Goldwind, the world’s top wind turbine supplier in 2022, expects the global offshore wind power market to expand hundreds-fold, possibly even thousands-fold, in the next few decades.

“The global offshore wind power development we see now is just the beginning,” Wu Kai, vice president of Goldwind, told CGTN in Beijing.

“With the comprehensive utilization of the ocean, as well as the great increase in global demand for new energies, the potential market is not just 10 or 20 times its current size, but hundreds or even thousands of times that,” he added.

He cited various factors that are pushing up the global demand for renewable energies, including energy security concerns shared by countries and regions across the world, as well as the pressure from global warming and the goals for reaching carbon peak and neutrality.

“Global demand for renewable energies like wind power is certain, and will remain high for quite a long time,” Wu noted.

In 2022, Goldwind just edged out Denmark-based Vestas to the top spot in the global wind turbine supplier ranking, according to the latest data released by BloombergNEF on March 23.

The company supplied 12.7 GW of wind turbines last year, becoming the first Chinese company to claim top spot in the rankings in the last seven years.

Worldwide, about 86 GW of wind turbines were commissioned in 2022, 15 percent lower from the previous year, data from BloombergNEF showed.

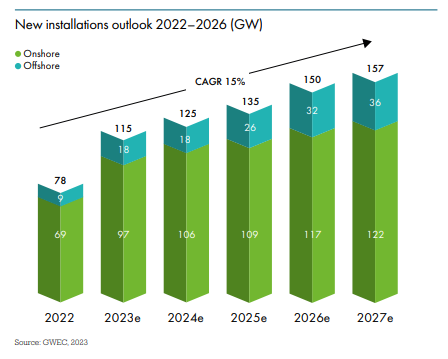

A chart from the Global Wind Report 2023 released on March 27, 2023. /Global Wind Energy Council

Later this year, global wind energy will reach the historic milestone of 1 TW of installed capacity, and it has taken the world around 40 years to get here, according to the Global Wind Report 2023 released by the Global Wind Energy Council on Monday.

However, the next TW will take only less than a decade, the report said, noting that the coming years will mark a crucial transition period for the global wind industry.

According to Wu, the company has observed very high demand in the past couple of years in various regions globally, such as Africa, with South Africa being a prominent example, in South America, where Brazil and Chile stand out, as well as in Australia and Central Asia.

“In the past year or two, the regions that have particularly stood out in terms of high demand are Central Asia and the Middle East, with Saudi Arabia being a significant case,” he said.

He said slightly different reasons are driving the growth in different countries and regions. For example, countries in the Middle East are eagerly seeking energy transition from fossil fuels to renewable energies, while Kazakhstan in Central Asia experienced power shortage in the last two years likely because of its burgeoning economy.

Speaking of the Asian market, Wu said it’s definitely an important strategic market, particularly member countries of the Association of Southeast Asian Nations.

In the past few years, there has been a significant increase in demand from countries such as Vietnam, Thailand and Indonesia, he said.

New trends in wind power

Traditionally, new energy companies have dominated wind power development. But now, more players are eagerly tossing their hats in the ring, not least financial institutions, mining and cement companies, and not to be left behind, the oil and gas giants, Wu said.

“This trend is not unique to China. The same is true for other countries and regions,” he said.

The green energy transition will mean a significant shift in business rules in the future low-carbon era, the expert said.

“Renewable energies are intrinsically linked to natural resources, with solar energy depending on ample sunlight and wind power needing optimal atmospheric conditions. Therefore, renewable energy supply and demand dynamics will differ significantly from those of the oil and gas era,” he said.

“Centralized large-scale conventional power stations, like coal-fired plants, may be replaced by multiple decentralized energy sources whose distribution models could serve single structures, such as industrial parks,” he explained.

“Meanwhile, it will bring about a restructuring of the grid and power consumption. This will create new demand for technologies such as AI and Big Data, primarily for algorithms to deal with more complex and varying electricity distribution and trading models. The goal is to better match the supply and demand sides of renewable energies,” he said.