Image: AFRY

At an event organized by Afry Management Consulting, the consequences of closing nuclear power plants in Spain were analyzed, and the potential deployment of solar and wind energy to compensate for the loss of capacity was discussed.

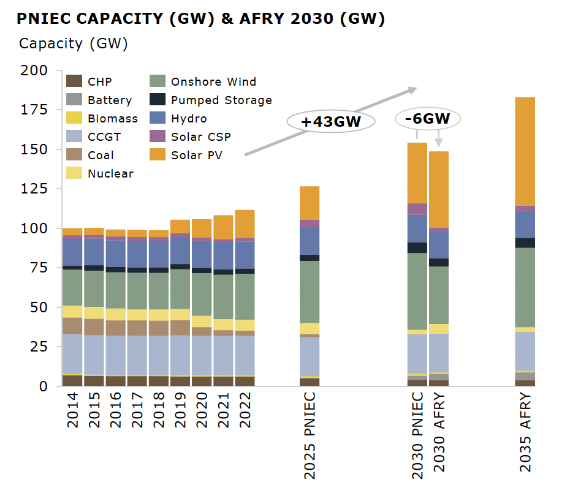

Currently, there are 60 GW of approved large-scale renewable projects, while the Spanish solar association UNEF has requested an upward revision of the country's energy strategy to enable the deployment of an additional 65 GW of PV capacity by 2030.

If the current deployment rate continues, it is projected that there will be 75 GW of installed capacity in 2030, surpassing the forecasts of the current energy strategy. Solar power is expected to exceed 50 GW, while wind power may not reach 40 GW due to approval process barriers.

In extreme scenarios modeled by Afry, the difference in solar revenue between a scenario of moderate renewables and high battery penetration and a scenario of high renewable penetration would be almost €40/MWh, with the latter dropping below €20/MWh from 2025.

The consultancy company highlights that there are many launched projects whose realization is uncertain and that the high renewable penetration scenario has less installed PV capacity in 2030 than the new objectives proposed for the energy strategy.

Regarding storage, Afry suggests that up to 17 GW, including pumped hydro, would be profitable but would require incentives for installation. The consultancy foresees 3-4 GW of grid-connected electrolyzers by 2030 in a basic scenario.

As solar prices decline, revenue for producers decreases, making power purchase agreements (PPAs) unfeasible if retail prices fall below the levelized cost of energy (LCOE). Only the government would be willing to pay above-market prices in such a scenario.

The early closure of nuclear plants would increase reliance on gas combined cycle plants, leading to higher prices and more volatility. It raises the question of whether to prioritize greater renewable generation with higher emissions or delay nuclear shutdown to reduce emissions and slow down renewable deployment.

A study on the security of supply in the event of nuclear shutdown has also been deemed necessary.