U.S. upstream oil companies are expected to bank 68% higher free cash flows per barrel produced in 2022 as surging prices fuel profits, while output growth lingers at 4.5% year to date, Deloitte consultancy said on Monday.

The study illustrates the clash between the White House and oil companies over how skyrocketing profits from high energy prices should be allocated.

Exxon Mobil Corp and Chevron Corp are expected to post strong upstream quarterly results on Friday, with some analyst expecting a new round of increase in dividends and buybacks.

U.S. President Joe Biden has been calling on producers to stop returning cash to shareholders and to invest in output to lower fuel prices for consumers.

Unlike in the past, when higher energy prices and profits would lead to increased investment rates, companies have been cutting down on costs and exercising cash discipline, Deloitte said.

Nearly 40% of surveyed executives from top 100 oil and companies in the U.S. selected debt repayments and returning cash to shareholders as their top priorities, making those the most common answers, Deloitte Vice Chair for U.S. Oil and Gas Amy Chronis said.

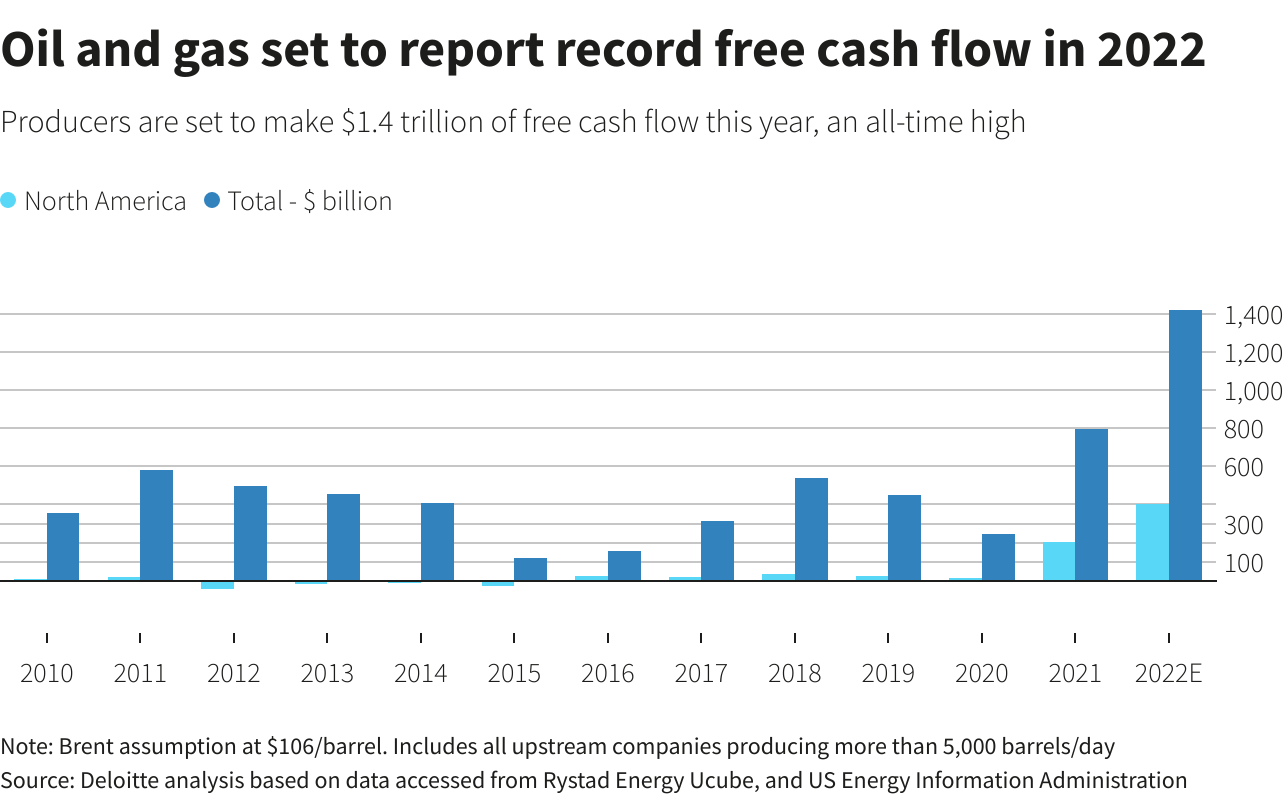

A previous Deloitte study showed energy prices could almost double oil producers' free cash flow this year to $1.4 trillion, giving them money to finance a faster shift to renewable fuels, erase debt or reward investors.

Reuters Graphics Reuters Graphics

U.S. upstream investments are projected to grow 29% this year to $108 billion, which is a much slower pace than cash flow gains, the firm said.

"We are really seeing caution in terms of where the capex is going," Deloitte Energy Executive Kate Hardin said.