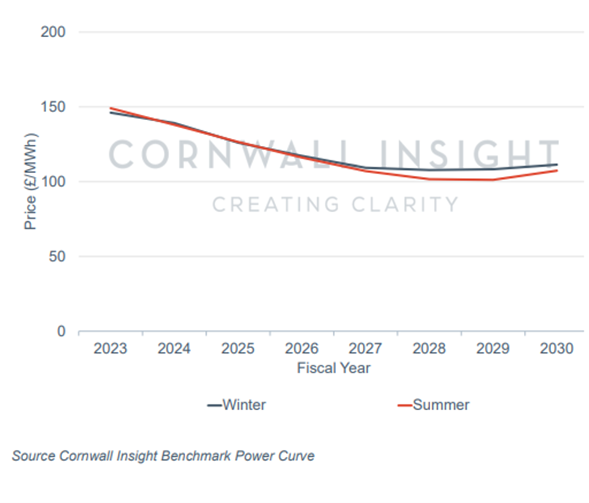

Cornwall Insight's latest report on the GB Power Market Outlook to 2030 has seen a rise in our projections for power prices in the latter half of the decade. Estimates indicate that prices are likely to remain above £100/MWh until 2030 and likely beyond.

The predictions, from data modelled in the first quarter of 2023, identify the decrease in nuclear availability in France as a contributing factor to the increase in the price forecasts. Lower French nuclear production is expected to increase the scope for power exports from Great Britain. Higher exports plus the wider electrification of the economy, particularly for heat and transportation, are predicted to lead to higher demand and higher prices than were previously forecasted in the fourth quarter of 2022.

In the short and mid-term, there is positive news as Europe's high gas storage levels, due to the reasonably mild weather during the winter of 2022-23, and the easing of concerns around future gas supply, contribute to a gradual decrease in forecast power prices up to 2027. Gas prices will continue to be sensitive to the availability of globally traded Liquified Natural Gas (LNG) which Europe is increasingly reliant on following the cutting back of supply from Russia.

Power prices are still expected to fall from today’s levels as sources of low-carbon generation are brought online. This will include a rapid expansion of offshore wind capacity in the UK, built to meet the government’s target of 50GW by 2030. However, given the development timelines, we forecast that the target will be achieved two years later by 2032.

Figure 1: Power price forecasts – average price per fiscal year

Tom Edwards, Senior Modeller, Cornwall Insight:

“The recent decrease in short-term power price forecasts, largely attributed to the unexpectedly mild winter, can only be seen as a positive development. In the mid-term, the transition towards renewable sources will enhance energy security further, and the affordability of wind turbines will be a driving factor in pushing down prices. The reduction in power prices indicates a potential return of cheaper tariffs for both households and businesses.

“In the long run, electrification of the economy, amongst other factors, is predicted to raise the demand for renewable power, driving up price forecasts in the process. The latest predictions indicate a significant increase in exports to the continent, the growth, particularly attributed to the decrease in France's nuclear capacity and the increase in wind capacity in GB, will likely result in power costs levelling out at a higher rate, surpassing pre-pandemic levels.

“The outlook suggests that we have come through the worst of the current energy crisis and that the exceptionally high prices seen over the past two years will continue to fall. However, the market is finely balanced and consequently susceptible to price shocks arising from any unforeseen circumstances. Continuing the decarbonisation agenda remains the best way to insulate the market and consumers from similar prices in future.”