonia could be one of the most important keys to unlocking the energy transition,” said Mariana Moreira, principal analyst for Wood Mackenzie Chemicals. “While the long-term benefits of low-carbon ammonia could be realized in a host of ways, including revolutionizing the power and energy markets, currently there is little incentive or demand to bring this process to scale. Natural gas prices are higher, but low-carbon ammonia production costs remain significantly higher than for conventional supply.”

“Therefore, it will take broad support from policymakers to ensure that ammonia producers are willing to make the investments needed to decarbonize the traditional ammonia industry, and for efficiencies and competition to bring down prices. This can create the scale needed for eventual future uses. The European Union is leading efforts in this area.”

In Wood Mackenzie’s base-case forecast, the global traditional demand switch to low-carbon ammonia will reach 21 Mt by 2030. If the EU meets its decabonisation targets, this could reach 43 Mt, or almost one-quarter of the current global market.

Low-carbon ammonia for energy

If scale is achieved, new energy markets for low-carbon could emerge in three key sectors:

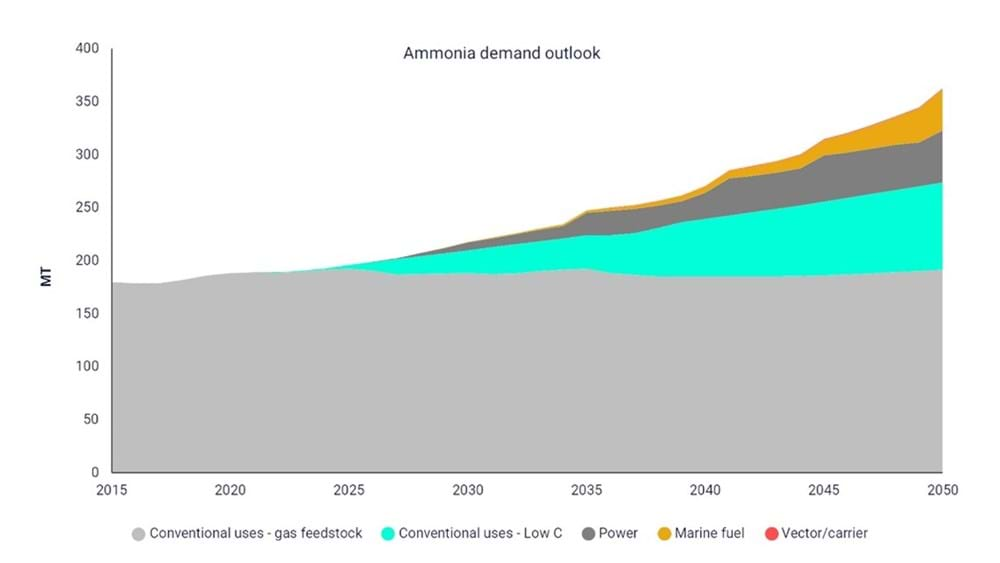

• Power - Ammonia as a fuel can be burned on its own, or as part of a fuel mix (ammonia co-firing). By 2050, the global potential for ammonia in both coal- and gas-based power generation is estimated at some 50 Mt in Wood Mackenzie’s base-case scenario, but could reach levels more than 100 Mt in a high-end scenario, where technology advances faster. Many power plants, especially coal-based, will benefit from co-firing with ammonia, reducing emissions.

• Maritime – Current projections by Wood Mackenzie’s downstream research team indicate that ammonia could make up for around 40% of global e-fuels by 2050, accounting for 40 Mt of demand.

• Hydrogen carrier – Ammonia is currently the most economical way to transport hydrogen over long distances. Developing the infrastructure and value chain to support ammonia as a hydrogen carrier will take significant investment, but it holds the potential to make a major impact on low-carbon ammonia beyond 2040.

Ammonia demand outlook by industry and by high/low carbon.

“It could still take decades for these new end uses to translate into demand on a scale that would incentivise the investments necessary to create enough competition to bring down prices. But the potential is very exciting, and ammonia could be the missing link in the energy transition,” said Moreira. “Ammonia is not currently used in power facilities, and this would be an effective way to introduce low-carbon hydrogen as a feedstock.”

Cost challenges remain

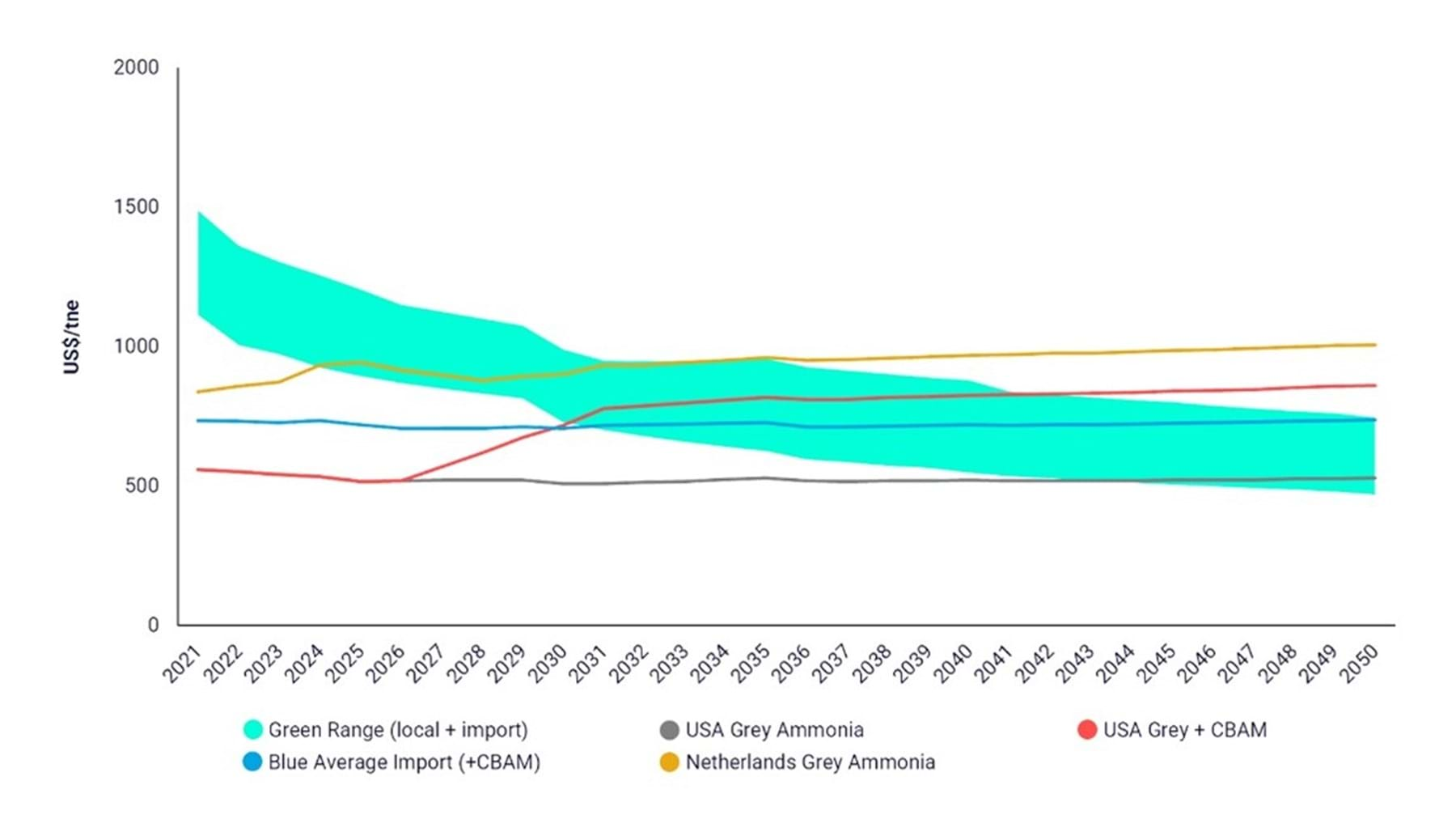

Low-carbon ammonia costs should remain significantly higher than grey ammonia, with natural gas as hydrogen source, for the next 10 years. As Europe will lead the ammonia transition to low-carbon feedstock, policies will have to be put in place to prevent the industry from leaving for overseas markets.

“As this transition occurs, European policymakers will want to avoid imported, carbon-intensive ammonia undermining European production, particularly because the fertiliser sector has important implications for food security,” said Moreira. “It will be a challenge. Our cost estimates show that low-cost grey ammonia sources (like the US) remain competitive with European low-carbon production for the next decade, becoming only marginally more expensive (much due to carbon taxation) out to 2040.”

Cost comparisons for grey, blue and green ammonia into Europe.

For More information about Wood Mackenzie’s Report:

Ammonia is one of the most versatile petrochemicals in the world. However, the potential for low-carbon ammonia remains largely untapped. This month’s Horizon’s explores how ammonia can be a major part of global decarbonization efforts and its potential use for future power markets.