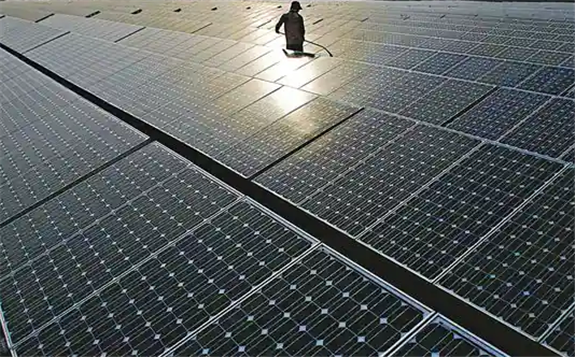

MIRA is hopeful of commanding a premium on the sale of its solar assets as a large share is located in Gujarat

Macquarie Infrastructure and Real Assets (MIRA), one of the largest foreign infrastructure investors in India, plans to sell around 450MW of solar power projects for an estimated equity value of around $300 million, said two people aware of the development.

Around 330MW of these operational solar assets were acquired from Hindustan Powerprojects Pvt. Ltd.

MIRA is hopeful of commanding a premium on the sale of Indian solar assets, given that the off-takers for the electricity generated at a higher tariff from most of these projects are Gujarat state-owned electricity distribution companies (discoms), with a history of timely payments.

The sale process for the proposed deal is yet to start and comes at a time when India’s solar power tariffs have touched a record low of ₹1.99 per unit. This, in turn, has resulted in tariff shopping by discoms with India’s clean energy space already facing problems such as power procurement curtailment and delayed payments.

A Macquarie Group spokesperson declined to comment.

“The reason why these assets are expected to command a premium is because a large part of this capacity is located in Gujarat, which has a history of timely payments. Also, when solar tariffs have gone south, these projects have power purchase agreements that were signed at a higher tariff," said one of the two people mentioned above, requesting anonymity.

“The process is yet to be launched and there is a lot of interest in these assets. A formal sale process is likely to start sooner rather than later," said the second person mentioned above, who also did not want to be named.

The sale plan by Macquarie comes against the backdrop of India’s quasi-sovereign wealth fund, the National Investment and Infrastructure Fund, emerging as the buyer of the hybrid annuity road assets of Ashoka Concessions Ltd as reported by Mint earlier. Ashoka Buildcon Ltd has a 61% stake in Ashoka Concessions, while the remaining 39% is held by MIRA.

In 2012, Macquarie, through its first India-focused fund, had bought the Ashoka Concessions stake for ₹800 crore. It had finalized the deal jointly with State Bank of India.

MIRA and its managed funds oversee investments in 12.4GW of green energy capacity. It is a part of Macquarie Asset Management, the asset management arm of Macquarie Group, which has assets under management of around €339.9 billion.