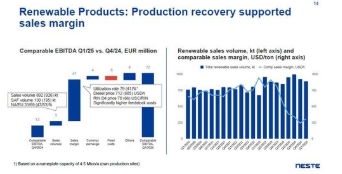

The comparable sales margin for renewable products dropped to $310 per ton in Q1 2025, down from $562 per ton in Q1 2024, primarily due to global oversupply affecting prices and elevated feedstock costs. Neste’s biorefineries maintained stable production, with an average utilization rate of 79%, compared to 88% in the same period last year, as output was optimized. Waste and residue inputs rose to 97% of the total, up from 91%.

Renewable fuels production totaled 1.11 million metric tons in Q1 2025, including 877,000 metric tons of renewable diesel, 207,000 metric tons of SAF, and 29,000 metric tons of other products. This compares to 1.14 million metric tons in Q1 2024, which included 933,000 metric tons of renewable diesel, 167,000 metric tons of SAF, and 35,000 metric tons of other products. Sales of renewable fuels reached 892,000 metric tons, up from 849,000 metric tons, with SAF sales increasing to 130,000 metric tons from 41,000 metric tons.

Europe accounted for 69% of renewable diesel and SAF sales in Q1 2025, up from 51% in Q1 2024, while North America’s share fell to 31% from 49%. Neste noted reduced U.S. biobased diesel production due to regulatory uncertainties and changes in tax credit structures. In Europe, renewable diesel market conditions improved as refineries resumed operations after outages.

Neste President and CEO Heikki Malinen stated: “Comparable EBITDA for renewable products fell to EUR 72 million during the first quarter, down from $242 million during the same period of last year.” He attributed the decline to weaker margins and highlighted that SAF sales are expected to grow toward the end of 2025, driven by seasonal demand and SAF mandates.

Neste’s Rotterdam biorefinery expansion remains on track for completion in 2027, aiming to become the world’s largest facility for renewable diesel and SAF production. The facility recently added 500,000 metric tons of SAF capacity, bringing Neste’s total SAF capacity to 1.5 million metric tons. Malinen emphasized the project’s alignment with the company’s long-term growth strategy.

For 2025, Neste anticipates higher renewable products sales volumes compared to 2024, supported by increasing demand for sustainable fuels. The company continues to prioritize operational efficiency and the expansion of SAF production to meet global clean energy needs, particularly in aviation.