In the lead-up to the COP26 summit in Glasgow later this year, Green Hydrogen has started witnessing an extraordinary spike in interest amongst governments, international agencies and corporations. More than 25 countries and 100+ corporations have now set up or are drawing up strategies for hydrogen. The key question in everyone’s mind is which demand sector will deliver the initial thrust to finally realize the hype of green hydrogen.

The green hydrogen advocates have historically failed to identify, strategize and advocate for the right initial demand sector for scaling clean-hydrogen. The answer might be different depending on the geographic location, industrial makeup and the renewables potential of the country. But, to an unbiased observer, countries with sizable petroleum refining capacities and favorable renewable electricity potential have a very obvious answer to this question. The answer lies in the world’s biggest guzzlers of dirty hydrogen: the petroleum refinery complexes.

Green hydrogen is often touted as the future of the energy sector. Having said that, most expert analysis and global think-tank projections bet big on the often under-reported avatar of green hydrogen - a phenomenal green chemical feedstock. The four pillars of a fast industrializing and urbanizing society, i.e., steel (7.2% of global emissions), ammonia, cement and plastic, have no substitutes and cannot be made with electricity alone. Green hydrogen will ultimately be necessary to achieving a truly low carbon paradigm in these sectors.

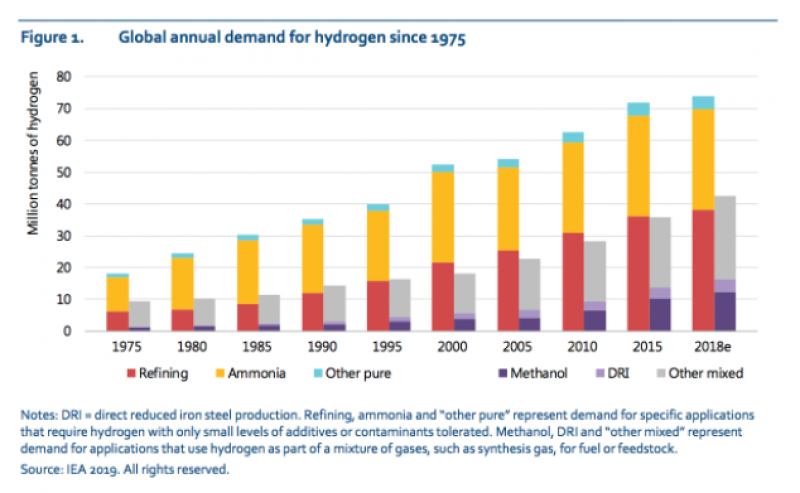

Hydrogen is already a valuable chemical commodity produced in very large scales: around 70 Million tonnes of hydrogen (as chemical) is consumed per year globally today in pure form, mostly for oil refining and ammonia manufacture for fertilisers; a further 45 Million tonnes is used in industry without prior separation from other gases. This number (70 M.t of hydrogen as chemical) will grow multiple times over the next three decades even without much intervention from governments.

But, for a green-hydrogen led decarbonisation to materialise, the economics of green hydrogen has to be optimized. It is well-known that current green hydrogen costs of about $4.5/Kg to $7.0/Kg should be brought down to $1.5-2.0/Kg for green hydrogen to make sense. This is why blending small quantities of expensive green hydrogen with cheap grey hydrogen is the prefered route to distribute and dilute the green premium for consuming zero-carbon hydrogen across many million tonnes of products. Over time as the green hydrogen prices come down, the green hydrogen share in the blend will be steeply increased. At some point, green hydrogen will become cheaper than the dirty grey hydrogen.

There are 7 key demand opportunities for green hydrogen such as petroleum refining, fertiliser manufacturing, steel production, methanol production, natural-gas blending, heavy-duty-long-distance transport and seasonal energy storage. Some of these areas such as fertilizer and methanol production will need additional investment to bring in necessary chemicals such as carbon-di-oxide which dirty grey hydrogen already delivered free-of-cost. Applications such as gas blending and transport requires huge additional infrastructure investments on top of the green premium that must be paid to use expensive green hydrogen. The steel industry, though promising, requires a transition to a DRI technology (which is still relatively nascent) to start using green hydrogen in scale. This does not mean these demand sectors should be ignored. On the contrary, active large-scale piloting, feasibility studies and innovation should be supported to get these sectors ready for hydrogen in the near-future.

On the other hand, petroleum refining provides for a reliable demand that is bound to surely and predictably expand in near-term due to tougher sulphur regulations all around the globe. Countries like India are expected to significantly expand their refining capacities providing for an opportunity of greenfield green hydrogen based refinery designs. More importantly, hydrogen, while accounting for less than 5% of the cost of the final refined product, contributes to 30% of the product’s emissions.

Utilizing green hydrogen in refineries has the least green-premium (switch-over cost) amongst any other demand sector. Using 20% green hydrogen in a refinery will only increase the cost of the final product by 1-5% which can be comfortably offset by ESG compliance benefits and potential carbon credit opportunities. Hence, for most major economies such as the USA, EU, India and China - petroleum refineries are the low-hanging fruit that delivers a least-cost pathway for a scaled green hydrogen adoption. This will spur technology innovation and evolve disruptive business models while reducing risk premiums for adoption of green hydrogen in other sectors.

India is the second-largest steel producer and home to some of the world's largest truck and agriculture vehicle makers. The 1,4 Billion strong nation also boasts one of the biggest and fast-growing refining & fertilizers capacites in the world. The interesting part is that all of these sectors are nowhere near attaining growth maturity in the country. Realizing the natural advantages the country has, India has announced a National Green Hydrogen Mission through its budget in March 2021, signalling a strong commitment to a low carbon growth trajectory. For India, this transition can be synergistic with the scale, ambition, and globally envied economic competitiveness of its renewable industry, which is well on its way to become the third largest in the world in a few years time.

Opinions expressed are strictly personal.

Kowtham Raj VS is Director, India Energy Storage Alliance, Fellow - NITI Aayog and Future Energy Leader in World Energy Council.