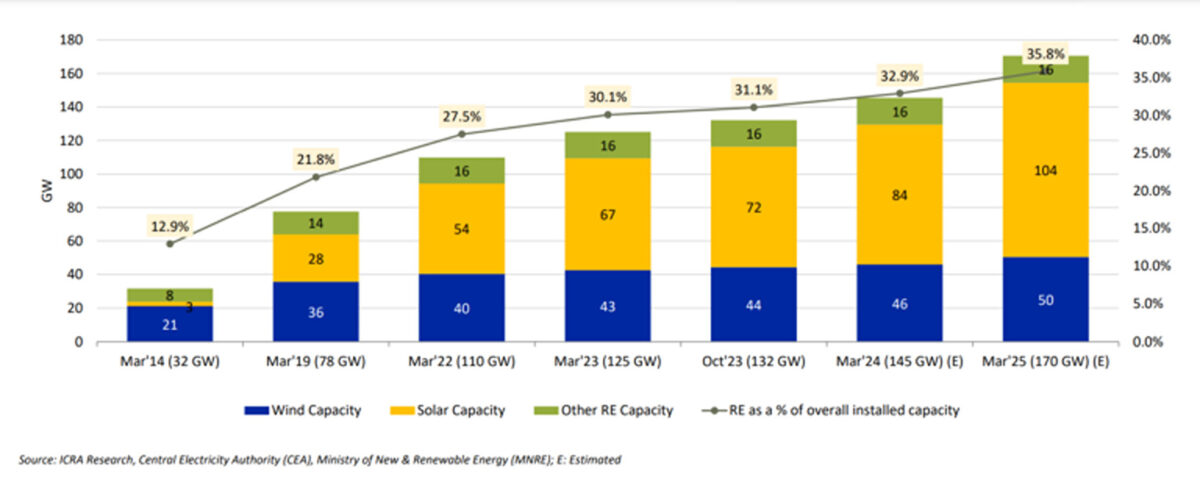

ICRA said renewable energy capacity additions will increase further after March 2025 due to a significant improvement in tendering activity in the current fiscal with over 16 GW of projects, including 11.2 GW solar, and another 17 GW expected to come from the tenders held by the central nodal agencies. This is in line with the 50 GW annual bidding trajectory announced by the Indian government in March 2023.

Vikram V, vice president & sector head – Corporate Ratings, ICRA, cited the sharp decline in solar PV cell and module prices and the timeline extension approved for solar and hybrid projects as the primary drivers for the improvement in renewable energy capacity additions to 20 GW in fiscal year 2024 from 15 GW in fiscal year2023. This, along with the growing project pipeline, is likely to support the scale-up in capacity addition to 25 GW in fiscal year 2025, mainly driven by the solar power segment.

However, the capacity addition prospects could be hampered by challenges on the execution front, such as delays in land acquisition and transmission connectivity, Vikram said.

The sharp decline in solar PV cell and module prices by 65% and 50%, respectively, over the past 12 months is leading to a healthy improvement in debt coverage metrics for the upcoming solar power projects. Benefitting from this, for a solar power project with a bid tariff of INR 2.5 ($0.030)/kWh and sourcing modules from domestic OEMs using imported PV cells, the average debt service coverage ratio (DSCR), has improved by over 35 bps.

“While this is a positive in the near term, the developers would remain exposed to movement in imported solar PV cell and wafer prices, till the development of fully integrated module manufacturing units in India,” Vikran said.

The rise in the renewable energy capacity over the next six years is estimated to increase the share of renewables plus large hydro in the all-India electricity generation from 23% in fiscal year 2023 to around 40% in fiscal year 2030. Given the intermittency associated with renewable energy generation, the availability of round-the-clock (RTC) supply from renewable sources remains important. This can be made possible through the use of wind and solar power projects complemented with energy storage systems.

“The tariffs discovered in the RE-RTC tenders so far remain highly competitive against the conventional sources, with recent bid tariffs in the range of INR 4.0-4.5 per kWh, well below the INR 5.2 per kWh discovered in the recent medium-term bid for supply from coal-based projects,” Vikram said. “The share of RE-based RTC projects is expected to rise in the upcoming bids as already seen from the tenders issued by the Solar Energy Corp. of India Ltd (SECI) in the current fiscal.”

“The returns for the winning developer under the RTC bids remain linked with the cost of the storage component, apart from the cost associated with the wind and solar components. Further, based on the prevailing capital cost of battery energy storage systems (BESS) and pumped hydro storage projects (PSP) projects, the viability of the RTC projects remains relatively better with the use of PSP capacity,” he added.