The climate crisis involves capital flows: according to the Paris Climate Agreement they must be made "consistent with a pathway toward low greenhouse gas emissions." But a new study shows that cross-border loans from public banks, especially from China, Japan and South Korea, are a major driver of new coal-fired power plants in the Global South. And the loans are often just a means to an end for export deals.

The study was led by the Berlin-based climate research institute MCC (Mercator Research Institute on Global Commons and Climate Change) and published in the journal Environmental Research Letters.

"For the first time, we are shedding empirical light on an aspect of the political economy of coal that has hardly been researched until now," says Jan Steckel, head of the MCC working group Climate and Development, and co-author. "While there is certainly a natural need for foreign capital in the countries where the new power plants are being built, we are gathering strong circumstantial evidence that supply of this capital significantly affects the level of demand.

"Manufacturers of turbines, power generators or steam supply systems, and project service providers such as architectural firms and engineering companies are apparently mobilizing capital providers in their own countries so they can do business beyond the borders."

The study draws on databases of the U.S. information services Global Energy Monitor and S&P Global Platts as well as the German environmental protection organization Urgewald who have researched the financial sources of 250 project companies at the information services Bloomberg, Thomson Reuters, and IJGlobal. This provided a unique data set for 459 new coal-fired power plant units with a capacity of 225 gigawatts.

The researchers concentrated on 188 plants with 91 gigawatts completed since 2018 or soon to be commissioned. The year 2018—two years after the Paris Climate Agreement came into force—was chosen because two years is considered the minimum time from securing financing to setting into operation.

Most of these plants, i.e., those with a capacity of 65 gigawatts, were financed in whole or in part by foreign capital providers. Researchers found that this was mostly serviced by supplier companies from the same country. For example, more than 90% of public financing from abroad goes hand in hand with a foreign turbine manufacturer—who then has a good 60% probability of coming from the same country as the lending bank.

A complementary scientific survey of international experts then helped clarify the cause-and-effect relationship, finding that financing is often only a door opener. The driver is the development of new sales markets. From the interviews, the study conveys the insight that the foreign government also plays an important role in linking such transactions. It uses its development bank as a strategic instrument to open up international sales markets for its export industry.

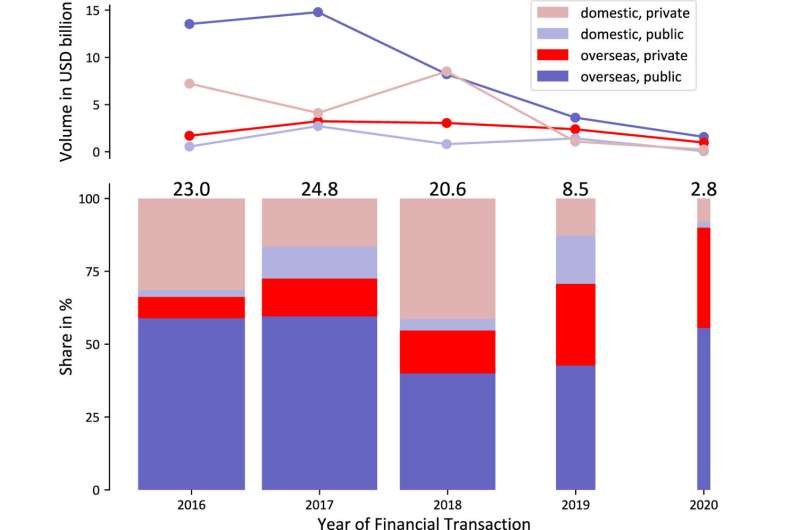

The 65 gigawatts of new power generation capacity financed in whole or in part by foreign capital providers involve 22 countries, mainly in Southeast Asia and sub-Saharan Africa. Vietnam and Indonesia alone account for 45% of this. There were 17 foreign investing states, led by China, providing 65% of foreign capital, Japan, 18%, and South Korea, 9%. The United States and the European Union are only minimally involved through private lenders.

Most recently, the number of new projects has been declining, and there are strong signals from China, Japan and South Korea that they will exit coal financing. But the study's lead author Niccolò Manych, until recently a Ph.D. student at MCC and currently a postdoc at Boston University, counters this. "The alliance of interests for new coal-fired power plants highlighted here could develop much momentum in the future, particularly since Russia's war of aggression against Ukraine has fueled new interest in fossil energy developments.

"In addition, similar linkage deals are now also emerging for gas-fired power plants, which are hardly less threatening to the climate," Manych stated. In the just energy transition partnerships (JETPs) initiated by the industrialized countries with regard to the Global South, one should take a close look at the interaction between industry and the financial sector: "It must be about redirecting both finance and the corresponding technology export towards renewables."