Watch The World/Shutterstock

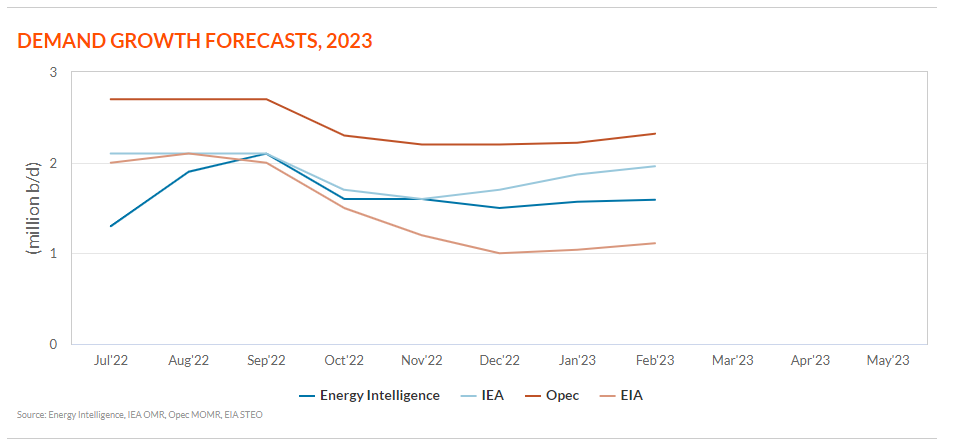

In the past half-year, central bank policies, recessionary fears in Europe and the US, and a sticking bearishness about China have conspired to weigh on the demand outlook. In September, consensus saw oil consumption in 2023 soaring by some 2.2 million barrels per day; this has now fallen by nearly 500,000 b/d based on February forecasts.

Balances also show that supplies will grow but not keep pace with demand. As a result, inventories built up last year and in the first half of this year will draw down in July-December. This imbalance, as well as how Opec-plus ultimately decides to react to the draw, will support oil prices.

Demand Focus on China

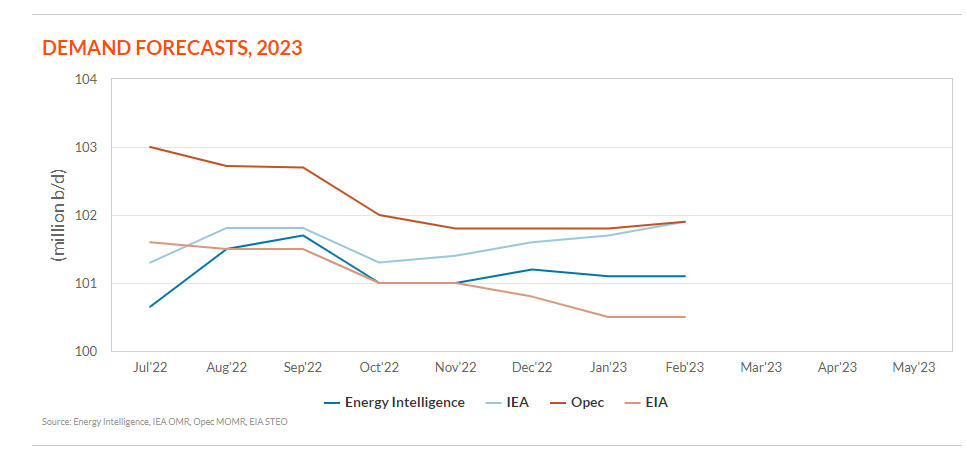

As goes China in 2023, so will global balances, one could argue. Chinese consumption will grow by 600,000 b/d — 900,000 b/d this year, according to the latest estimates, which comprises the bulk of demand growth worldwide.

Energy Intelligence is in the lower range of consensus as we see Chinese demand, stifled by a fragile housing market and a sluggish manufacturing sector, increasing by 650,000 b/d to 14.7 million b/d. In our view, China will account for 40% of global demand growth in 2023.

Opec’s forecast for Chinese consumption gains is closer to 600,000 b/d, or one-fourth of global growth of 2.3 million b/d, while the International Energy Agency (IEA) forecasts that consumption in the world’s second-largest economy will rise by 900,000 b/d to 15.9 million b/d, or 45% of global growth.

Outside consensus in this metric is the US Energy Information Administration (EIA), which sees Chinese consumption increasing by 730,000 b/d to 15.9 million b/d. This is a hefty 65% of global demand growth. According to the EIA’s latest Short-Term Energy Outlook, oil demand worldwide will rise by only 1.1 million b/d this year — the lowest among the four forecasts in this survey.

As far as the US, both the IEA and EIA see oil demand this year as flattish, while Energy Intelligence reckons that consumption will rise by 200,000 b/d to 20.6 million b/d.

Supply Harmony

In terms of global supply, there is a greater consensus than with demand. The range of annual growth among the four forecasts is a fairly narrow 1.2 million-1.5 million b/d.

Energy Intelligence is in the middle of this range: We estimate that global supply of hydrocarbon liquids this year will grow by an average 1.3 million b/d to 101 million b/d. The IEA and EIA both forecast annual growth of 1.2 million b/d.

Opec does not forecast its own growth but instead estimates how much additional crude from the alliance will be needed to balance markets — the “call on Opec.” As of February, this call in 2023 is assessed at 29.4 million b/d, which represents an 830,000 b/d increase on 2022.

Interestingly, this increase in the call is up 200,000 b/d from the January report, and given that Opec’s latest Monthly Oil Market Report was issued only four days after Russia’s decision to cut production by 500,000 b/d in March and perhaps after that, and indeed does not mention the decision, the next report could see another bump up in the call.

Balance Divided

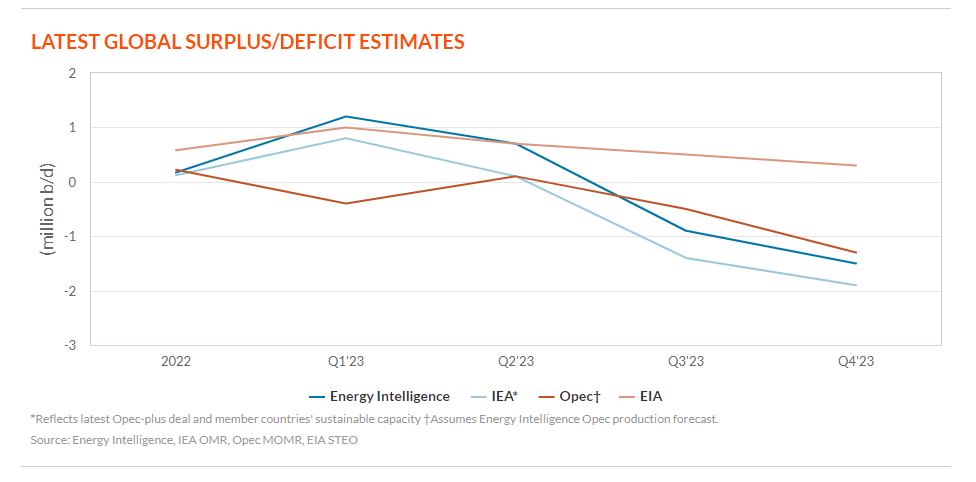

Balances compiled by Energy Intelligence and the IEA show a surplus of supply in the first half of 2023 and a significant draw in the second.

Our balance indicates that inventories will grow by almost 1 million b/d in January-June, but then decline by 1.2 million b/d in July-December, for a net draw of 120,000 b/d for the entire year.

By contrast, the IEA sees a more modest increase of 400,000 b/d for stocks in the first half of the year, followed by a steeper decline of 1.6 million b/d — denoting a net draw of 600,000 b/d over the year.

Since Opec does not forecast its own output, its balance is geared toward the aforementioned call — or what it should produce to keep markets supplied. However, using Energy Intelligence’s forecasts for production of the group’s 13 members — alongside Opec’s demand and non-Opec output numbers — Opec’s balance implies a net inventory draw of 530,000 b/d for the year.

EIA stands apart on balances. The agency is forecasting four consecutive quarters of surplus supply, with first half exceeding that of the second half of the year. On net, global markets will see a 630,000 b/d build in inventories this year, according to the EIA. This continual build, the US agency says, will lead to downward pressure on prices through 2023-24.

Curiously, the Oxford Institute for Energy Studies, which also publishes monthly oil market reports, is in solidarity with the EIA and is forecasting a 300,000 b/d surplus in global balances this year.