The good news in the US is that intent to buy a hybrid (conventional or plugin) is up 5 percentage points compared to the previous year. The better news is intent to buy a conventional fossil-fueled car is down 5 percentage points. The bad news is intent to buy an EV is down 1 percentage point!

Another good piece of news is that concern about public EV charging may be overhyped. “Demand for public charging infrastructure may be exaggerated, as 79% of U.S. EV intenders surveyed plan to charge their vehicle at home.”

Across the board, I’m not going to lie — it’s an interesting survey. I don’t know if the sampling and methodology is extra good or extra weird, as I’m surprised by a number of the results. It also found that a full 52% of respondents are concerned about fully autonomous robotaxis operating near where they live. Really. I’m not the most gung-ho about robotaxis, and I do think they will increase traffic, but are 52% of people really afraid of them?

On the flip side, “More than 4 in 10 U.S. consumers surveyed aged 18-34 would be willing to give up vehicle ownership in favor of a fully available mobility-as-a-service (MaaS) solution.” So, more than half of Americans are concerned about robotaxis, but more than 40% of American adults under the age of 35 are open to the idea of using MaaS instead of owning a car — and how many of them are fine if that’s a robotaxi instead of human-driven MaaS?

Also, 54% of respondents plan to switch auto brands the next time they buy a car. With so much talk of brand loyalty in the industry, that’s got to be a bit of a disappointing result for automakers — but also opportunity for those much desired “conquest sales.” Interestingly, though, brand loyalty is much weaker in China and India, where 76% and 72%, respectively, plan to buy a different brand with their next vehicle purchase.

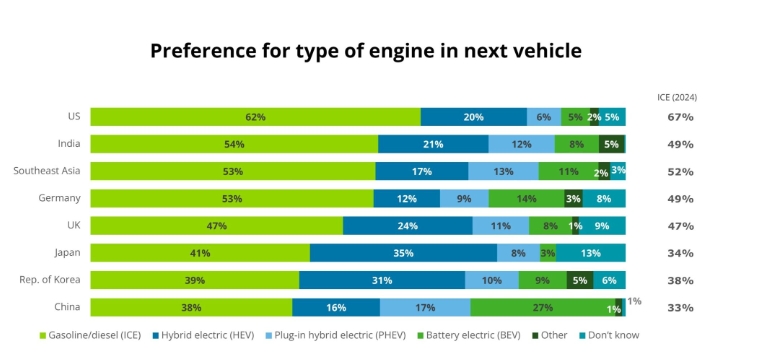

Getting back to the topic of EVs, here are some of the key findings:

“Lowering fuel costs remains the top reason among U.S. consumers surveyed to purchase an EV (56%), followed by environmental considerations (44%) and driving experience (36%). However, available battery driving range remains a top concern (49%) for U.S. consumers surveyed, followed by the time required to charge (46%) and the lingering cost premium associated with BEVs (44%).”

“One-third (35%) of U.S. consumers surveyed said they drive 60 miles or more from their home only once or twice a month with a further 23% saying they never drive that far away, raising an important question regarding the amount of investment being earmarked to build out EV charging infrastructure.” (I think the semi-conclusion at the end there is a weird one — even if most driving is local, there’s still plenty of medium- and long-distance driving that requires public charging, and there are also many people who can’t charge at home, as this survey itself finds.)

“More focus on making it easy and affordable for people to install a home charger may be required as 58% of those surveyed said they currently do not have access to a dedicated EV charger.”

“Charging wait times may be a softening barrier for U.S. consumers surveyed as three-quarters (77%) are willing to wait up to 40 minutes to charge their vehicle to 80% from zero. U.S. consumers surveyed prefer a dedicated EV charging station (44%) to a traditional gas station with EV chargers (15%).”