Following the outbreak of COVID-19 in China in late 2019, solar manufacturing was severely disrupted in Q1 2020 as the Chinese national holiday was extended and restrictions were placed on movement.

This reduced workforces, cut the supply of critical components for PV modules such as cells, connectors, or glass, and made it almost impossible to ship completed products due to the closure or partial closure of transport routes, ports, etc. As restrictions gradually eased, manufacturing in China slowly resumed from late February, and has the potential to reach full capacity by the end of Q2 2020.

Throughout March, as the COVID-19 pandemic quickly spread around the world, disruption to supply has quickly turned to an unprecedented stall in global demand, switching the industry almost overnight from a sellers’ market to a buyer’s markets. Tight restrictions on people movement have been quickly put in place by Governments in almost every major solar market in the world in an effort to curb the spread of the disease are making increasingly challenging to complete installations. Almost all large projects originally planned for completion in H1 2020 will be impacted in some way, and roof-top installations will grind to a halt. COVID-19 will also severely hit the planning and kicking- off of new projects in H2 2020.

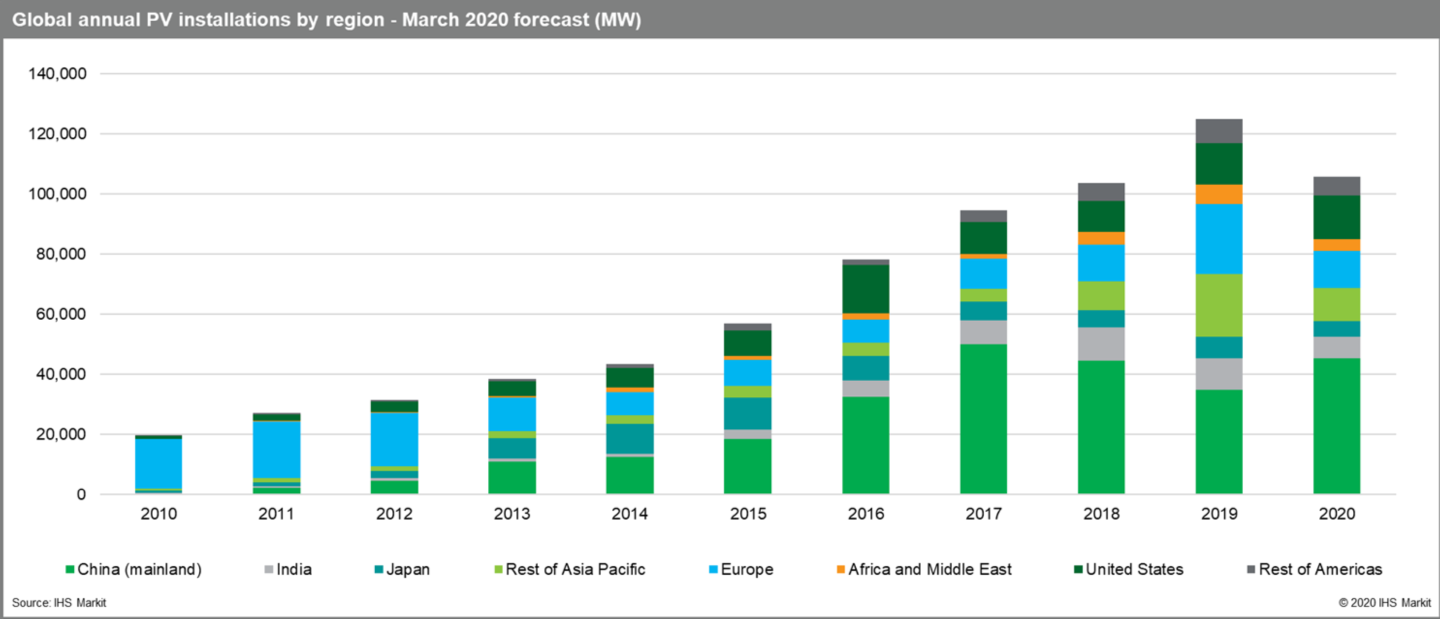

IHS Markit new solar PV outlook forecasts 105 GW in 2020, a 16 per cent Y-o-Y decline from 2019 global installations. The most-likely scenario assumes that restrictions will be slowly lifted throughout Q2 2020 and Q3 2020. IHS Markit predicts activity will return to the market in the second half of the year but gradually, depending on segments and countries. However, the severity of the global economic downturn triggered by the pandemic will prevent a rapid recovery this year. Some markets may benefit from renewables being featured in the stimulus packages that will be required to help economies recover, but the general financial environment will impact heavily on demand for all types of PV systems. The hardest hit regions will be Europe, India and the rest of Asia given that they were some of the largest regions for solar deployment in recent years.

In great contrast to the rest of the world, IHS Markit is increasing its forecast for PV installations in China in 2020 to 45 GW – 5GW higher than the general market expectation. In this exceptional environment, it is assumed that a rapid recovery of demand in H2 2020 will be aided by Government support in order to protect its domestic manufacturing and installation base. If this is the case, China will once again account for more than 40% of global installations in 2020, as it did each year between 2016 and 2018.

Beyond the colossal short-term disruption that solar will face in the remainder of 2020, the broader question is whether or not there will be a fundamental change to the outlook for solar worldwide under a new economic scenario with low-priced conventional resources. The view is that, after this major short-term disruption, installation growth will resume from 2021 to continue the growth trajectory that solar PV has seen in the last decade.

Despite this major global health and economic crisis, IHS Markit believes the mid-term fundamentals for solar PV growth continue to be strong, including continued cost reduction, the need for greater resilience and autonomy, low-carbon energy generation, distributed generation and scalability.