A deal would be Exxon's biggest since its $81 billion acquisition of Mobil in 1998. It would make the company one of the leading producers in the lucrative Permian basin, the largest U.S. shale oil field as the country's oil production closes in on an all-time record of 13 million barrels a day.

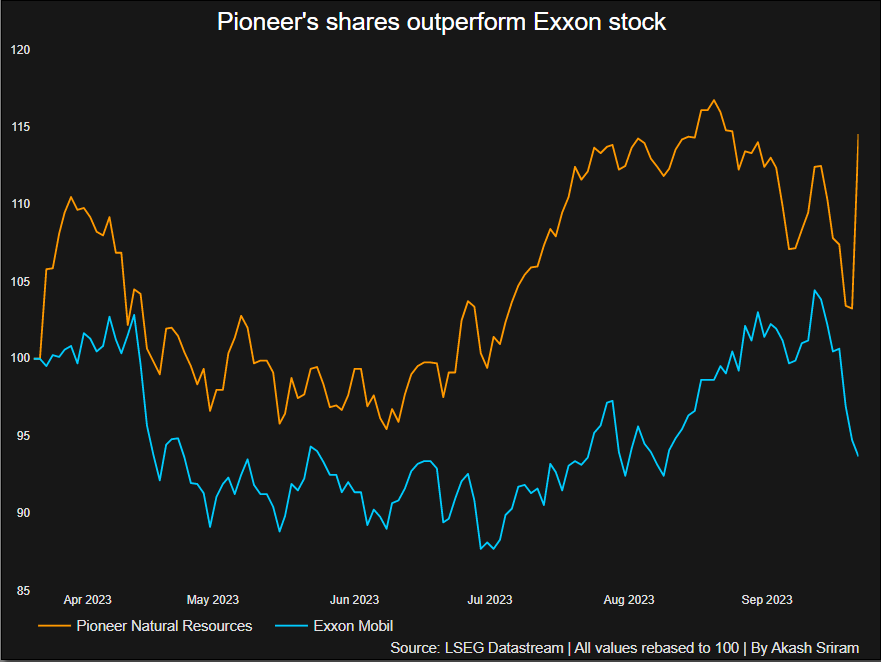

Pioneer's shares were trading at $238.50 on Friday, valuing the company at nearly $56 billion, while Exxon shares were down 1.2%. The offer implies a roughly 20% premium to Pioneer's Thursday close. A deal's value can change at any time in negotiations.

The premium is in line with other E&P mergers this year, but "still strikes us as slightly low for a company with the unique scale and quality of inventory held by Pioneer," said Andrew Dittmar, a director at Enverus.

Friday's gains leave Pioneer's stock short of the implied offer, as it is possible that the two companies will not reach an agreement.

Reuters Graphics

"Would not expect Exxon to pay a substantial premium for the assets given the limited number of alternative buyers out there for something of this scale," said RBC Capital Markets analysts Biraj Borkhataria.

Pioneer holds an estimated 6,300 net locations of high-quality inventory, according to Enverus.

Reuters Graphics

The deal value implies Exxon is paying about $4.5 million for Pioneer's high-quality locations and $3.7 million for all locations, above the recent M&A trends that have valued assets around $3 million per location, Enverus said.

If the negotiations conclude successfully, an agreement between Exxon and Pioneer could be reached in the coming days, Reuters reported on Thursday, citing three sources.

However, any deal could attract political and regulatory scrutiny.

"Pioneer is the Permian's largest operator at 9% of gross production while Exxon is No. 5 at 6%. Combined amounts to 15% of operated Permian production, but only 6% of total U.S. production. These datapoints are relevant given FTC scrutiny around consolidation," RBC Capital Markets analyst Scott Hanold said in a note.

U.S. crude oil output rose to just shy of 13 million barrels per day (bpd) in July, only slightly less than the record set in November 2019.

Oil majors have focused on returning cash to shareholders rather than boosting production. They have been slow to increase spending despite record profits and near-record U.S. oil output.

Industry experts said the deal could set a precedent for more large-scale M&A in the sector.

"If ExxonMobil is crowned the undisputed king of the Permian in the coming days, the shale sector will fundamentally become a more mature consolidated business," said Matthew Bernstein, senior shale analyst, Rystad Energy.