It’s been a tumultuous four years for US commodity industries that found themselves a key focus of the White House through its aggressive trade policy agenda.

From steel and aluminium tariffs to grain subsidies to boosting exports of liquefied natural gas, very few corners of the global commodities market eluded Donald Trump’s attention. There was at least one memo, executive order, pronouncement or tweet bringing some sort of attention to uranium, soybeans, and rare earths, the kinds of materials that haven’t received attention from American presidents in years.

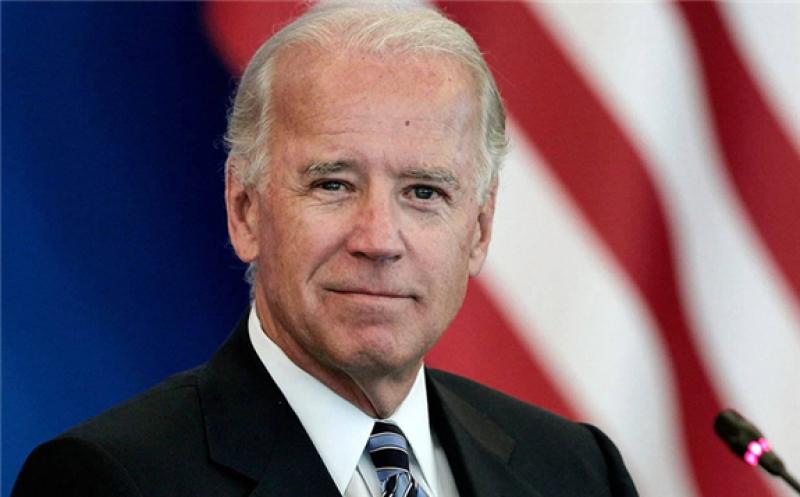

Now, with Joe Biden winning the election, how will the next US president diverge from his predecessor, and where he might keep the status quo?

Steel and aluminium: The biggest issues in steel and aluminium are very similar, given these two industries – especially steel – were a top priority for the Trump administration. Tariffs aren’t expected to go away any time soon under Biden, and market participants have adjusted for the 25% duty on steel imports and the 10% levy on aluminium.

Removing them would be like catching a falling knife: It would alienate voters across the Midwest who helped Biden across the finish line. It would also lead US Steel Corp and Century Aluminum Co, among others, and the United Steelworkers union to lobby for some sort of new trade action to protect their industries.

Biden is more likely to maintain the tariffs and work with key allies – including the European Union, Japan and Canada – to form a bloc opposing the subsidies China gives to its industries, which produce more than half of the world’s steel and aluminium. The Trump administration openly shunned multilateral trade partnerships, so this would be a big change in policy. It’s still unclear, though, what policies Biden would enact to further protect the industries, both of whom claim need more help.

LNG: Trump administration officials criss-crossed Europe and Asia in 2019 touting US LNG exports as “freedom gas” and “molecules of US freedom,” but trade wars hurt sales as did environmental concerns over flaring in the Permian Basin and other emissions associated with production and shipment.

Biden didn’t state a position about LNG on his campaign website but boasts a plan to reduce methane emissions and flaring, which European buyers would welcome. Biden was vice president when the Obama administration approved permits for all six of the current LNG export terminals.

Political observers believe that Biden would bring the US back into the Paris Agreement, an environmental treaty between nearly 200 nations to reduce greenhouse gas pollution. With buyers across the globe seeking greener or carbon-neutral LNG cargoes, the move might benefit US exporters.

“Our biggest concern is American LNG exports to Asia and to Europe, and how those have declined as a consequence of some of these trade wars,” said Mike Sommers, the president of the American Petroleum Institute. As a previous longtime member of the Senate Foreign Relations Committee, Biden “has a firm understanding of how important American energy independence is from a foreign policy perspective as well,” he said.

Oil: Energy will likely be on the table in US trade talks with China.

“As long as US energy production such as shale oil, LPG and natural gas exceeds domestic demand, America would be an exporter,” said Sandy Fielden, director of research for Morningstar Inc. “So China, as the world’s largest consumer, will use energy as a bargaining chip. A Biden administration would implement a measured trade policy without the Trump tit-for-tat noise.”

“With a Biden victory, what you’re going to expect is a lot less trade uncertainty, and that is great for oil prices,” said Edward Moya, a senior market analyst at Oanda Corp. “We see the best demand when globalisation is trending.”

Despite ratcheting up sanctions on Venezuela’s state oil company, Trump wasn’t able to dislodge Nicolas Maduro. Analysts say that a Biden victory won’t necessarily reverse all the measures taken against Maduro.

Biden will seek to re-enter the 2015 Iranian nuclear deal and lift sanctions on the country, according to RBC Capital Markets’ Helima Croft. “We continue to anticipate Iran being able to return around 1mn barrels a day of exports back to the market by the second half of 2021,” Croft said in a note.