Intense competition from natural gas cut the EU's net monthly thermal coal imports to their lowest this century in July, according to provisional Eurostat data.

Net EU thermal coal imports from countries outside of the region fell by 3.7mn t on the year to 5.5mn t in July. This was down from 5.7mn t in June and is the EU's lowest monthly intake since before 2000.

The collapse in imports this summer amid weak coal burn and persistently high stockpiles means that January-July receipts have slumped by more than 10mn t, or 16pc, on the year to 52.3mn t. This is the EU's lowest net receipt of coal for any January-July period since 2000 — when around 50mn t was imported — and down sharply from the 2016-18 average of 62.6mn t.

Weak overall power demand and strong competition from natural gas — the price of which has been heavily pressured by high stocks and firm LNG supply — has weighed heavily on European coal burn this year. In January-August, coal-fired generation across Germany, Spain the UK and France fell by 35.3TWh on the year to around 47TWh. This is the equivalent of around 13.3mn t of 5,700 kcal/kg coal burn in 40pc-efficient plants.

Gas-fired generation in the same countries, by contrast, rose by 30.1TWh over the same period to 172TWh.

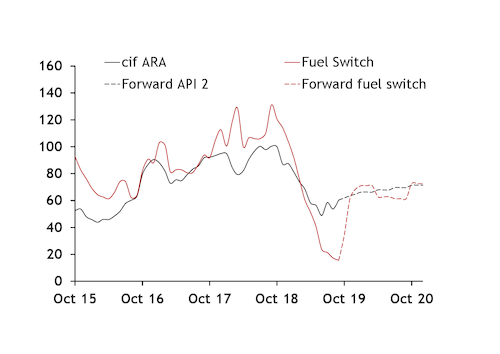

The shift towards greater gas use and away from coal has been driven by a comparatively steeper fall in European gas prices this year. European physical coal prices have typically been low enough in recent years to encourage running 40pc-efficient coal-fired plants ahead of 55pc-efficient gas-fired units, but heavy weakness across European gas hubs this year has pushed this coal-gas fuel-switch threshold lower and made coal increasingly uncompetitive for thermal output.

Argus' daily cif Amsterdam-Rotterdam-Antwerp (ARA) physical coal price assessment was, on average, €2/MWh ($16/t) higher than the coal-to-gas fuel-switching threshold during the second quarter and has been €5/MWh ($39/t) higher so far in the third quarter. Last summer, cif ARA coal prices were €1.86/MWh ($15/t) lower than the equivalent fuel-switch threshold, on average.

Total power generation in Germany, Spain, the UK and France fell by nearly 33TWh on the year in January-August, compounding the impact on demand for the least competitive fossil fuels in thermal generation. Generation from other thermal sources excluding coal and gas — predominantly German lignite — declined by nearly 23TWh on the year in January-August.

Renewable output was little changed at 308TWh, compared with 306TWh last year, while total nuclear output was down by 6.5TWh at 377TWh.

A steep contango on the natural gas forward curve suggests that gas' competitive advantage for thermal output will be reined in during the winter, and coal currently looks more competitive than gas for output in the first quarter of 2020. But coal's advantage over gas looks likely to be lower than in previous years, meaning that gas may continue to eat into coal's share of thermal output, even if outright generation climbs because of seasonal shifts in power demand.

Spain and the Netherlands were the key drivers of the overall decline in net EU coal imports in July, with receipts falling by 1.3mn t and 710,500t, respectively, to 136,000t and 1.7mn t. And the Netherlands' coal exports hit a seven-month high of 93,000t, with 75,000t of this heading to Ukraine.

Imports by Poland, the UK and Portugal also contributed to the weaker EU receipts, with only six countries recording nominal year-on-year increases.

In January-July, Spain, Italy, Poland, the UK, France and the Netherlands all imported at least 1mn t less coal than during the same period last year, together accounting for more than 90pc of the overall 10.1mn t decline.

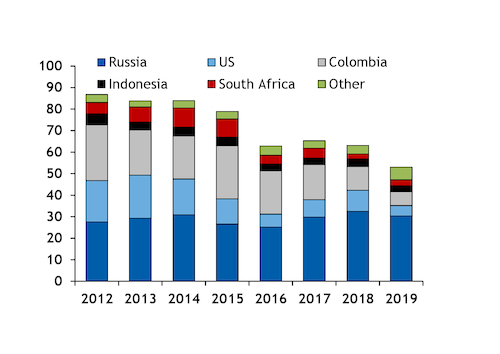

Imports from the EU's three main coal suppliers — Russia, Colombia and the US — all fell by close to 1mn t on the year in July, according to Eurostat data. The 3.5mn t of Russian arrivals represented a 33-month low and was down from 4.5mn t a year earlier, while Colombia and the US accounted for 680,000t and 650,000t, respectively.

Imports of Russian coal fell by 2mn t on the year to 30.4mn t in January-July, with US and Colombian volumes down by 5mn t and 4.6mn t, respectively, at 4.8mn t and 6.5mn t.

Net EU thermal coal imports (Jan-Jul) mn t

Monthly net EU thermal coal imports mn t

cif ARA coal vs German coal-gas fuel switch (40:55) $/t