The proposed change would require batteries with a capacity of 5MW or greater to respond automatically to small changes in power system frequency, known as a Primary Frequency Response (PFR). The rule would impact all batteries enabled for Frequency Control Ancillary Services (FCAS), where imbalances in grid frequency are addressed.

AEMO says the new rules are necessary to stabilise the power grid as the move to renewables increases the risk of imbalance. However, there are concerns the rules could have the opposite effect and harm economic efficiency and system reliability.

Currently, batteries are able to discharge their energy at economically optimal times, often when electricity prices are high. Under the new rules, batteries could end up being forced to discharge energy at less profitable times, such as in the middle of the day, to compensate for small changes in frequency, lowering their revenue. There may also be implications for the contingency FCAS markets1 as battery operators decide to reduce support in these markets to conserve energy for the evening peak.

Additionally, there are concerns about the implications that increased cycling of batteries could have on battery warranties and battery degradation over time.

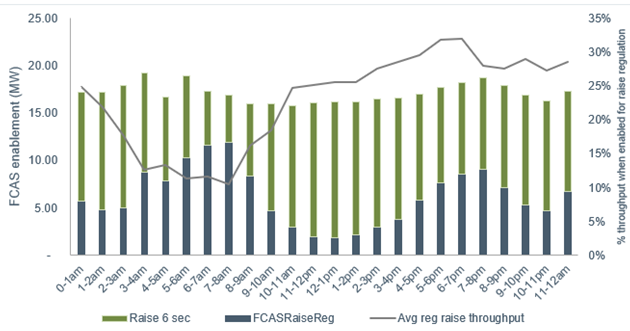

Data from the regulation raise market2 (Figure 1) analysed by Cornwall Insight Australia shows that if the provision of PFR follows a similar path, PFR provision will likely occur during daylight hours, historically the best times for batteries to be charged. If batteries are to navigate the change, they are likely to need higher contingency FCAS prices to compensate for the losses.

Source: AEMO, NEM SCADA 4-second data

Data from Lake Bonney BESS in the regulation raise and contingency raise 6-second markets demonstrates the reduction in regulation raise, which happens as a consequence of the need to discharge energy at different times of the day.

Oliver Skelding, Managing Consultant, Cornwall Insight:

“This rule change could have unintended consequences for the electricity market. Batteries are already facing challenges in finding financing. The introduction of a mandatory obligation to provide PFR when enabled for Contingency FCAS could make it even harder.

“We know there are two sides to every discussion, and given the increase in intermittent renewable generation, there will need to be more PFR contingencies put in place. Given the preference for using price signals to meet contingency FCAS requirements, it would seem most prudent to do the same for PFR and elicit a market-based response from the technologies that are best placed to provide that service. If the implementation of the new rule ultimately leads to fewer batteries or cuts their lifespan, the grid will be worse off than it was before the change.

“The AEMO has some big decisions to make as we transition towards a greener future, and we await the results of the consultation to see the direction it intends to take.”