As countries seek to reduce their greenhouse gas (GHG) emissions while providing cost-effective energy to businesses and consumers, hydrogen is emerging as a key technology – and it could soon be a multi-billion industry in the United States.

Two scenarios in the Energy Policy Simulator (EPS) illustrate pathways in which hydrogen becomes a major part of the U.S. energy mix, earning revenue of $130-170 billion per year by 2050 while lowering greenhouse gas (GHG) emissions by 20 or 120 million metric tons (Mt) of CO2 equivalent (CO2e) annually.

But to achieve even a small fraction of this level of hydrogen technology deployment, increased support for research and development will be crucial.

Hydrogen Poised for Global Expansion

Hydrogen, a flammable gas, emits no carbon dioxide (CO2) when it burns. This makes hydrogen different from fossil fuels like natural gas and petroleum, whose combustion is responsible for the vast majority of GHG emissions today.

Hydrogen technologies are not yet widely used, but some countries are investing heavily in their future. Japan, which sees hydrogen as a way to reduce costly energy imports, hopes to have 800,000 hydrogen-powered vehicles by 2030 and to reduce the cost of hydrogen production by 90% by 2050 – making it cheaper than natural gas.

In March, China announced a plan to develop its hydrogen fuel cell vehicle industry and subsidize hydrogen fueling station construction. California has a target of 200 hydrogen fueling stations and over 47,000 hydrogen vehicles by 2025 and is hoping that hydrogen will help balance its electric grid.

Yet, hydrogen’s greatest potential may be in the industrial sector, which uses the overwhelming majority of today’s hydrogen, particularly in oil refining and in ammonia, methanol, and steel production. Today, hydrogen is commonly used as a chemical feedstock, but there is potential for it to also be burned for heat. Many industrial processes require high temperatures, including firing of kilns for cement, ceramics, or glass; forging steel; and heating boilers to produce steam. In many high-heat processes, it is difficult or costly to replace fossil fuels with electricity with today’s technology. Hydrogen combustion offers a route by which industries can obtain high heat without direct GHG emissions.

The extent to which hydrogen prevents GHG emissions depends on how that hydrogen is made. Of the 70 Mt of hydrogen produced each year worldwide today, 76% comes from reforming natural gas, 22% from coal gasification, and 2% from electrolysis, in which electricity is used to split water into hydrogen and oxygen with zero emissions. The 98% of hydrogen production from fossil fuels emits 830 Mt of CO2 per year, equivalent to the annual emissions from the energy used by 100 million U.S. homes.

Possible Hydrogen Pathways

A new release of the U.S. EPS, a free and open-source computer model that estimates the impacts of energy technologies and policies, allows users to explore the future of hydrogen in the U.S. Three scenarios highlight some of the most interesting results:

A business-as-usual case (BAU) shows modest growth in hydrogen vehicles, in line with predictions from the U.S. Energy Information Administration. Hydrogen is not used in industry except as a feedstock. U.S. hydrogen production remains dominated by fossil fuels (where 95% comes from natural gas and 5% from electrolysis).

A hydrogen demand (HD) case gradually increases the share of newly-sold, hydrogen-powered on-road vehicles to 5% (cars and light trucks) or 10% (buses, medium trucks, and heavy trucks) by 2050. Also, industry shifts 10% of its non-feedstock fossil energy use to hydrogen by 2050. However, hydrogen production remains dominated by reforming natural gas (95% natural gas, 5% electrolysis).

A hydrogen demand plus electrolysis (HD+E) case includes growth in hydrogen demand in the transportation and industry sectors identical to the HD case, and hydrogen production gradually transitions to 100% electrolysis by 2050.

The HD and HD+E scenarios illustrate the potential impacts of large-scale hydrogen deployment and are not meant to realistically predict future decarbonization pathways. In reality, many non-hydrogen technologies (such as vehicle and industry electrification, increased energy and material efficiency, etc.) will also play important roles in reducing emissions.

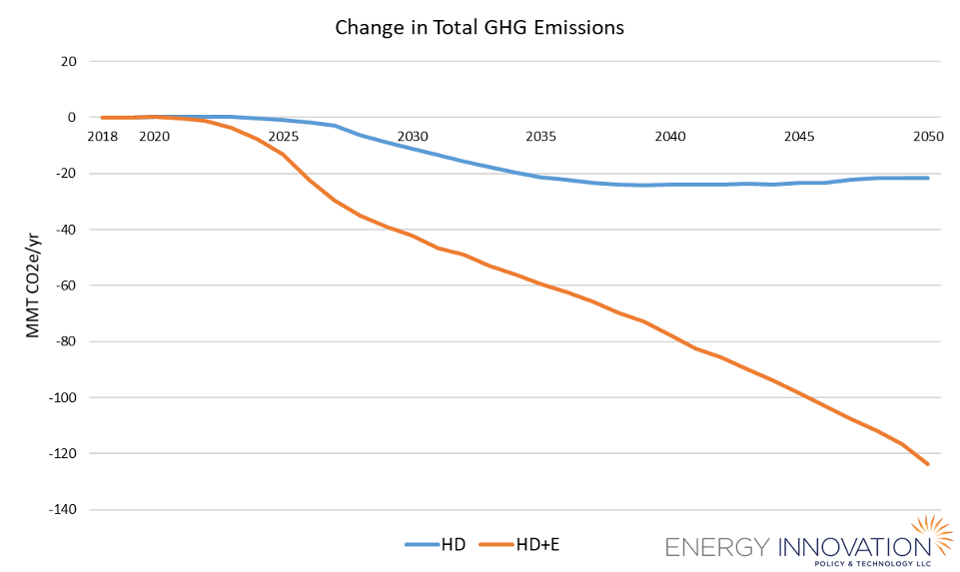

Both the HD and HD+E scenarios reduce total GHG emissions relative to the BAU case (Fig 1). By 2050, the HD case reduces GHG emissions by 20 Mt of CO2e per year, while the HD+E case reduces GHG emissions by over 120 Mt CO2e per year in 2050 – comparable to removing 25 million passenger vehicles from U.S. roads.

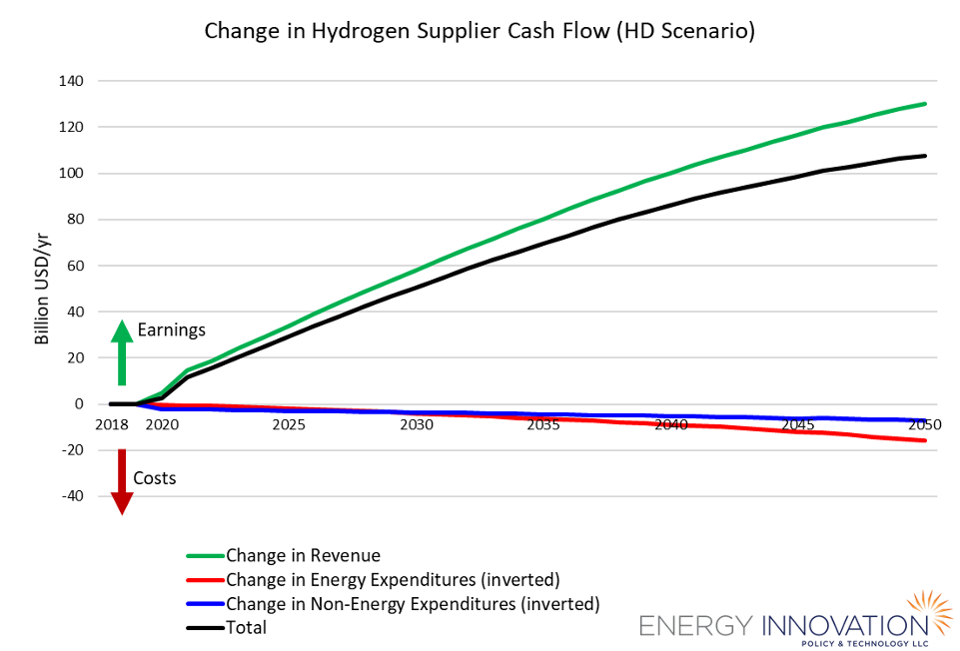

In the HD scenario, U.S. hydrogen supply becomes a $130 billion per year industry by 2050 (Fig 2). Hydrogen sector revenues and profits rise rapidly through the early 2030s, with revenue growth slowing only slightly due to technology-driven declines in the cost of hydrogen production (and, hence, retail prices). Energy expenditures remain low, due to the low cost of natural gas and relatively high efficiency of transforming natural gas into hydrogen.

Note that non-energy expenditures (the blue lines in Figures 2 and 3) include capital equipment to produce hydrogen, as well as operations and maintenance costs for that equipment. They do not include the costs of building or maintaining hydrogen distribution infrastructure, such as new pipelines, tanker trucks, or storage tanks. Some industrial facilities may generate their hydrogen on-site, and it is possible to transform hydrogen into other high-energy molecules that are compatible with existing energy infrastructure (such as ammonia or methane) with modest energy losses, both approaches that could minimize the need for new distribution infrastructure.

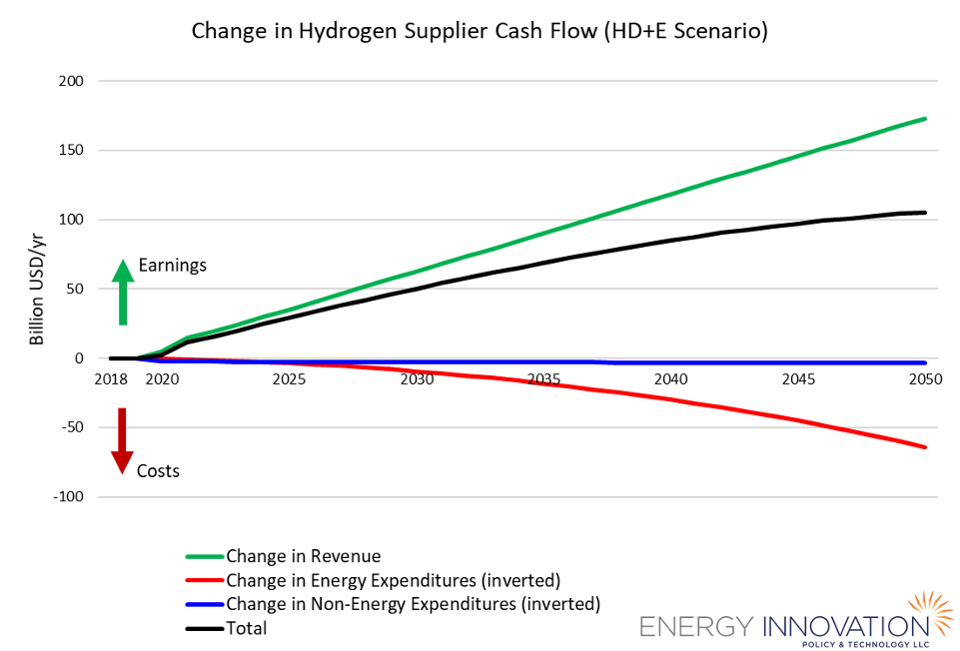

In the HD+E scenario, the hydrogen supply sector sees much higher energy expenditures than in the HD scenario (Fig 3, red line), because it is more expensive to purchase electricity for electrolysis than to purchase natural gas for steam reforming. Electricity costs more than natural gas per unit energy, and less energy is required to convert natural gas to hydrogen than to split water, as natural gas consists of high-energy molecules (primarily methane), while water is a low-energy molecule.

However, hydrogen suppliers are able to pass these increased energy costs on to hydrogen buyers, as the increases in hydrogen demand in the HD and HD+E scenarios are fixed (i.e. hydrogen demand does not respond to changes in hydrogen’s retail price in these scenarios), and a lack of hydrogen import/export availability prevents the influence of a global market that could hold down hydrogen prices.

Therefore, increased revenue for hydrogen suppliers offsets their higher fuel expenditures, and they achieve a profit of over $100 billion per year by 2050 in the HD+E scenario, similar to their profit in the HD scenario.

Costs to hydrogen buyers could be lower if technology breakthroughs lower the costs or improve the efficiency of electrolysis, if electricity prices are lower than expected, if a robust import/export market for hydrogen develops, or if alternative zero-carbon hydrogen production technologies (such as thermochemical water splitting) are commercialized and surpass electrolysis in cost-effectiveness.

Achieving a hydrogen-powered future

No one fuel or technology is by itself the solution to climate change, but hydrogen has the potential to be an important part of a decarbonized energy system.

Hydrogen shows particular promise in decarbonizing industrial processes that are not amenable to electrification. Though industrial facilities would generally need new equipment to burn hydrogen, as noted above, hydrogen may be transformed into other high-energy molecules that are compatible with existing industrial equipment. This could allow for a gradual transition to hydrogen, avoiding early equipment retirements or write-offs. Working in harmony with industry’s equipment replacement cycles and minimizing factory downtime will be important for rolling out this new technology.

This transition depends upon high-quality research and development into hydrogen technologies, particularly in developing cheaper and more efficient ways to produce GHG-free hydrogen. While many clean energy technologies are cost-effective today (such as wind and solar power, battery electric cars, smart thermostats, and more), hydrogen technology needs more research to achieve its full potential.

There are crucial ways governments can support research and development, including long-term funding commitments, partnerships between national labs and the private sector, and immigration and education systems that provide companies with the high-level STEM (science, technology, engineering, and math) talent they need.

Even as the U.S. deploys proven, emissions-reducing technologies today – including solar power, wind power, and energy efficiency – we must invest in research and development, to ensure that hydrogen technology is ready to transform the last few, difficult-to-decarbonize elements of the energy system in the coming decades.