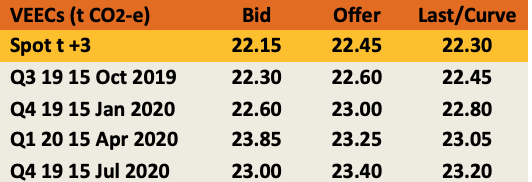

Prices as at 31st July 2019

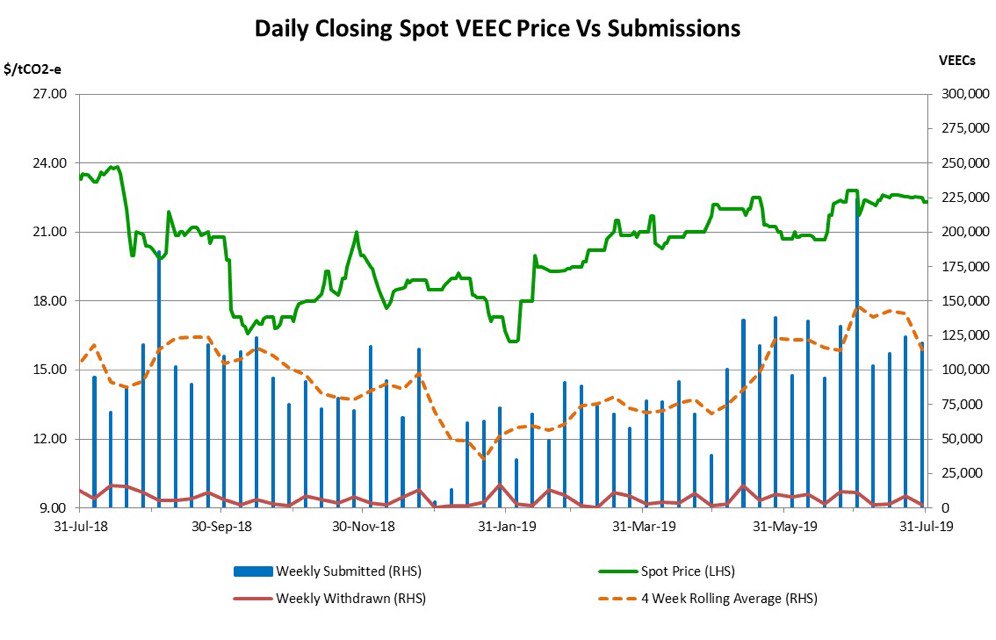

The delayed on-set of Schedule 21A (residential lighting replacements) eventually saw VEEC submissions rise after a prolonged period of softness, yet it wasn’t enough to stop the VEEC price from trending higher. News of the 2021-2025 target extension consultation continued to be hotly anticipated across the first half of 2019, yet to-date the market’s appetite for information remains unindulged.

Having reached a low of $16.25 in Feb19, the spot VEEC market rallied sharply across the remainder of that month to surpass the $20 mark in early March. From there it continued a general upward trend across April that saw it back into the mid $22s in May.

The source of the rally appeared to be the persistently low submissions numbers which, across the first 4 months of the year averaged only 68k per week, a little over half the number required to meet the 2019 target of 6.3m if the surplus is ignored. Importantly this softer number persisted despite all the talk surrounding Schedule 21A and the speculation as to what its contribution to VEEC supply would be.

As can be seen in the chart above however, VEEC submissions grew sharply across May with an increase in 21A along with Schedule 34 (commercial lighting). In the period since average weekly submissions numbers reached climbed to 126k, almost double the earlier period’s activity. The increase may have been the result of tardiness in submission, with the 30 June deadline for 2018 vintage VEECs flushing out backlogged supply.

Yet it is also likely that when the state’s residential solar industry ground to a halt in May following the capping of the state’s rebate, electricians who had previously prioritised solar over lighting upgrades suddenly returned to the fold.

While this sharp rise in activity did temporarily impact on the spot VEEC price, which softened back below $21 in June, the market ultimately rebounded to spend most of July in the low to mid $22s.

With the 2021-2025 target due to be released by April 2020 and the Department having repeatedly acknowledged the both the benefits to the broader market, as well as its intentions of coming to a decision early, participants have keen awaited news of the consultation process.

As is often the case with anxious people involved, there were repeated rumours which circulated predicting the release of consultation documents which never eventuated. At the time of writing and with nothing released, there is growing speculation that perhaps the process may not play out early as was first hoped, with participants potentially forced to wait till later in the year for the process to begin.

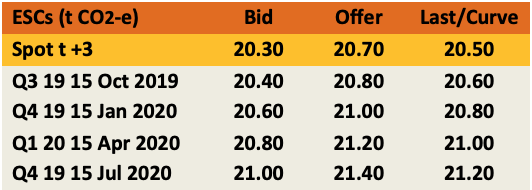

New South Wales Energy Savings Certificates (ESCs)

Prices as at 31st July 2019

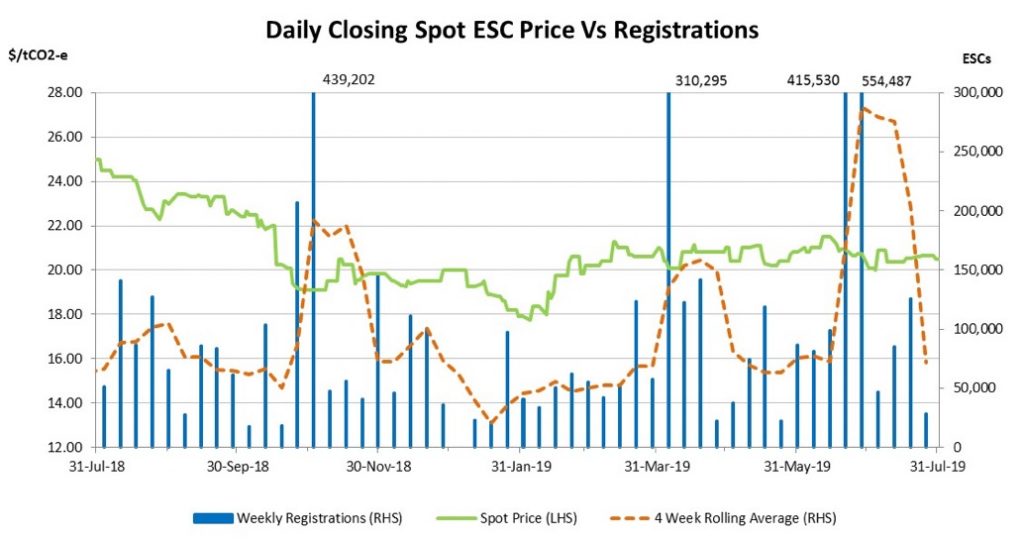

The year to date in the ESC market has been a generally uneventful period in which pricing has remained particularly stable. Of note however were the considerable ESC creations which came as somewhat of a surprise in June, along with the ongoing review of the scheme.

Following the artificial spike in ESC registration volumes in October 2018 following a deadline for changes to the commercial lighting methodology, ESC supply had been trending downward across the early part of 2019. March saw a sharp increase with many participants who were previously battling to get through their audit cycle managing to do so at once.

Having been somewhat counterintuitive in relation to ESC supply across the early part of the year, the spot ESC price stabilised from March, with prices in the $20 to 21.50 prevailing during this time. And, interestingly, the very larger creation in the month of June, which came as a surprise to many, also failed to significantly impact on price.

Each year, the 30thJune deadline for registration of the previous year’s ESCs (defined as for upgrades completed by 31stDecember) flushes out a backlog of certificates. In 2017, in the first truly large spike, over 1m ESCs were approved. In 2018 north of 900k went emerged. And while most suspected a healthy number to be created in 2019, few were anticipating the more than 1.1m that arose.

There were several reasons for this. Firstly there had been a sense that a combination of a more mature market with much of the low hanging fruit already picked, along with prevailing prices that, whilst not necessarily super low by historical standards were also not high enough to be a strong stimulus of activity.

And secondly, the belief that the October 18 cut-off for commercial lighting would have already depleted a lot of that backlog before it could grow.

The other major issue for the scheme remains its review by the state government, which comes at a time in which the existing target has reached its peak, flatlining from 2019 for another 6 years.

Thus far the review has produced a consultation paper with a raft of changes aimed at improving a variety of creation methodologies by clarifying ambiguities and proposing other changes to streamline administration. Yet there has been no public discussion as yet about the target and whether the status quo is acceptable, or if the scheme will be used to contribute to the more ambitious emissions reduction target that the state has adopted.

Marco Stellais Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.