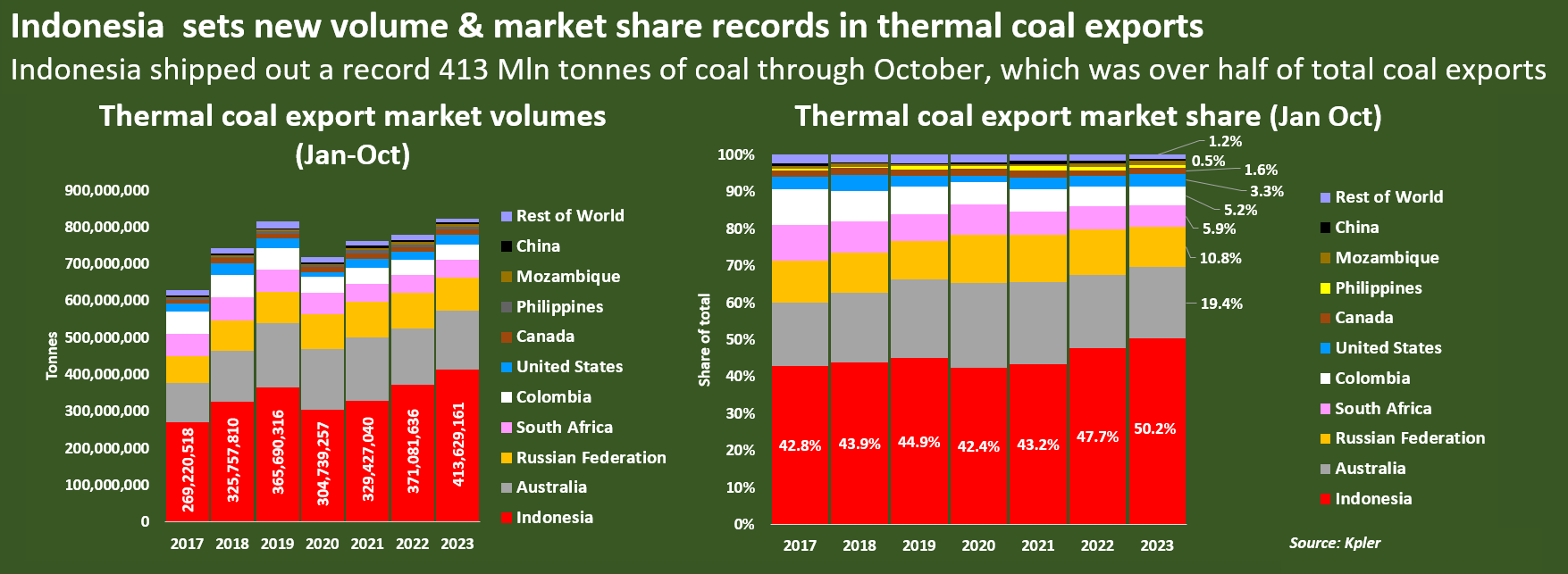

Indonesian shipments jumped 11.5% from the same period in 2022, roughly twice the growth rate of total global coal exports that are on track to touch new highs in 2023 despite efforts to transition several major energy systems away from fossil fuels.

For the first time, Indonesia accounted for more than 50% of global thermal coal exports during the January to October window, data from Kpler shows, indicating its success in wresting share from rival exporters.

Indonesia sets new volume & market share records in thermal coal exports

Second-largest coal exporter Australia's share was 19.4% for the opening 10 months of 2023, down from 20% in 2022, while No.3 exporter Russia had an 11% share, down from 12.3% in 2022.

South Africa and Colombia, the fourth- and fifth-largest exporters respectively, also lost share to Indonesia in 2023. The United States, the sixth-largest exporter, slightly gained global share.

TOP MARKETS

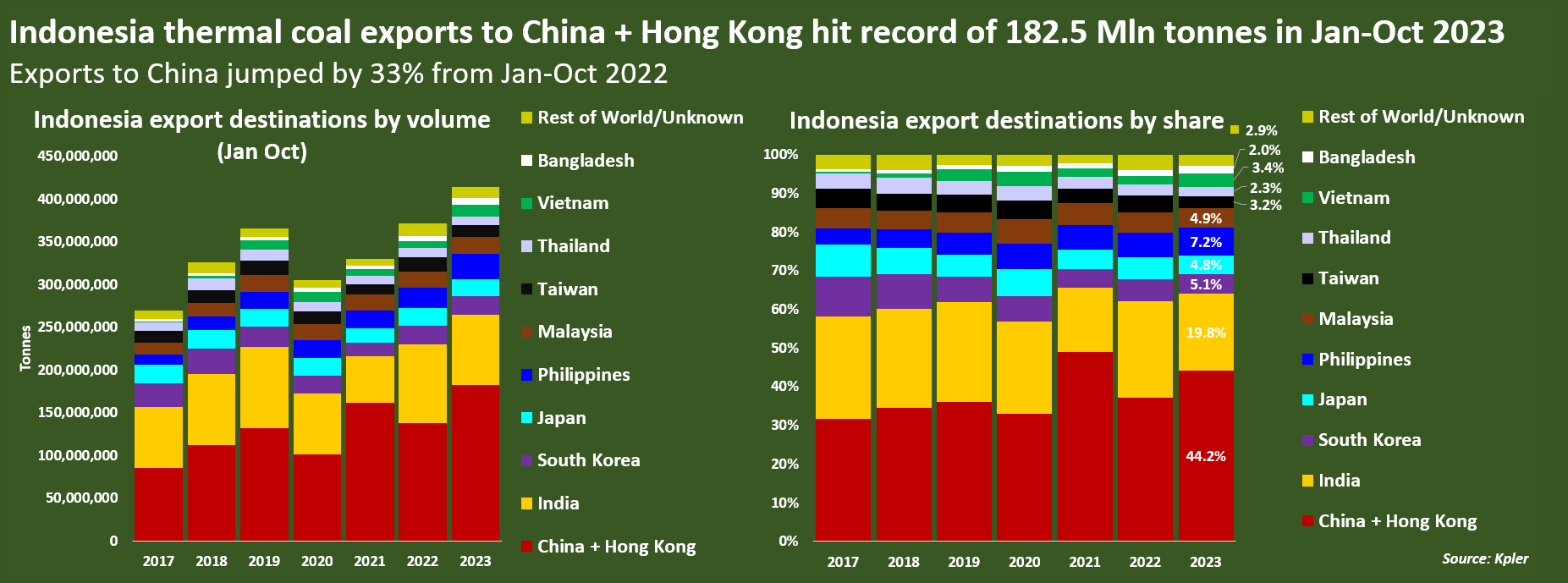

China was the top destination for Indonesian coal, along with Hong Kong, importing 183 million tons through October, or around 44% of Indonesia's total exports.

That tally was up 33% from the same period in 2022 and is illustrative of 2023's pick-up in Chinese industrial activity compared with the COVID-stunted demand levels of last year.

Indonesia coal exports by destination

India was the second largest buyer of Indonesian coal, grabbing a roughly 20% share of the total (82 million tons). The Philippines was the third largest market with a 7.2% share (30 million tons).

Japan, South Korea and Taiwan were also major buyers, and, same as China, can be expected to crank up their coal imports over the final months of the year as utilities stock up ahead of the seasonal climb in power demand for heating.

PRICE PRESSURE

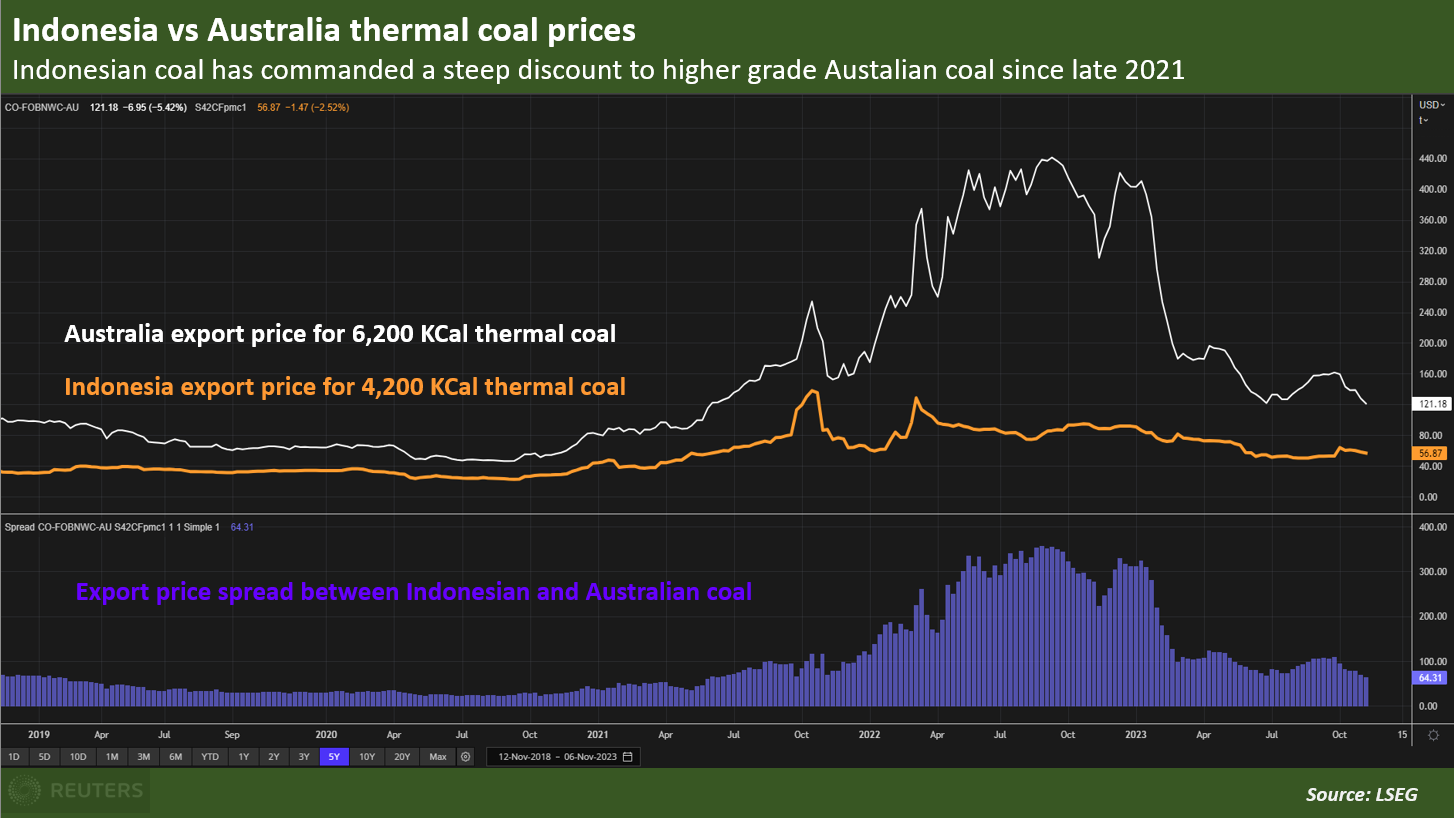

Key to Indonesia's market share growth has been the relatively low price of Indonesian coal compared to the higher grades peddled by rivals such as Australia.

The benchmark grade of Indonesian thermal coal - with a calorific value of 4,200 kilocalories per kilogram (kcal/g) - has averaged around $65 a ton so far in 2023, according to LSEG.

Indonesia vs Australia thermal coal prices

That compares to an average $184 per ton for the roughly 6,200 kcal/kg coal shipped from Newcastle in Australia.

Export prices from Colombia, South Africa, Mozambique and Russia have ranged roughly midway between Indonesian and Australian prices, highlighting that Indonesia enjoys a sustained price advantage relative to peers because of the lower quality of Indonesian coal compared to other grades.

Indonesia also enjoys a significant freight cost advantage to top coal consumers China and India, making it a popular supplier for cost-sensitive importers throughout Asia.

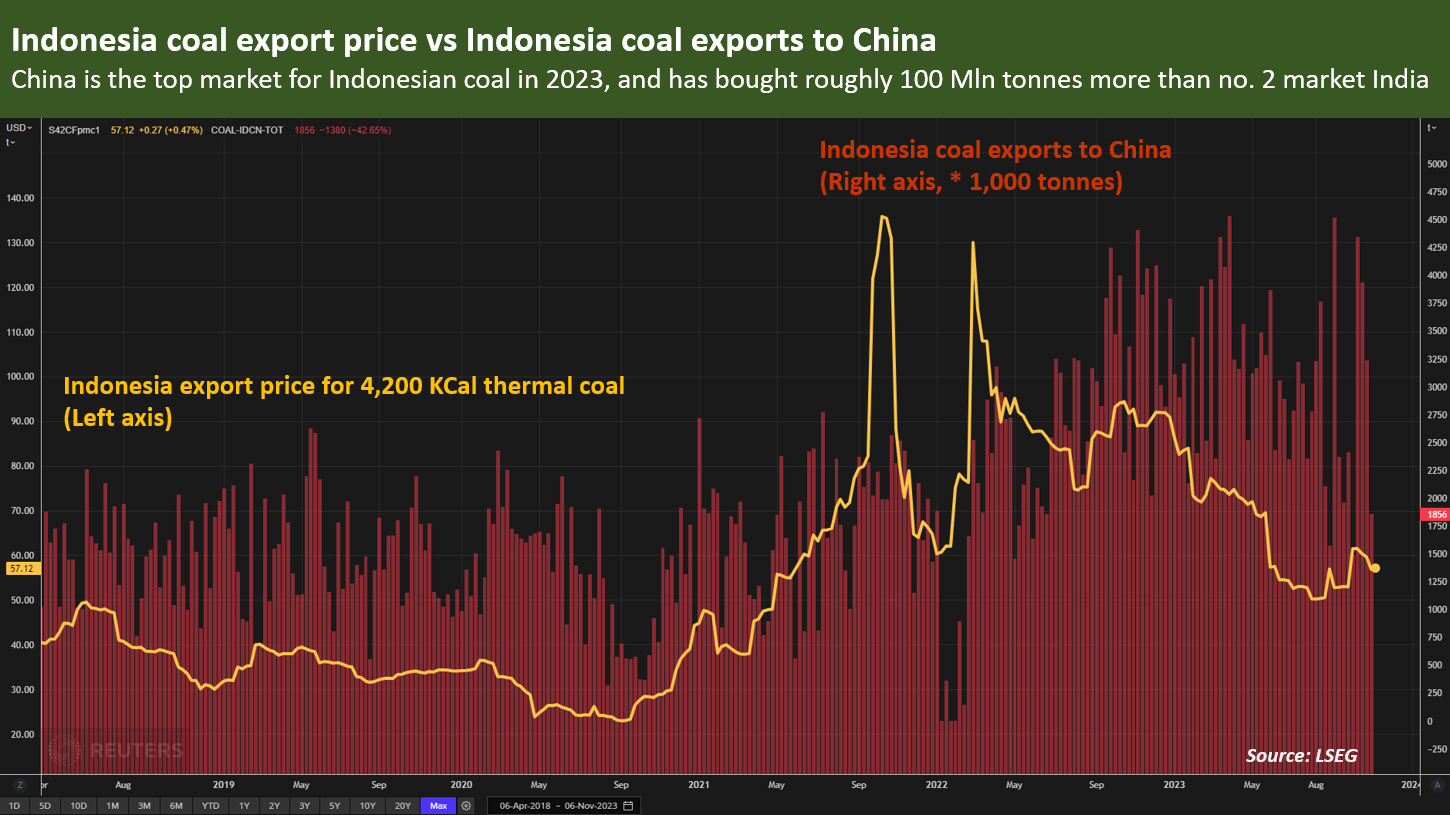

Indonesia coal export price vs Indonesia coal exports to China

The price to ship a ton of coal from Indonesia to China is currently around $8-$10, compared to $14-$15 a ton for the Australia to China voyage, according to Shanghai Shipping Exchange data.

The journey time from Indonesia to major coal import hubs in China and India is also roughly half that from Australia, which gives Indonesian exporters an advantage in securing spot deals for urgent cargoes.

This combination of proximity and low price looks set to keep Indonesia in the mix for further coal exports over the remainder of year, when coal consumption tends to peak across the northern hemisphere.

A recent decline in Australian coal prices to their lowest since mid-2021 should also trigger increased interest in higher quality Australian grades by utilities looking to maximize power output while limiting emissions.

But for power producers who remain primarily focused on generating as much power as possible at the lowest possible price, Indonesian coal will remain their first choice.

And that means Indonesia's full-year coal exports will smash previous records for 2023 as a whole.