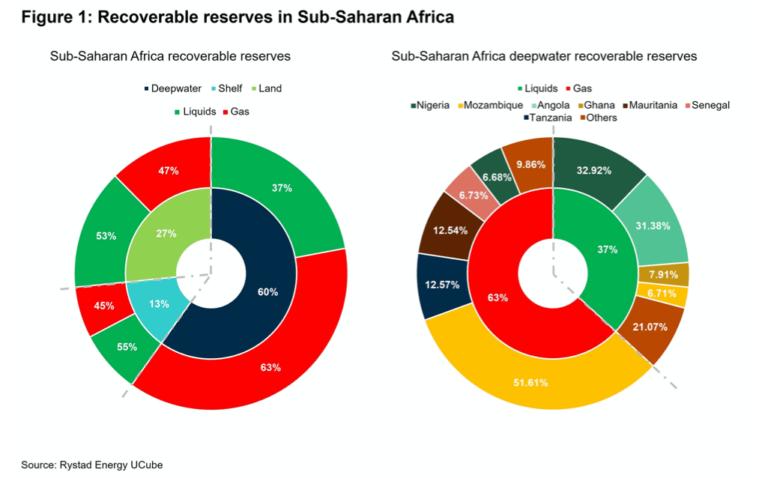

As the final frontier for hydrocarbon exploration, Africa’s upstream potential remains unparalleled. While the continent’s onshore discoveries have revealed sizeable reserves, independent energy research and business intelligence company, Rystad Energy, emphasizes that Africa’s deepwater discoveries have stood out even more. According to Rystad, of the current potential recoverable reserves across sub-Saharan Africa, approximately 60% lie in deepwater regions.

Notwithstanding opportunities to meet global demand, the development of these deepwater prospects could initiate a number of benefits for Africa. Firstly, deepwater developments could address energy poverty continent wide, ensuring both a secure and consistent energy supply for years to come. With over 600 million people without access to electricity, the continent’s oil and gas reserves could directly address this challenge. Secondly, new developments could spark new opportunities for job creation, domestic market growth and skills transfer, which will usher in a new era of economic development for Africa. In a post-COVID-19 context, this remains vital. Thirdly, deepwater developments could significantly enhance Africa’s domestic production capacity. While such developments have already played a critical part in improving the continent’s output – Rystad notes that approximately 50% of sub-Saharan Africa’s liquid outputs were from deepwater developments – tapping into undeveloped prospects could improve these levels even further. Specifically, Rystad suggests that deepwater liquid production is expected to increase by 45% from current levels by the middle of the next decade while natural gas is expected to increase 18-fold. In addition to meeting continental demand, these production increases could address global energy challenges for years to come.

The recoverable reserves associated with key deepwater projects continue to attract global player attention. For example, the ExxonMobil-led Area 4 Liquefied Natural Gas (LNG) project in Mozambique boasts recoverable reserves of 2,335 million boe, and is considered to be one of Africa’s biggest deepwater projects. Similarly, the TotalEnergies-led Brulpadda project offshore South Africa, with recoverable reserves set at 1,240 million barrels of oil equivalent (boe) is expected to be transformational for the southern Africa country. In addition to showcasing Africa’s upstream potential, these developments are set to ease regional supply constraints while strengthening local economies.

However, the potential of Africa’s deepwater basins may not be enough to get these projects off the ground. Specifically, increasing production levels through deepwater developments requires significant levels of capital. These cost extensive projects not only require large upfront investment but often comprise demanding development costs resulting in high breakeven prices per barrel – often costs are in excess of $20 per boe. Accordingly, solutions to bringing down these costs are critical. In this regard, Rystad notes that restructuring prominent fiscal regimes could create further incentives to make projects more attractive and investor friendly. In Nigeria, for example, through the implementation of the Petroleum Industry Act, the country has managed to reduce breakeven prices from $67 per barrel for the Bongo South West (BSW) field and $61.50 for the Aparo tieback to $60 for the BSW field and $53.50 for Aparo, respectively.

What’s more, considering the high upfront costs, state-owned companies are likely unable to come up with the necessary funds, placing heavy reliance on international project partners. In the current energy transition climate, whereby global oil majors face increasing pressure to shift to renewables and reduce emissions, this reliance could directly hinder project take-off. However, alternative financing solutions have been presented. Notably, through the creation and utilization of domestic financing institutions such as an African Energy Bank, the continent will be able to mobilize significant levels of capital for upstream oil and gas. Additionally, by utilizing a myriad of financing instruments and multilateral financing agencies, large quantities of capital can be raised for deepwater developments. As the continent looks to expand its upstream market, Africa’s deepwater prospects hold the potential to transform the energy landscape.