Federal goals and incentives are laying a launch pad for renewable hydrogen, aiming at a five-fold increase from current capacity, but biogenic hydrogen could be left on the ground if some environmental advocates succeed in getting restrictive rules.

The Biden administration’s goal is to expand clean hydrogen production from today’s nominal levels to 10 million metric tons per annum (MMTpa) by 2030 and 50 MMTpa by 2050, backed by serious money. The 2021 Bipartisan Infrastructure Law allocates $7 billion to build regional clean hydrogen hubs and the Inflation Reduction Act includes a production tax credit worth between sixty cents for carbon intensity (CI) between 2.5 and 4 kilograms of CO2 equivalent per kilogram of hydrogen (kgCO2e/kgH2), up to a maximum of $3/kg for a CI lower than 0.45 kg CO2e/kg. The details of how CI will be measured and what will be eligible are yet to be determined. A debate is raging right now about how restrictive those rules should be. .

Biogenic supporters point out that biogas, particularly dairy manure, could support carbon negative hydrogen. The U.S. DOE reports pyrolysis, though less than 1% of current U.S. production, produces hydrogen with carbon intensities (CI) in a range of 1.5-3.5. kgCO2e/kg H2. That category appears to include other forms of biogenic hydrogen.

Currently, industry annually produces about 10 million metric tons per in the U.S. and 90 million metric tons globally, mostly at oil refineries to be used in refining, ammonia-based fertilizer and other large-scale chemical production. Using natural gas as the feedstock, hydrogen production generates about 100 million metric tons of greenhouse gases (GHG) each year, according to the DOE’s draft “National Clean Hydrogen Strategy and Roadmap.” The DOE projects the use of clean hydrogen can enable a 40-90% reduction in GHG emissions by displacing incumbent fossil fuels. Defining exactly what “clean hydrogen” means is one of the tasks ahead.

The DOE’s document “Clean Hydrogen Pathway to Commercial Liftoff” lays out the vision further. Hydrogen can help fuel difficult-to-decarbonize sectors in industry, chemicals, heavy duty transportation, aviation and marine applications. The document covers the challenges and opportunities in building infrastructure and markets applicable to all production methods, but when it comes to discussing production hurdles, the focus is entirely on electrolysis. “Biogas has been sort of a footnote,” says Gabriel Olson, director of carbon strategy and policy at BayoTech, adding that it is significant that biogenic sources of hydrogen are explicitly named in federal incentives, even though only given a nod in DOE documents.

Headquartered in Albuquerque, New Mexico, BayoTech provides gas storage and transportation equipment, supplying about 80% of the California on-road hydrogen transport market, Olson says. This summer, the company is commissioning its first commercial, modular small-scale hydrogen production unit just west of St. Louis at Wentzville, Missouri. The facility will produce 350 tons per year for local industrial gas suppliers, fleet operators and fuel cell equipment manufacturers in a 300-mile radius. Siting its plant on the Ranken Technical College Campus, BayoTech is collaborating with the college to educate and certify skilled workers, developing curriculum on hydrogen manufacturing, plant operations and maintenance, as well as dispensing, fueling and transportation.

BayoTech’s scaled-down steam methane reactor (SMR) builds on technology first developed by Sandia National Laboratory to efficiently miniaturize the massive oil refinery SMR units. Putting production close to the end user minimizes transportation and storage costs, Olson says. “What we were seeing even before the tax credit in the Inflation Reduction Act is an emerging need for hydrogen for a variety of end uses. They’re smaller customers, but typically they don’t have access to a reliable and cost-effective supply of hydrogen.”

There are not many suppliers of hydrogen, Olson says, so the large players effectively have a monopoly, which is reflected in unfavorable contracts and retail prices as high as $30/kg. “We see that as an opportunity,” Olson says. “We see the ability to be more attractive on pricing and contract terms, and to be more flexible.” He lists chip manufacturers, pharmaceuticals and a variety of food products as near-term markets as well as future, larger markets in fueling heavy-duty trucks and power generation, particularly in back-up generators.

While BayoTech’s modular SMR units could be colocated with a biogas producer at a wastewater treatment facility, landfill or livestock anaerobic digester, Olson expects the units will more likely be sited closer to the hydrogen users. In order to produce carbon neutral hydrogen, BayoTech will utilize book-and-claim accounting, contracting the environmental assets of biogas produced elsewhere and applying those credits to the hydrogen produced at their facilities, which use locally supplied pipeline natural gas.

Policy Uncertainties

Two factors could impact the economics of leveraging biogas as a feedstock to create low-carbon hydrogen—the fate of book-and-claim accounting and the framework of the federal production tax credits. “Dairy biogas is considered to be deeply negative with a CI score of negative 300,” Olson says. “That’s great, because you can use that negative carbon intensity to offset your carbon emissions and reach carbon neutrality cost effectively. But the environmental folks in the debate around the production tax credit say ‘That’s not accurate, not fair. Don’t give negative value to biogas, it should be zero at best. ’ ”

Another potential landmine is efforts to disallow book-and-claim. “There’s a debate in California and Colorado that you can’t use biogas from out of state if you want their incentives,” he says. “Some are looking to restrict book-and-claim to only allow local, or even onsite use of biogas.”

On top of those two concerns is uncertainty about how the carbon intensity of hydrogen will be determined for the new federal incentives and the specifics of the eligibility rules. Katrina Fritz, executive director the California Hydrogen Business Council, concurs the debate around federal rules is critically important. “The two packages of incentives at the federal level, the Infrastructure Investment and Jobs Act and the Inflation Reduction Act, have different carbon intensity requirements. The IRS still has to issue guidance, and there’s a hot debate on how strict will it be with hydrogen.” Some groups are advocating stricter rules than any other resource or technology, she says. “There’s no requirement that the grid be 100% renewable when you charge your electric vehicle. Some want a requirement that only hydrogen produced from electrolyzers using wind or solar is allowed, which would totally exclude biomass.”

The business council advocates for inclusive policies that allow the use of biomass and waste to generate hydrogen, and for equal treatment for biogenic hydrogen in any mandates, she says. “It’s been determined by numerous studies and research to be necessary as a decarbonization pathway, and it’s included in the climate change scoping update from 2022 by the California Air Resources Board as a necessary pathway.”

California’s Hydrogen Expansion

California’s Low Carbon Fuel Standard has been a major driver behind the state becoming the nation’s, and indeed the world’s, leading market for hydrogen. Almost 16,000 cars and 66 buses traverse the state’s roads, with another 103 buses on order. The state has 58 hydrogen fueling stations for cars today, with 37 proposed or under construction. For light- duty vehicles, adding hydrogen fueling can be as simple as adding a pump to existing gas stations. “The footprint is much smaller to put in one pump than to have charging stations for an hour or two,” she says.

The infrastructure for heavy-duty trucks is beginning to develop as well, with three stations in service and another nine funded. That is expected to pick up pace as fleet operators plan for the state’s goal of reaching 100% zero emission vehicles by 2035. They’re going to test both batteries and hydrogen, Fritz says, adding that hydrogen offers some advantages. In addition to a longer range for fuel cell vehicles and much shorter time requirement for refueling with hydrogen, there’s an infrastructure hurdle to overcome for batteries. Charging a fleet of 20 or 30 heavy-duty trucks requires not only upgrading a facility’s electrical system, but often the substation providing the power. The queues for getting that work done are five or 10 years long, Fritz says. “Today, you can get the hydrogen infrastructure built in one year.”

California hopes to boost its growing hydrogen sector with the aid of a DOE hydrogen hub grant. The infrastructure act allocated $7 billion to support six to eight hydrogen hubs across the nation. “California has a huge coalition of organizations, companies, the California university system and the governor’s office,” Fritz says. California’s $1.6 billion proposal seeks to demonstrate several production systems, including renewables, as well as delivery and end uses. The competition will be stiff, as Fritz reports 33 full proposals were submitted to the DOE. “There will be a very extensive review process,” she adds. “If you’re awarding more than $1 billion to a project, you want to make sure those projects are going to succeed, that they’re going to move the market.”

Building Out California’s Biogenic Hydrogen Sector

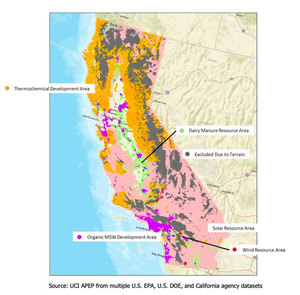

The following sampling of biogenic hydrogen projects under development in California demonstrates the multiple approaches being developed to utilize the state’s bountiful biogas, biomass and waste streams.

Yosemite Clean Energy. Yosemite Clean Energy received two $500,000 grants from the California Department of Conservation for its forest biomass to carbon-negative fuels projects. Announced in January, the first grant supports Yosemite’s flagship project in Oroville, California, to produce 24 tons of hydrogen per day. The second grant will support preliminary engineering for Yosemite’s Tuolumne County hydrogen project. Using Austrian firm Repute’s technology, Yosemite gasifies woody biomass into syngas, which is then processed into hydrogen and renewable natural gas. Both gasification and reforming technologies are proven, commercialized processes. In its news release announcing the Oroville project, Yosemite describes its business model as a democratization of clean energy with partial ownership by farmers and forest landowners, who in return will provide wood waste gathered at the end of an orchard’s lifecycle or through sustainable forest management.

Raven SR. Also in January, Wyoming-headquartered Raven SR Inc. announced a collaboration with Chevron New Energies and Hyzon Motors to commercialize a green waste-to-hydrogen production facility at Richmond, California. To produce the hydrogen, the project is expected to divert up to 99 wet tons of green and food waste per day from a landfill into Raven’s noncombustion steam/CO2 reforming process, producing up to 2,400 tons annually of renewable hydrogen. Chevron plans to market its share of hydrogen in northern California. Hyzon, a global supplier of fuel cell electric commercial vehicles, plans to develop a hydrogen fueling hub in Richmond.

The Raven SR technology is a noncombustion thermal, chemical reductive process that converts organic waste and landfill gas to hydrogen and Fischer-Tropsch synthetic fuels. In describing its technology, Raven says it is unlike other hydrogen production technologies in that its steam/CO2 reformation does not require fresh water as a feedstock and uses less than half the energy of electrolysis. The process is more efficient than conventional hydrogen production and can deliver fuel with low to negative carbon intensity. Additionally, Raven SR’s goal is to generate as much of its own power onsite as possible to reduce reliance on or be independent of the grid. Its modular design provides a scalable means to locally produce renewable hydrogen and synthetic liquid fuels from local waste.

SGH2 Energy. SGH2 Energy is partnering with the city of Lancaster, California, to process 40,000 tons of mixed waste to generate 12,000 kg of hydrogen per day, or 3.8 million kg (3,800 tons) per year. The company will use its patented Solana Plasma Enhanced Gasfication technology to convert waste “from paper to plastics, tires to textiles” into green hydrogen. The process uses a plasma-enhanced thermal catalytic conversion process optimized with oxygen-enriched gas. In the gasification island’s catalyst-bed chamber, plasma forces generate high temperatures that disintegrate the feedstock without ash. The syngas goes through a pressure swing absorber system resulting in pure hydrogen. In February, the company received the final approval from the Lancaster Planning Commission, getting the green light for the engineering, procurement and construction phase of the project. The approval also clears the company to receive a $3 million grant award from the state.

FuelCell Energy. FuelCell Energy expects to bring its Trigeneration Direct Fuel Cell Power Plant online this fall at the Toyota Logistics Services facility in the Port of Long Beach, California. In its 2022 annual report, the company described the project as “the first fuel cell project in the world to produce electricity, hydrogen and water from direct renewable biogas. To our knowledge, this will be the only distributed hydrogen platform in the world with a 20-year off take agreement with an investment-grade counterparty.”

Biogas sourced from agricultural waste will be utilized by the Trigen facility to produce 1.2 tons of hydrogen, supporting 10,000 Toyota Mirai fuel cell vehicles processed at the port annually, and a fleet of 20 or more Class 8 fuel cell electric trucks. Trigen will also generate 2.3 MW of renewable electricity, more than what the port facility requires. Byproduct water generated by the system will supplement municipal water for the onsite car wash.