Monolith Materials, Inc. has received an investment from Mitsubishi Heavy Industries America, Inc. to support its commercial-scale, emissions-free hydrogen manufacturing technology. The announcement is the latest in a series of recent strategic investments made by MHI in support of achieving a decarbonized world.

Monolith Materials is the first US manufacturer to produce “turquoise hydrogen” on a commercial scale.

Olive Creek 1 in Hallam, Nebraska is Monolith Materials’ first commercial-scale emissions-free production facility designed to produce approximately 14,000 metric tons of carbon black annually along with clean hydrogen.

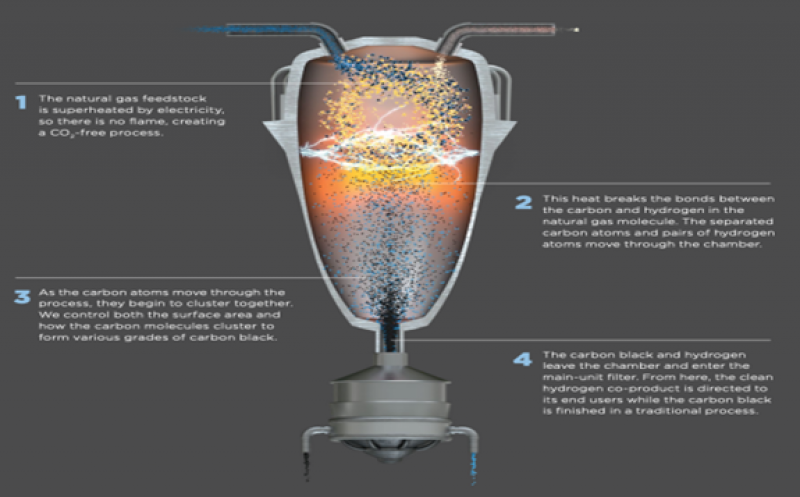

Through an innovative and proprietary development in commercial-scale methane pyrolysis, Monolith is now manufacturing emissions-free, economically sustainable hydrogen using 100% renewable energy. Monolith’s hydrogen is classified as “turquoise hydrogen”.

Monolith Materials, which was founded in 2012, developed a process technology that converts natural gas into clean hydrogen and a solid carbon material called carbon black, a critical raw material in the automotive and industrial sectors. The company is currently in the operating stage of Olive Creek 1 (OC1), its first commercial-scale emissions-free production facility designed to produce approximately 14,000 metric tons of carbon black annually along with clean hydrogen.

In addition to producing carbon black and clean hydrogen, the company recently announced its plans to produce emissions-free ammonia at a second phase production facility known as Olive Creek 2 (OC2) in Hallam, Nebraska.

Combined, Monolith Materials’ production of hydrogen, emissions-free ammonia and carbon black are expected to reduce greenhouse gas emissions by as much as 1 million metric tons per year compared to traditional manufacturing processes, the company said.

Monolith is backed by Azimuth Capital Management, Cornell Capital LLC, Imperative Ventures and Warburg Pincus.