For months the administration has been divided over whether to recognize the Department of Energy's Greenhouse Gases, Regulated Emissions and Energy Use in Technologies (GREET) model.

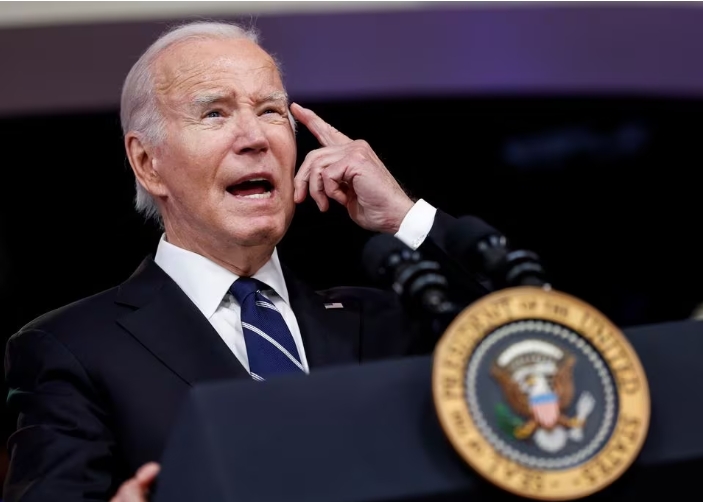

As it stands, that model would enable ethanol-based SAF to qualify for tax credits under the Inflation Reduction Act, President Joe Biden's signature climate law.

The news, which was first reported by Reuters, is a win for the ethanol industry and the U.S. Corn Belt, a powerful constituency ahead of the 2024 presidential election.

The group sees SAF as one of the only routes to grow ethanol demand amid rising sales of electric vehicles. Biden, a Democrat, is seeking re-election and will depend on votes from closely contested Midwestern states that are the heaviest corn producers.

The administration, however, is also expected to announce it will update the GREET methodology by March 1, the sources said.

That leaves some uncertainty for corn-based ethanol producers, as the administration is expected to ultimately tighten requirements around SAF feedstocks.

Until the updates are announced, a fierce lobbying push is expected. Ethanol groups have been at odds with environmentalists who want standards that elevate feedstocks like used cooking oil and animal fat.

The Treasury Department declined to comment for this story, while the White House did not respond to a request for comment.

SAF producers seeking tax credits under the IRA must demonstrate, with an approved scientific model, that their fuel generates 50% less greenhouse gas emissions over its lifecycle than petroleum fuel.

The ethanol industry argues the U.S. needs to use ready technology like ethanol to quickly reduce carbon dioxide emissions. Renewable Fuels Association President Geoff Cooper called the administration's decision "a pivotal moment for the future of sustainable aviation fuels" earlier this week.

One of environmental groups' central concerns about the use of the GREET model - that it would underestimate the emissions generated by tilling land for crops - appears to be unresolved, said Nikita Pavlenko, fuels team lead at the International Council on Clean Transportation.

The lifecycle emissions calculated by GREET for any given fuel can vary widely depending on what data sources and assumptions are plugged into the model, and any future update on how producers should use the GREET model needs to take a stringent approach, he said.

"Some of the values (for land-use change) favored by industry haven't gone through the regulatory process, and don't line up with the academic consensus," he said.

White House adviser John Podesta said on Thursday the SAF guidance would be released very soon.

"We think, in order to take advantage of the credit, that emissions have to be 50% below what oil-based aviation fuel looks like," Podesta told reporters on Thursday.