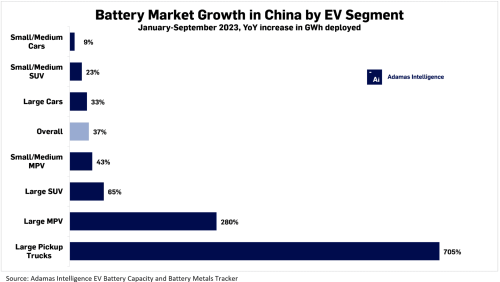

While OEMs and manufacturers are assembling higher capacity battery packs, another factor behind the rapid expansion of battery capacity deployment is Chinese EV buyers’ growing fondness for large trucks, SUVs and MPVs, Adamas said.

The total battery capacity deployed onto Chinese roads in newly sold large pickups—such as the popular Radar Auto RD6 (part of the Geely line-up) and the JAC Motors iEV330P—during the first nine months of the year is up 705% compared the same period in 2022.

While local pickups are still just a tiny portion of the country’s market, and full-size trucks as exemplified by the Rivian R1T haven’t made a dent, bigger is becoming better and more desirable for Chinese EV shoppers, and not just to the benefit of trucks but also other body styles and purposes too, Adamas said.

Through the first nine months of 2023, the battery capacity deployed onto Chinese roads in newly sold large MPVs, such as the Denza D9 minivan and the Zeekr 009 luxury 6-seater, was 280% greater than the same period last year, outstripping overall sales growth of 105% in the MPV category by a wide margin. Deployment growth in small and medium-sized versions of these people carriers also exceeded average battery capacity growth in the country at 65% year-over-year.

The capacity deployed into large SUVs hitting roads in China this year is also growing rapidly. The combined battery capacity deployed in models in this segment—such as the Li Auto L8 and L9, the Hongqi E-HS9, and the ubiquitous Tesla Model Y—is up by 65% even though plug-in hybrid SUVs now constitute a bigger part of this market segment than BEVs.

In contrast, the small and medium car segment in China, represented by the likes of BYD’s Seagull and Dolphin models along with ORA’s Good Cat, only expanded by 9% year-over-year. In terms of the EV sales mix in this bracket, consumer preferences have shifted dramatically. Sales of BEVs and HEVs in the small and medium car segment, surprisingly, are down year-over-year, while PHEV sales have increased by a factor of five.

The rate of overall battery capacity deployment growth in China through September this year (up 37% year-over-year) is running well ahead of unit sales growth (up 27% year-over-year) speaking to consumer preferences for larger form factor vehicles with often beefier battery packs.

—Adamas Intelligence