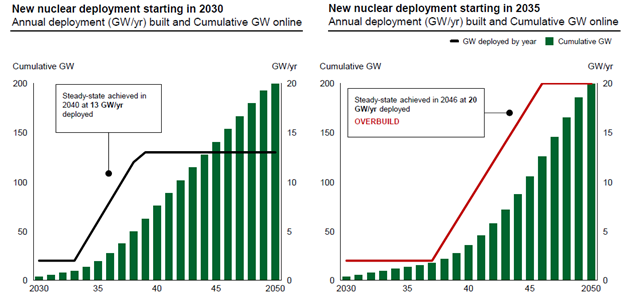

These graphs illustrate how rapidly scaling the nuclear industrial base would enable nearer-term decarbonization and increase capital efficiency, versus a five-year delay to reach the same 200 GW deployment by 2050. (Source: DOE, Pathways to Commercial Liftoff: Advanced Nuclear, Fig. 1)

The Department of Energy released Pathways to Commercial Liftoff: Advanced Nuclear earlier this month. It is one of the first in a series of reports on clean energy technologies and the private and public investments needed to overcome hurdles to full-scale deployment. The report makes a clear case for investment in nuclear power and challenges potential investors and operators to move beyond the current “wait and see” stalemate and generate “a committed orderbook . . . for 5–10 deployments of at least one reactor design by 2025.”

Define “liftoff”: According to the Advanced Nuclear report, “‘liftoff’ refers to the economic and technical state at which the industry becomes self-sustaining in service of meeting U.S. decarbonization goals.”

The DOE says its Liftoff reports are “developed through extensive stakeholder engagement and a combination of system-level modeling and project-level financial modeling. . . . They do not reflect DOE official policy or strategic plans; they are a resource intended to inform decision-making across industry, investors, and the broader stakeholder community.”

Before we get into the details a few more definitions are needed. Useful (if overused) terms like “small modular reactor” and “advanced reactor” have been tailored to fit dozens of designs that may not have much in common. In this report, advanced reactors include “a range of proven and innovative technologies” in two categories: Gen III+ and Gen IV. Gen III+ designs are water cooled and fueled with low-enriched uranium, while Gen IV designs use “novel” fuels and coolants. Both Gen III+ and Gen IV reactors may be categorized as “large reactors (~1 GW), small modular reactors (~50–300 MW), and microreactors (50 MW or less).”

First steps for nuclear: Advanced nuclear developers must have “a committed orderbook, e.g., signed contracts, for 5–10 deployments of at least one reactor design by 2025 . . . to catalyze commercial liftoff in the U.S.” The report ventures to say that “given expressed U.S. utility risk tolerances, it is likely that the first design to reach a critical mass of orders may be a Gen III+ SMR, which could be followed in parallel or sequence by Gen IV reactors.”

The next step? Delivering those plants “on time and on budget (i.e., ±20%) will be essential for generating sustained demand and commercial momentum,” the report states. “While the estimated first of a kind (FOAK) cost of a well-executed nuclear construction project is ~$6,200 per kW, recent nuclear construction projects in the U.S. have had overnight capital costs over $10,000 per kW.”

“Delivering FOAK projects without cost overrun would require investment in extensive upfront planning to ensure the lessons learned from recent nuclear project overruns are incorporated. Subsequent nuclear projects would be expected to come down the cost curve to ~$3,600 per kW after 10–20 deployments depending on learning rate; this cost reduction would largely be driven by workforce learnings and industrial base scale up.”

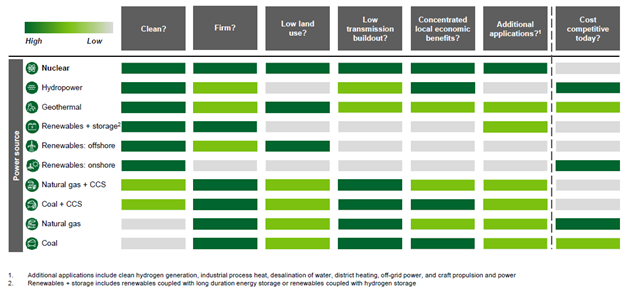

This graphic details “select elements of nuclear’s value proposition as compared to other power sources.” (Source: DOE, Pathways to Commercial Liftoff: Advanced Nuclear, Fig. 5)

Clear case: The report emphasizes nuclear power’s capacity factors and land use efficiency—both which top those of any other electricity production source. “Six features contribute to advanced nuclear’s value proposition in a decarbonized grid,” the report says: clean generation, firmness, low land use, low transmission requirements, regional economic benefits, and supplementary use cases.

The U.S. nuclear power fleet currently has less than 100 GW of capacity, but has the potential to scale up to about 300 GW by 2050 through the deployment of advanced nuclear reactors, according to the report, and beginning that build out as soon as possible will be critical to success.

“Rapidly scaling the nuclear industrial base would enable nearer-term decarbonization and increase capital efficiency,” the report states. “If deployment starts by 2030, ramping annual deployment to 13 GW by 2040 would provide 200 GW by 2050; a five-year delay in scaling the industrial base would require 20+ GW per year to achieve the same 200 GW deployment and could result in as much as a 50% increase in the capital required.”

Clear needs: That level of deployment of advanced nuclear power through 2050 would require a stronger and more nimble resource infrastructure in four key areas: workforce, fuel supply chain, component supply chain, and licensing. According to the report, the United States would need the following:

About 375,000 additional workers with technical and nontechnical skillsets to construct and operate 200 GW of advanced nuclear.

About 5,000 metric tons (MT) per year of additional fuel fabrication capacity, about 50,000 MT per year of additional triuranium octoxide (U3O8) milling throughput, about 65,000 MT per year converted to uranium hexafluoride (UF6), and about 30M separative work units (SWU) per year of additional enrichment capacity, including HALEU enrichment capacity.

Substantial growth in the component supply chain to support 200 GW of advanced nuclear; the largest gap is in large forgings.

Nuclear Regulatory Commission license application capacity scaled from about 0.5 GW per year to 13 GW per year to meet projected demand, likely requiring significant additional resources for the NRC.

“Wait and see” won’t work: During interviews conducted for the report, the DOE found that “multiple utilities have stated that they would like to ‘wait and see’ how the first deployed advanced reactors meet cost and schedule expectations before committing.”

“The stalemate poses a significant risk,” the report states. “If demand does not materialize for a critical mass of reactors, supply chain standup will be less efficient and it will not be possible to move down the learning curve with repeat deployments. . . . With a projected two-year licensing period and [three to five] years of construction, “waiting to see” the results of the first deployments would likely lead to missing decarbonization targets and missing out on opportunities for establishing a strong U.S. nuclear industrial base.”

The report concludes that “because of the risks of cost and schedule overruns, it is unlikely that a first mover will emerge to deploy advanced nuclear without rate recovery. Therefore, regulated utilities or public power will more likely be first movers as opposed to merchant or nontraditional companies.”

A role for government: The DOE’s Liftoff reports are intended to steer clean energy investments already authorized in the Bipartisan Infrastructure Law and Inflation Reduction Act, but they also point Congress toward support mechanisms that could require future authorizations and appropriations.

“To break the current stalemate and generate demand for 5–10 nuclear reactors of the same design by 2025, different forms of government financial support could help de-risk early projects and accelerate private sector commitment,” the report states, describing four potential mechanisms for government support: cost overun insurance; financial assistance through tiered grants that supply to most money to first movers and decreasing amounts for subsequent deployments; government ownership of nuclear power plants, either through a federally owned electric utility or to supply power to military installations or other national security infrastructure; and offtake agreements, such as direct power purchase agreements for up to 10 years.

Testing infrastructure for non–light water reactors also gets a callout: “The U.S. had planned on building a fast test reactor, the Versatile Test Reactor (VTR); however, funding was eliminated in 2022. There are only a handful of operating fast-neutron test reactors globally and most reside in Russia. To successfully deploy Gen IV reactors, the U.S. would need to invest in a fast-test reactor or align with other nations to use their test reactors to support the deployment of Gen IV reactors.”

A “living document”: The DOE plans to update its Liftoff reports “as the commercialization outlook on each technology evolves,” and will continue to solicit input through industry forums, requests for information, and other interactions. Direct public input may be submitted via email to liftoff@hq.doe.gov.