Xiamen Xinglin Bay City Scenery In Fujian,China GETTY

China is seizing on an international opportunity that the Trump administration has forsaken — helping other countries expand their domestic infrastructures and potentially with green power plants. China’s most ambitious project is known as the Belt and Road Initiative that stretches across four continents and 76 countries

The economic undertaking sets out to create an expansive network of railways, pipelines and highways from Asia to Africa to the Middle East and Europe. For some, the move is indicative of an aggressive China and one that wants to exert its influences around the globe by becoming bankers to the needy. Others, though, see it as a chance for China to expand the markets for its own goods and services — in much the same way that any capitalistic economy would.

“We’re seeing improved economics in Belt and Road countries, alongside supportive government policies in China,” says Robin Xing, Morgan Stanley’s Chief China Economist. “These factors reinforce our view that China’s investment in Belt and Road countries will increase by 14% annually over the next two years, and the total investment amount could double to $1.2-1.3 trillion by 2027.”

The “belts" refer to railroads that will connect China with Europe, Russia, the Middle East and Central and Southeast Asia, the author adds. The “roads" refer to maritime routes and multiple ports that will be expanded or built along the South China Sea, Indian Ocean and South Pacific. The participating countries account for 30% of global gross domestic product and 44% of the world's population.

The dynamics at play are complex and involve such factors as the access to financing and the market need for new energy sources. And it all bodes well for China because — as Morgan Stanley notes — the Asian Infrastructure Investment Bank says that there is a $21 trillion gap between the infrastructure needs of Belts' and Roads' countries and the amount of financial support that is currently available to them.

But China is also well-positioned to meet the demand for financing investment in renewable energy projects, especially in light of Trump’s dismissal of prevailing climate science. Its long-term planning has it investing $6 trillion internationally in low-carbon technologies over the next two decades, all to meet a global increase in electricity demand of 30% by 2040.

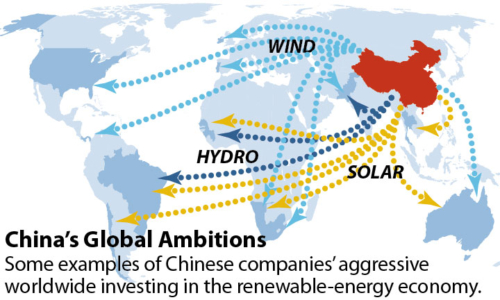

China accounts for one-third of the world’s new wind power and solar PV and more than 40% of global investment in electric vehicles, says the International Energy Agency. In the absence of U.S. leadership, it wants to become the go-to country for solar panels and hydro-electric resources, having already invested billions in this effort.

“What seems clear is that clean energy is a 21st century industry that China is well positioned to dominate,” says the Brookings Institution. “Where the Trump administration sees renewable energy as a threat to jobs, China is leveraging clean energy as part of a long-term strategic gambit.”

To be sure, China will still rely on coal to meet its energy needs — something that may conflict with its ambitions associated with its Belt and Road Initiative. While China would like to power a preponderance of its economy with renewable electricity, it has 860 gigawatts of coal power in operation. And much of that is newer, meaning it has decades to live on.

The situation became magnified in April as China’s National Energy Administration lifted the moratorium on the use of coal in 11 of its provinces. This extends a move made in 2018 in which the country increased its coal-fired power capacity as well as its coal production, say Aiqun Yu and Christine Shearer, energy analysts with Global Energy Monitor for the Diplomat.

The two analysts add that, overseas, China is also involved in funding a quarter of all new coal plants — under the banner of the Belt and Road Initiative. Of the $51 billion China spent financing power plants between 2014 and 2017, they say that 36% of that money went to coal projects and 11% went to wind and solar facilities.

“Chinese banks and equity funds will have to get considerably more comfortable with—and more adept at—financing low-carbon solutions abroad if they are going to contribute to a ‘green Belt and Road Initiative,’” says the World Resources Institute. “Chinese financial institutions are well-positioned to help finance the largest expansion of sustainable, climate-resilient infrastructure in history.”

China's decisions on how it fuels its own growth as well as how it assist other nations will thus have an impact on global greenhouse gas levels. Given its desire to expand the markets for its own goods and given the expected growth in renewables, its conclusions should be clear.