The cost of wind and solar continue to decline and are now at the point where they beat, or at least match, even the marginal costs of coal-fired generation and nuclear power, according to the 13th and latest edition of Lazard’s Levelized Cost of Energy Analysis, one of the most highly regarded assessments in the world.

The new Lazard report puts the unsubsidised levellised cost of energy (LCOE) of large scale wind and solar at a fraction of the cost of new coal or nuclear generators, even if the cost of decommissioning or the ongoing maintenance for nuclear is excluded.

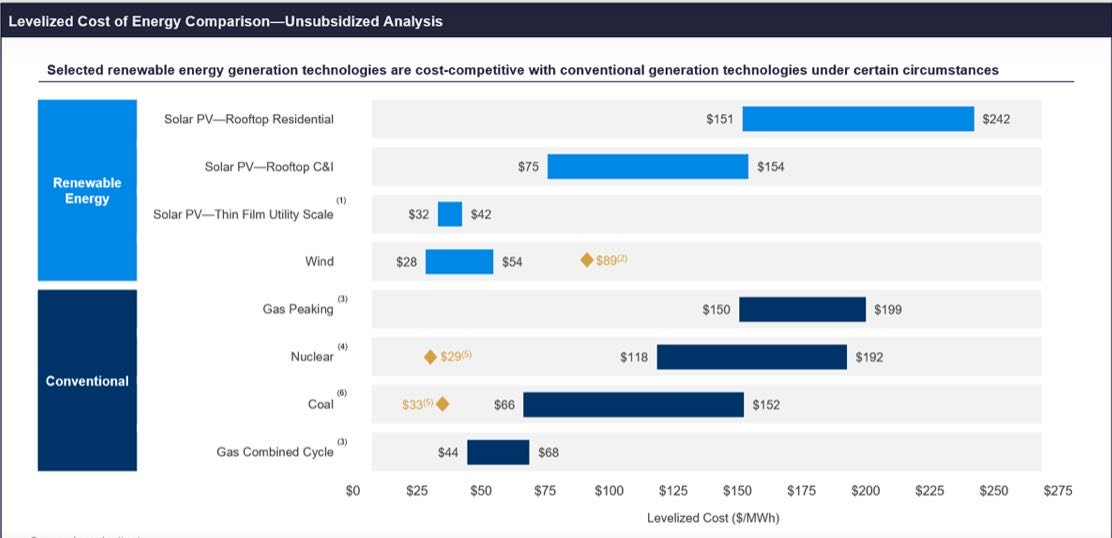

Wind is priced at a global average of $US28-$US54/MWh ($A40-$A78/MWh), while solar is put at a range of $US32-$US42/MWh ($A46-$A60/MWh) depending on whether single axis tracking is used.

This compares to coal’s global range of $US66-$US152/MWh ($A96-$A220/MWh) and nuclear’s estimate of $US118-$US192/MWh ($A171-$A278/MWh).

Wind and solar have been beating coal and nuclear on costs for a few years now, but Lazard points out that both wind and solar are now matching both coal and nuclear on even the “marginal” cost of generation, which excludes, for instance, the huge capital cost of nuclear plants. For coal this “marginal” is put at $US33/MWh, and for nuclear $US29/MWh.

The cost of solar, Lazard notes, has fallen 89 per cent over the past decade, and is still falling at an average rate of 13 per cent a year. The more mature wind technology has fallen 70 per cent over the same period of time, and is still falling at around 7 per cent.

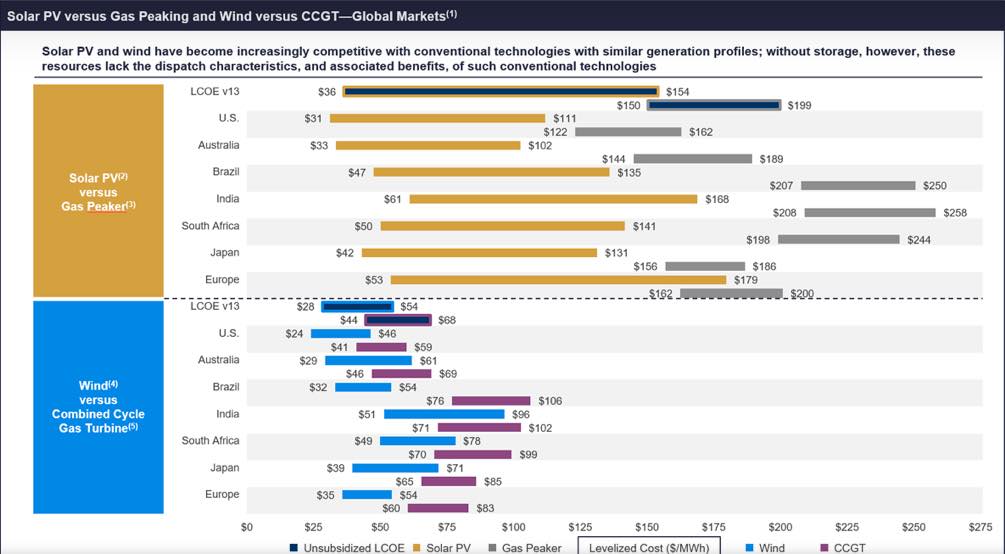

The two technologies also beat gas on various measures. Solar is far cheaper than peaking gas, and wind beats out the more conventional combined cycle gas. Australia, it notes, has amongst the world’s cheapest wind and solar costs of the markets it has analysed.

The Lazard findings are significant and timely because, like their previous editions and also the CSIRO-AEMO GenCost report of 2018, it shows that wind and solar are clearly cheaper than coal and nuclear by several factors.

The coal and nuclear sectors – represented by the same lobby groups such as the Minerals Council of Australia – have railed against the CSIRO-AEMO report, saying it doesn’t reflect reality. They point to the potential of “small modular reactors” and the optimistic prices pushed forward by their various proponents.

But as CSIRO and AEMO pointed out in recent testimony to the nuclear inquiry, that technology is at least 10 years away from putting its first commercial plant into operation, and the nuclear industry consistently overshoots its budgets and experiences huge delays.

The first nuclear reactor being built in France is now more than a decade late and at least three times its original cost after yet another blowout, and the first reactors to be built in the UK and the US in decades are suffering similar delays and cost blowouts.

Lazard has also released its latest and fifth version of its Levellised Cost of Storage report, which notes continuing declines in the of lithium-ion batteries,

It analyses a range of different scenarios and uses for battery storage, both in wholesale markets and behind the meter. For large-scale solar and lithium-ion batteries, it puts the cost of solar plus four-hour storage at $US102-$139/MWh ($A147-$A200/MWh).

The significance of this is that it beats the cost of peaking gas – $US150-$US199/MWh ($A217/MWh-$A288/MWh) and explains why so many utilities in the US, for instance, are using this combination rather than peaking gas plants.

It should be noted, however, that the US tenders have shows far cheaper prices than those nominated here by Lazard, and that may be explained by the fact that Lazard’s estimates are an average cost of three different technologies – lithium-ion and vanadium and zinc bromide flow batteries – and across multiple jurisdictions.

“Solar PV + storage systems are economically attractive for short-duration wholesale and commercial use cases, though they remain challenged for residential and longer-duration wholesale use cases,” Lazard notes. It also notes though that solar and storage can deliver multiple revenue streams, due to the versatility of the battery,

Its report does not look into pumped hydro, which will be the likely storage of choice for longer durations, along with hydrogen further down the track.