Japanese companies are racing to create momentum for fusion power, a nascent technology that is rapidly gaining attention in the U.S., the U.K. and China as a potential source of clean energy. The technology is expected to be on the agenda at this week's summit between the leaders of Japan and the U.S.

Twenty-one companies, including Sumitomo Corp., IHI, Furukawa Electric, as well as startups, on March 29 launched the Japan Fusion Energy Council, or J-Fusion, an industry group that will work to speed up technological development in fusion and lobby the government on safety rules and standards.

The members hope to spur funding to avoid falling behind foreign rivals in the race to commercialize fusion power. The group will also engage with the public, where wariness over nuclear technology lingers 13 years after the devastating meltdowns at the Fukushima nuclear plant. More than 50 companies have shown interest in joining the group.

"We cannot sustainably generate large amounts of power with existing energy sources like fossil fuels, nuclear or renewables," which come with climate and energy security concerns, said Takaya Taguchi, co-CEO of Tokyo-based startup Helical Fusion and one of the founders of J-Fusion.

He believes the solution lies in fusion, which happens when the nuclei of lighter elements merge. Fusion powers the sun and stars. If it can be harnessed on Earth, it could generate huge amounts of energy from small quantities of material -- mainly deuterium and tritium, which are widely available from seawater -- without producing carbon dioxide emissions or high-level radioactive waste. Fusion is also considered safer than conventional nuclear power, which creates energy through fission, that is, splitting the nucleus of an atom in two.

Taguchi's company aims to have a pilot fusion plant up and running by 2034. He says this will give Japan access to a primary energy source within its borders and help tackle long-standing concerns over energy security.

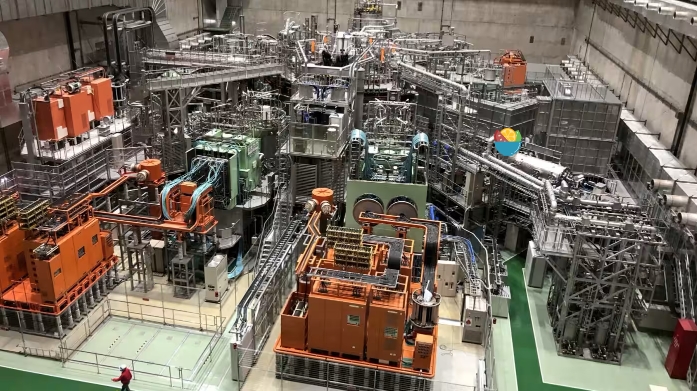

apan has been engaged in research and development of fusion for decades, and is home to many skilled manufacturers, but lags the U.S. and U.K. in terms of enthusiasm in the private sector," Taguchi told Nikkei Asia in a recent interview. "It would be a shame to lose out in the global race due to funding issues."

The two Western countries are pushing hard to develop fusion power as the industry experiences notable growth worldwide. About 40 companies had secured over $6 billion in investment as of June 2023, up 27% from the year before, according to a report by the U.S.-based Fusion Industry Association.

The biggest recipient of investment at that time was Commonwealth Fusion Systems, at over $2 billion, followed by TAE Technologies at over $1.2 billion, according to the report. Both companies are headquartered in the U.S. ENN Science and Technology Development of China and Tokamak Energy of the U.K. were also well funded, with $400 million and $250 million at their disposal, respectively.

By comparison, the total capital raised by Japanese companies came to just over $98 million, with Kyoto Fusioneering securing $91 million, the report said.

Taguchi's Helical Fusion, which obtained another 2 billion yen ($13 million) in government funding in October, after the report was published, is looking to secure another few hundred billion yen. "We want to first collect this domestically, as relying too much on foreign investors could weaken our position," he said. "For starters, public funding will be key."

The government drafted a national strategy to "industrialize" fusion energy a year ago, outlining its aim to commercialize the technology by around 2050, and to support startups and other entrants into the field. The strategy noted that, "Fusion startups in countries such as the U.S. and U.K. are accelerating the competition in research and development, amid active private investment."

It added: "In China, the government is strongly promoting plans to construct experimental equipment and prototype reactors, which could pose a threat to research and development competition in the future."

Governments are also stepping up their collaboration on fusion as countries seek ways to implement the clean energy transition. Japan and the U.S. are expected to agree on exchanging personnel and sharing facilities in fusion research when Prime Minister Fumio Kishida meets President Joe Biden in Washington on Wednesday.

While Japan's newly launched industry group is a step forward, Taguchi acknowledged that enthusiasm for fusion varies widely among member companies. "Some are skeptical, as the technology is not established yet," he said. "Others are occupied with other existing nuclear power technologies."

"We've been participating in national research projects on fusion, and we welcome the participation of today's startups," said Hitoshi Kaguchi, a representative director with J-Fusion member Mitsubishi Heavy Industries. At the same time, Kaguchi said, "Fusion is a very difficult technological field," drawing on his past experience of studying fusion in university and as a veteran of the company's nuclear power business.

As a nuclear technology, fusion also faces possible public resistance, particularly given Japan's searing experience of the Fukushima nuclear power plant disaster in 2011. While polls show that more Japanese are willing to rely on nuclear power as the meltdowns recede into the past, Helical Fusion's Taguchi said the level of acceptance among local governments varies when he consults them about building a fusion plant.

"Places where the image of Fukushima is deeply marked are sensitive, but others welcome it as a next-generation technology," Taguchi said.