The PV glass shortage that persisted through the last quarter of 2020 set module prices surging, forcing developers to slow inventory draw. Module manufacturers were forced to renegotiate contracts signed at lower prices or postpone delivery until this year due to glass price hikes.

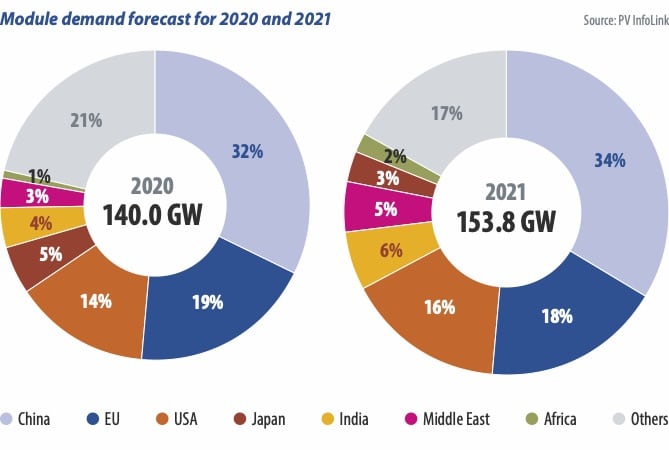

As 2021 gets going, much of the world is still struggling to contain the Covid-19 pandemic. Though concerns over the crisis are again rising among PV manufacturers, global PV demand is expected to shine brighter in the post-pandemic world. PV InfoLink expects global module demand to reach 153.8 GW this year, growing by 10% from 2020.

The strong growth can be ascribed to projects deferred by the pandemic or by price increases. Other contributing factors are stronger demand expected in traditional PV markets across the globe. China, the United States, Europe, and India will dominate more than 70% of the market. This year will mark the beginning of China’s 14th Five-Year Plan, under which unsubsidized projects will become the major market driver. Relaxed regulations on the PV-to-inverter ratio will result in 52 GW of module demand in China.

Driven by postponed commercial/distributed-generation projects, U.S. PV demand is likely to grow slowly, and with President Joe Biden having taken office and the solar ITC having been extended, the long-term outlook for the U.S. market is optimistic, with demand likely to reach 24 GW this year. While the resurgence of Covid-19 continues to rage across Europe, strong PV demand on the continent looks set to continue this year, thanks to continued support from governments. Europe is forecast to see 27 GW of demand.

India is expected to recover from the pandemic crisis, as well as conflicts with China and price increases. With auctions for utility-scale PV underway, PV InfoLink calculates 9 GW of demand for the country. Emerging markets including the Middle East and Latin America are worth noting. The United Arab Emirates, where utility-scale projects in Dubai are likely to be commissioned this year, will see demand growth. Driven by IPP and unsubsidized projects, demand will continue to grow in Brazil and Chile. In contrast, the Vietnamese market will slow down with a lack of incentives, after experiencing a demand boom last year.

Declining prices

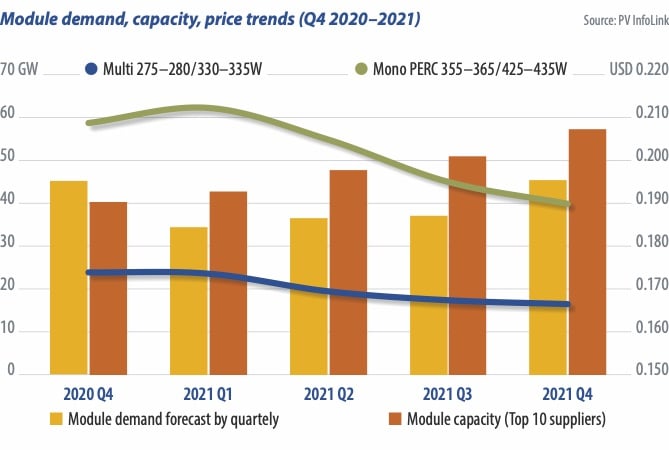

Since manufacturers were stocking up on materials ahead of the Lunar New Year in February, material prices held ground in January. Consequently, module prices also stayed higher at the start of the year. While new PV glass capacity will come online after the Lunar New Year, easing the shortage, module manufacturers will not lower prices after higher costs cut into their profits. As a result, module prices will remain high through February.

Demand will grow in the second quarter, when the Chinese market begins the June 30 installation rush and other markets are connecting deferred projects to the grid. However, as the U.S. dollar has been slipping against the Yuan and ocean freight rates have been rising since the end of 2020, the volume of new orders is low. Moreover, cell prices began to slide in January. Against this backdrop, module prices are expected to return to the downward trend between March and April.

China will officially enter the grid parity era after the mid-year installation rush. The traditional high season will return to Europe and the United States, while India will rebound after the fiscal year begins. Overall, the second half of this year will see stronger demand than the first.

Meanwhile, capacity ramps will continue. The 10 largest module manufacturers will bring more than 50 GW quarterly capacity online during the third and fourth quarters – far exceeding estimated demand of 40 GW for the period. Coupled with growing glass capacity and cell price decreases, module prices will be driven down at a faster pace in the second half. PV InfoLink predicts that mono PERC modules rated at 355-365 W to 425-435 W will fall to $ 0.19-0.195/W.

Post pandemic

The virus continues to rage, but impacts on solar and renewables are diminishing gradually, as countries reopen their economies and roll out vaccines. Projects will develop more smoothly this year with relatively relaxed measures, and those postponed from last year will start installing. This points to optimistic market prospects for the year.

Driven by postponed projects, as well as China’s June 30 installation rush, strong demand is likely to persist from the second half of 2020 to the first half of this year. Meanwhile, prices for modules and their components have remained high due to strong demand ahead of the Lunar New Year holiday. But these will begin to decline rapidly in the second quarter, when new glass capacity comes online, cell prices slip, and overseas customers are in “wait-and-see” mode.

The second half will see strong demand as the traditional high season returns to Europe and the United States, while demand from unsubsidized projects in China emerges. In the meantime, new module production lines will be commissioned in the second half and the surplus will drive down module prices. The PV market will recover from the pandemic in 2021. As the world moves toward carbon neutrality and grid parity, solar PV will remain a major driving force behind renewables targets.

This article is reproduced at www.pv-magazine.com