Brisbane-based Galilee Energy is to press ahead scoping a potential hydrogen demonstration at the Glenaras gas project after receiving an R&D refund.

The company was successful in its R&D application to the Australian Taxation Office (ATO) and will receive a refundable R&D tax offset of $7.6m for the 2021/22 financial year.

The refund enables it to accelerate activities at the pilot project, such as enhancing de-watering – following recent heavy rainfall – as well as detailed scoping analysis and front end engineering work on a potential hydrogen demonstration.

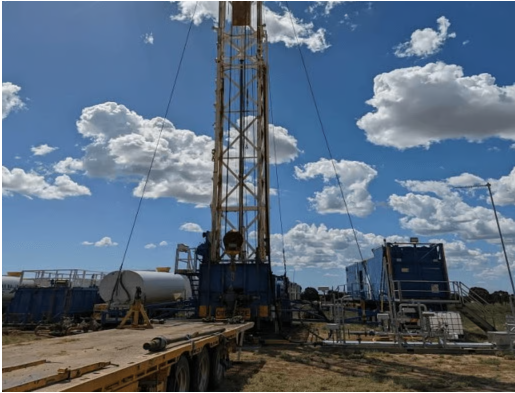

Wild Desert Rig 24 has successfully completed cementing operations on Glenaras 27 and is currently on Glenaras 28 (pictured). The aim of the programme is to ensure that the lower Aramac sands are isolated and are not contributing to water production and thereby delaying gas desorption.

David Casey, Galilee’s Managing Director, said it is “favourably positioned” given its plentiful supply of relatively fresh, high temperature water.

He said, “The combination of a strengthened balance sheet, positive results at the Glenaras pilot and potential hydrogen opportunities in addition to our existing farming operations, places Galilee in a unique position to leverage off its enormous resource base at a time of tightening east coast gas supply.”

Galilee is the 100% equity holder and operator of the Glenaras Gas Project, which is located in ATP 2019 (formerly ATP 529) in the central portion of the Galilee Basin in central Queensland.

The Galilee Basin is a vast, sedimentary basin covering approximately 247.000 sq.km through central Queensland and contains globally relevant volumes of Permian-aged coal. However, it has long been established that the Glenaras area is the most prospective region across the entire basin for coal seam gas with ATP 2019’s expansive 3,247 sq.km covering the entire Glenaras coal seam gas “sweetspot”.

The R&D Tax Incentive is an Australian Government programme under which eligible companies with aggregated turnover of less than $20m are entitled to claim a 48.5% refundable offset for eligible expenditure incurred on eligible research and development activities.

The value of the refundable offset is equal to the corporate tax rate of the entity plus an 18.5% premium, for Galilee Energy this results in a refundable offset of 48.5%.

The incentive received is a result of expenditure incurred on the R&D activities undertaken on both the Glenaras multi-well pilot (Pilot) and the water management project.