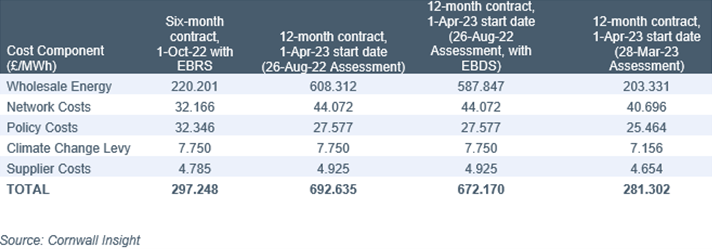

Data from Cornwall Insight’s Delivered Electricity Cost forecaster has shown businesses that fixed their energy contracts at the peak of the energy market last year1, could be facing up to a 133% rise in bills from April. The figures2, which represent a worst-case scenario, demonstrate how high wholesale prices at the time of fixing, combined with a reduction in government support, have left some businesses with steep increases to contend with.

The introduction of the less supportive Energy Bill Discount Scheme (EBDS) happening on 1 April, represents a scaling back of business energy support, from what the government calls unstainable levels under the current Energy Bill Relief Scheme (EBRS). The new system will mean a difficult return to market prices for many. This is especially true of those businesses that fixed their bills at the height of the market who will have to contend with fixed contracts at levels the new support will barely touch.

The impact of the EBDS will be felt differently across sectors, and while the scheme does offer protection for energy-intensive industries such as manufacturing, other industries that are sensitive to the market, such as hospitality and retail, will not be afforded relief. Individual businesses’ bills will depend upon their usage, but the modelled figures provide an indication of the magnitude of the increase – and challenge – that businesses will be facing.

Dr Craig Lowrey, Principal Consultant at Cornwall Insight said:

“The reduced levels of support offered to most businesses through the Energy Bill Discount Scheme are expected to have financial and operational implications for non-domestic consumers across the UK. It will be especially brutal for those that locked in fixed bills during the peak of the wholesale energy market, who will no longer be able to count on the safety net of government support to cap their bills at an affordable level.

“The impact of EBDS on businesses is not uniform and will vary significantly across sectors. Energy-intensive industries that will receive additional support under EBDS may experience greater financial stability, while vulnerable businesses, some already struggling post-pandemic, may find reduced support levels and expensive fixed contracts a tough pill to swallow.

“The impact on business cash flows could also have knock-on effects in other areas, with constraints placed on their ability to invest in decarbonisation and Environmental, Social and Governance schemes, actions necessary to support the UK on its journey to net zero.”

Reference:

Based on the peak wholesale price, recorded on 26th August.

Cornwall Insight's Delivered Electricity Cost Assessment (MWh)

Note: Forecasts are presented for an archetypal half hourly metered, high site. Annual demand c. 2,344MWh. National average figures. EBRS assumed Supported Wholesale Price of £211.00 per MWh. EBDS assumes eligibility for maximum discount.