In its new report “Solid Oxide Fuel Cells 2023-2033: Technology, Applications and Market Forecasts,” technology company IDTechEx provided an overview of the solid oxide fuel cell (SOFC) market and projected its value to reach $6.8 billion by 2033.

Courtesy of IDTechEx

More specifically, the report includes an assessment of the key technology trends and major players as well as a granular 10-year market forecasts for SOFC demand and market value, segmented by application areas.

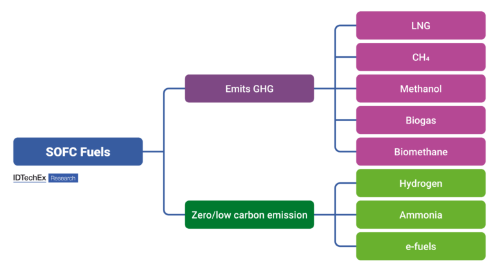

IDTechEx said that fuel cells could play an important role in the future of power generation, enabling the transition from traditional hydrocarbon fuels to low or zero-emission fuels, and noted that the fuel flexibility of SOFCs offers a competitive advantage over the currently dominant proton exchange membrane fuel cell (PEMFC), which is limited to operating on hydrogen. To remind, SOFCs can run on fuels such as hydrogen, LNG, biogas, methanol, ammonia, e-fuels and more.

IDTechEx stated: “Despite the hype of the hydrogen economy, it could be considered foolish to expect that an imminent abundant supply of green or blue high-purity hydrogen will become available to fulfil all demand in the near future, presenting an opportunity for the fuel agnostic SOFC.”

The technology company also noted that there are downsides to all fuels:

LNG is the most deployed fuel in many applications, but it is not a long-term low-carbon solution due to methane slip and energy-intensive cooling and re-gassing processes.

The key issue with hydrogen is its low volumetric energy density and storage temperatures of -263°C, which is energy intensive to reach and maintain.

Ammonia requires new bunker infrastructure and is highly toxic in a spillage, and green ammonia is a derivative of green hydrogen so an abundance of green hydrogen must exist first.

A byproduct of methane is carbon, meaning carbon capture is required for zero emissions, and this can be problematic due to added cost and complexity. Methane is susceptible to methane slip (boil-off methane), a powerful greenhouse gas, while e-methane relies on carbon predominantly from industrial sources.

In the report, IDTechEx said that, over the past year, a trend has emerged amongst companies producing larger-scale stationary power solutions to look towards the marine sector. It pointed out the partnership between Bloom Energy and Ceres Power and their pilot projects to explore the marine sector.

To conclude, IDTechEx said that, in a future centered around the hydrogen economy, PEMFCs should be expected to dominate the fuel cell market, however, SOFCs offer interesting opportunities in the interim while operating on today’s widely available fuels and pipeline infrastructure.