Colombia’s oil and gas production along with its proven reserves are falling and investment will likely fail to recover to pre-Covid-19 pandemic levels this decade, according to new analysis from Rystad Energy.

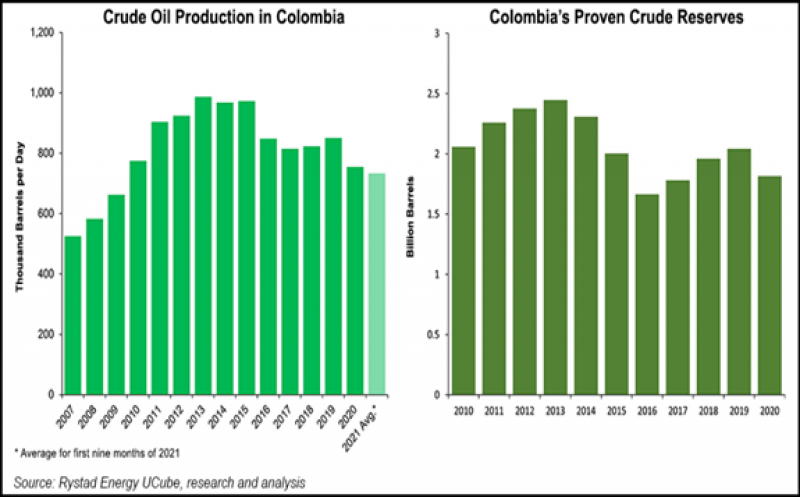

Colombia is Latin America’s third-largest oil and gas producer behind Brazil and Mexico, but crude oil production this year is on track to hit its lowest level since 2009. Current production is at just over 730,000 b/d, down from 754,000 b/d in 2020, Rystad data show.

With upstream activity on the decline, the country’s proven crude reserves at the end of 2020 stood at 1.82 billion bbl, a three-year low and “a far cry from the 2.45 billion bbl recorded in 2013 when the country was flexing its muscles against regional peers,” analysts said.

Natural gas output in Colombia, meanwhile, has been flat since 2016. Production this year so far is around 1.07 Bcf/d, up 2.7% against 2020 but “well below the highs of the previous decade.” Proven gas reserves have been on a continuous decline since 2012, ending 2020 at 2.95 Tcf, from 5.73 Tcf recorded in 2012.

“Colombia is in urgent need of additional investments and exploration success as proven resources have dwindled. It must double these resources in the next decade to continue to be energy self-sufficient. Although its exploration sector stayed dormant in recent years, there is some hope from wildcats following a recent acreage offering,” said Sofia Forestieri, upstream analyst.

One problem is that the country’s oil and gas-rich zones are in conflict territories, such as Catatumbo, which is estimated to hold 17 million bbl of unexplored oil reserves, according to Rystad. The country also went through a series of protests earlier this year that brought the economy to a standstill.

State oil company Ecopetrol SA recovered from a production blip in the second quarter stemming from these protests, executives said in a third quarter earnings conference call. The company has shifted focus to capital discipline and the energy transition.

About 21% of production during 3Q2021 consisted of natural gas and liquefied petroleum gas (LPG). Ecopetrol has set a goal of getting the share of gas and LPG to 35% by 2030 as part of the energy transition strategy. Part of the energy transition strategy also revolves around electrification. Ecopetrol recently purchased the Colombian government’s 54.1% ownership stake in utility Interconexión Eléctrica (ISA). Ecopetrol has additionally pledged carbon neutrality by 2050.

Ecopetrol CEO Felipe Bayon sees capital expenditure ramping up to $4-5 billion in 2022 from about $3.5 billion this year. “And historically, 80-85% of the capex has gone to the upstream,” Bayon said during the earnings call. However, he said the company wants “to stay very focused and disciplined in terms of how we deploy the capex in operations.”

Investment in exploration is key to the decline, Rystad analysis shows. Exploration expenditure offshore Colombia for example, which reached over $600 million in 2015 and over $500 million in 2017, has plunged since then, only managing $145 million this year. Nevertheless, “a mild uptick is expected,” and in 2023 exploration spending is forecast to inch over $200 million for the first time in six years.

A recent oil and gas round also “could provide much-needed impetus to the country’s dormant exploration sector,” the Rystad analysts said. The auction saw 30 blocks of the 53 offered receive valid bids from seven participating companies.

The government secured over $148.5 million in initial investment commitments. “Any announcement of new finds within these blocks will not only help increase the country’s hydrocarbons production, thereby benefiting national revenue, it will also instill confidence among investors and could have a significant positive impact on any future bid rounds,” analysts said.