The electric vehicle (EV) wave has come ashore. EV penetration is transitioning from its embryonic stage to the market growth stage across many transportation industry segments: cars, light trucks, buses, light commercial vehicles (LCVs), even Class-8 trucks (those more than 33,000 pounds). Although some segments are electrifying faster than others in terms of market penetration, overall this change will be the single most transformative event in the transportation sector since Henry Ford invented automobile assembly-line manufacturing. This change impacts everything — how far vehicles travel before requiring refueling (recharging in this case), the time recharging takes, where and when vehicles recharge — the very nature of replenishing the vehicle's energy reserves. With this change comes opportunities for a new set of players to enter the marketplace, with the most impacted entity, the electric utility. These new market entrants will also bring new business models into a marketplace that is still evolving and will take some time to mature.

Over the past decade, following significant advances by the European Union (EU), upwards of two dozen investor-owned and municipal utilities in the United States have launched significant EV charging network infrastructure pilots. Initially, state governments drove these initiatives to achieve aggressive carbon reduction targets, but now EV charging capability is rapidly expanding into a national priority. Concurrently, a host of emerging companies have defined and advanced home charging, superchargers, and fleet charging technologies. Many of these companies participate in utility-supported EV infrastructure pilots. While some of these newer entrants questioned utilities' involvement, most have seen utilities' ability to help accelerate ubiquitous charging coverage as an important accelerator for EV adoption by alleviating EV range limitations or intercity use concerns among consumers. For example, California IOUs have installed more than 12,000 charge spots since 2016 — a significant portion of the nearly 70,000 charge spots installed in the United States by early 2020.

Major automakers shifting significant production to EVs by 2025 will further accelerate transportation electrification. Yet charging infrastructure is at risk of lagging further behind as charging deployment to date is well under 10% of the coverage required by the mass market to support EV adoption by 2025 (source: International Council on Clean Transportation analysis–ICCT).

The residential EV charging segment represents a significant electricity consumption increase. For example, households charging two Tesla Model 3 class EVs twice weekly drive an increase from 909 kWh to over 2000 kWh per month (average residential change per U.S. EIA). Utilities, after a decade of year-over-year load decline, want this growth. Will utilities largely remain as reactive connection/delivery entities or consider broader collaboration with suppliers and their customers? Like the roles of established and emerging third parties, the utilities' role will be dictated by regulations, business models, and stakeholders' views on how to best drive progress to achieve carbon reduction targets.

Except for California's recent order banning carbon-emitting vehicles by 2035, the regulatory landscape remains heavily subsidy-driven for leading EV suppliers. The business models span capturing the customer with unrelated services (that is, advertising) during charging, augmenting existing refueling infrastructure, vehicle-as-a-service, employee benefit charging (in office complexes), and rate-based electricity supply. Even with significant financing chasing these business models, many will not survive in the long term. Technological innovation, however, offers both opportunities and threats that may change this outlook. Ubiquitous Class III charger deployments not only reduce charging time but also drive business model viability as much as customers who embrace charging primarily at home and work. Regardless, utilities have an opportunity to take on proactive roles, whether as direct suppliers of solutions for fleets and private vehicles or as a commodity supplier to those serving consumers.

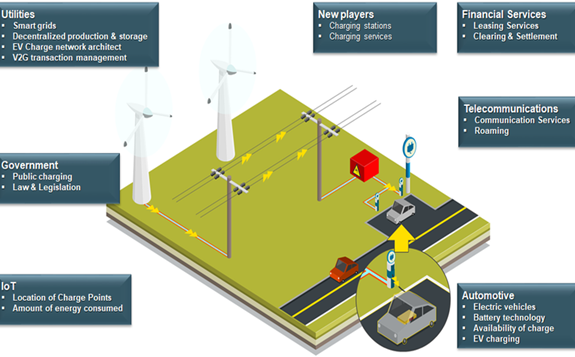

With battery technology anticipated to drive cost parity of EVs by 2022 to 2024, most automakers are expected to phase-out ICE-driven cars from their portfolio by 2025 to 2040. Resulting from this phase-out, demand for ubiquitous coverage of charge spots with appropriate capabilities (for example, slow versus supercharging) will increase dramatically, essentially shifting from government "push" to consumer/major manufacturer "pull." Significant capital will be required to meet ICCT projected charge point coverage required to support mass-market EV penetration. The EU has also demonstrated the value of a master network architect function that combines energy and telecommunications requirements to define utility network capabilities and charge spots' location. Partnerships with cities and statewide transportation authorities will be critical.

While today's charge spot providers recover their investment (and expensive capital charge) through charging rates that often exceed 50 cents/kWh, a broader footprint enabling a wider range of consumer adoption will require support via governmental or utility mechanisms. A key factor to keep in mind is that private investors will mostly flock to urban centers where they believe the business value exists. To support countrywide EV adoption, however, ubiquitous EV charging coverage requires identifying a Provider of Last Resort (POLR), who must be appropriately compensated for possible electricity sales at reduced rates. European models (for example, Norway) have recognized the master network architect role's value. This window provides utilities the opportunity to establish their value-added position (for example, low cost of capital, superior ability to manage long-term charge point investment risk given evolving consumer behavior) at the state level so that charging network infrastructure addresses the rising wave of consumer demand for EVs.

Further, there will be a need to add charging stations along the country's highway and byways, making range anxiety a non-issue. Unless utilities act quickly, however, their role in creating this future is far from assured. With the appearance of distributed energy resources (DERs) and the budding emergence of hydrogen as a transportable or locally-produced commodity, this opportunity could be quickly taken away from the electric utility, allowing other business models to dominate. Now is the time for the electric utility as the commodity provider to show leadership and bring other businesses to provide services to the public.

In the words of legendary Chrysler CEO, Lee Iacocca, "Utilities can lead, follow, or get out of the way." Utilities have a unique opportunity, just as with ICE-based cars, where there was a complete dependency on oil companies. In the future, the supplier of the commodity will be the electric utility as the primary distributor of electricity. Electricity is ubiquitous in its availability, from the residence to the office and beyond.