Daqo New Energy is one of a number of companies with significant new polysilicon capacity set to come online in 2023. Image: Daqo New Energy.

Polysilicon prices have fallen off a cliff since mid-late December and the downward trend is expected to continue at least until the Chinese new year.

As of 4 January, according to EnergyTrend figures, the average spot price of mono-grade dense polysilicon was RMB175/kg (US$25.54). Two days later, on 6 January, Shanghai Metals Market placed the average price of mono-grade dense polysilicon between RMB150-165/kg (US$21.89-24.08).

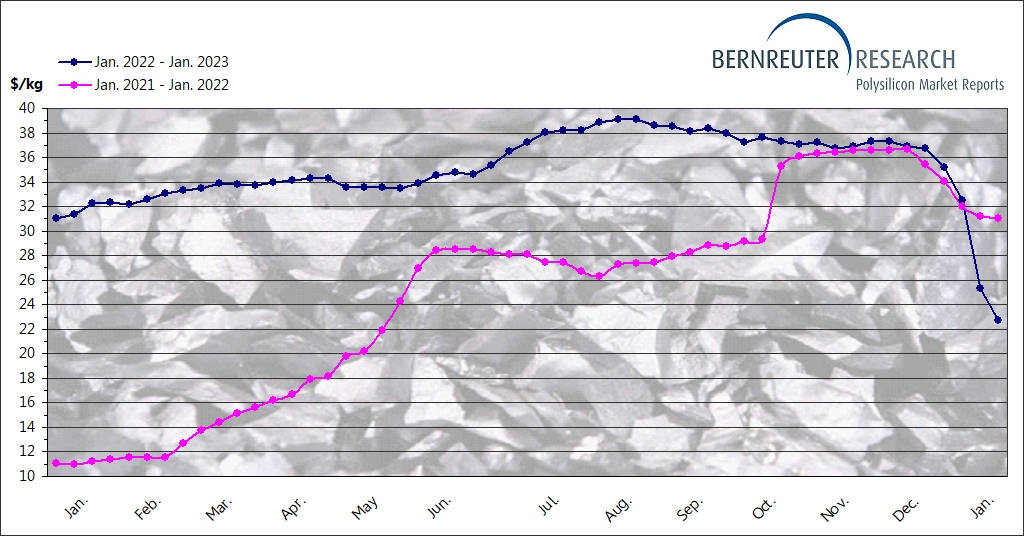

For comparison, market research firm Bernreuter Research said that the average price for 21 December 2022, around the time that the price slide began, was RMB223.4 (US$32.60). Until this point, the trajectory of the price had been almost identical to the same period leading up to Christmas a year earlier.

According to research firm InfoLink, polysilicon supply and production have continued to increase despite the price plummeting. The fact that the price is set to continue to fall for the next couple of weeks will likely see much of this supply sitting dormant as buyers wait for the opportune moment, lest they risk depreciating their inventory.

InfoLink also said that in the face of low prices some tier-two and tier-three manufacturers may cut production and struggle to fulfil orders as the price gap between tier-one companies and others widens.

Until Christmas 2022, the polysilicon price slump was not different from the seasonal decline in 2021. Chart: Bernreuter Research.

The downturn was likely triggered by an excess supply of solar wafers. Around 329GW of wafers were produced in China alone with an estimated 10GW of additional production elsewhere.

As a result of the excess production, 182mm M10 monocrystalline wafer prices fell 27% between mid-November and 21 December, according to Bernreuter Research. Once the price decline began in earnest in the closing days of December M10 wafer prices almost halved since November, falling 48%. The decline has put pressure on polysilicon prices, which have likewise fallen 39% in the same period.

Wafer manufacturers have begun to reduce their utilisation rates to deplete surplus inventories rather than produce more stock, which is likely to take the pressure off wafer prices. The lunar new year holiday in China will also see production temporarily ease off.

In the short term Bernreuter said this will reduce demand for polysilicon, however as surplus diminishes and manufacturers from polysilicon downstream are required to replenish stock, the price collapse is likely to end. Predictions say this will happen by the end of the month.

Cell prices have also fallen, by around 15% in the last week. The same principle applies here, where most manufacturers are expected to cut utilisation rates to 70-80% for the Lunar new year, with the knock-on effect of slowing the price drop.

Module prices fell, though less drastically as the ripples gradually travel downstream.