At 4:52pm on Friday 9 August 2019, the UK suffered its first wide-scale blackout in more than a decade. More than 1.1 million consumers were plunged into the dark as rail lines screeched to a halt, traffic lights failed and even airports reported problems. Liam Stoker looks at the root causes, and how battery storage came to the rescue in an article which first appeared in PV Tech Power Vol.20.

16:52:33.490. Those nine consecutive digits won’t mean much outside of the UK’s energy sector, but they’re likely to be etched into folklore. It’s the precise timestamp for when, on 9 August 2019, a single lightning strike sparked a cascade of events that caused the UK’s first major blackout in more than a decade.

More than one million people experienced power outages and significant disruption, with not insignificant swathes of the country’s rail network taken out of action, albeit temporarily. The incident made national headlines for days after, as theory and rumour abounded.

A cyber attack? No, the UK’s transmission system operator National Grid quickly dismissed. Were renewables to blame? Earlier that day wind had provided more than half of the country’s power,a feat which had the renewables lobby celebrating. That just hours later the lights had gone out was a fact not lost on a number of climate change sceptics.

But those theories were also dismissed by National Grid in the days after the event. While there was indeed marginally less inertia on the grid that day, courtesy of less synchronous generation, this was not something that ultimately contributed to the blackout.

The true cause, National Grid’s preliminary investigation, released on 19 August, was perhaps both simpler and more complicated at the same time.

Thunderbolts and lightning

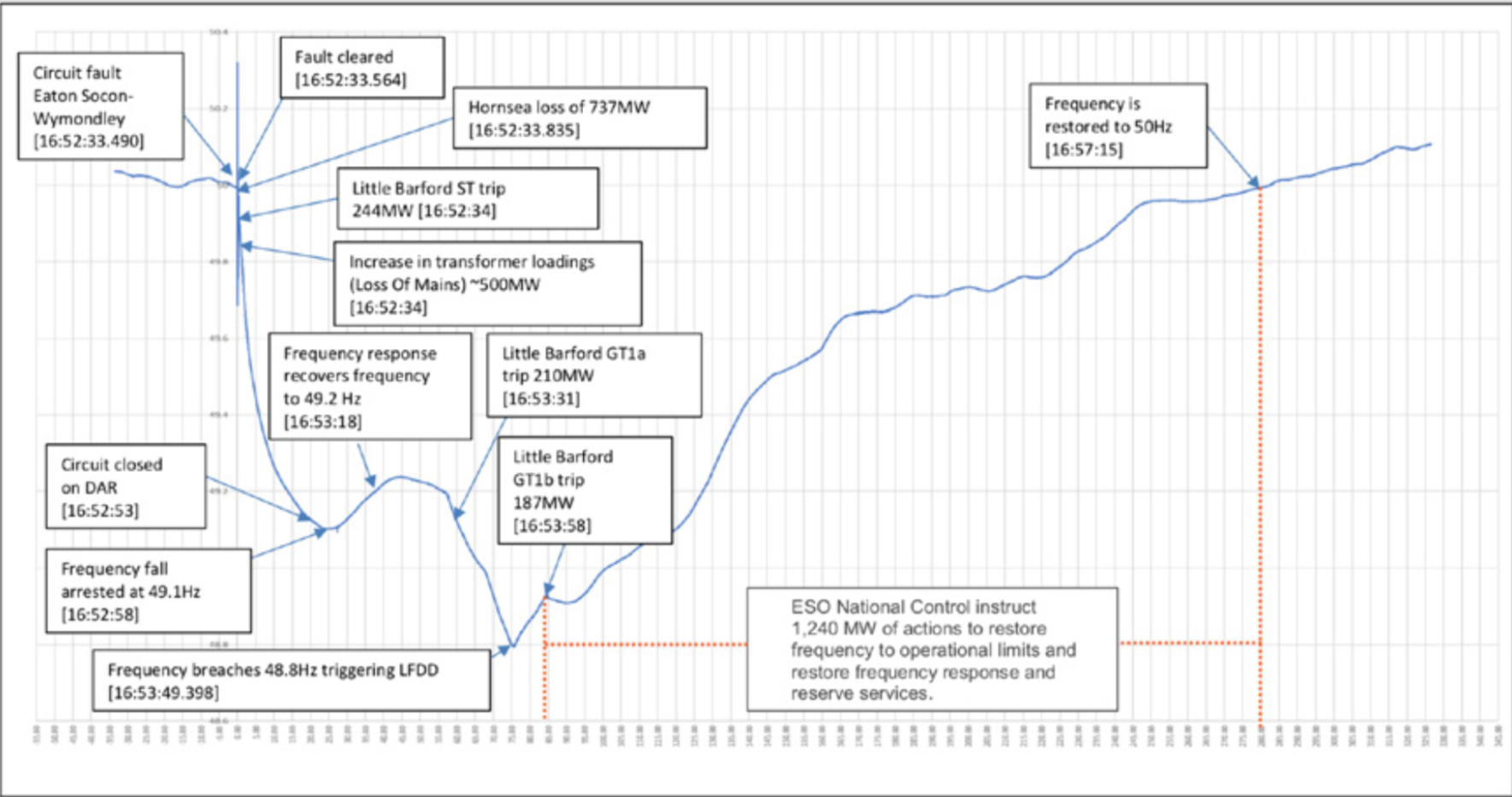

National Grid’s timeline of events puts together a sequence of events that while individually manageable, together caused a drop in frequency sizeable enough to cause the blackout. Lightning struck a transmission circuit near Eaton Socon, a town near St Neots in Cambridgeshire.

That lightning strike, as tens of others that hit grid infrastructure that day, was said by National Grid to have been dealt with by its protections systems normally. It did, however, trigger a Loss of Mains protocol that took around 500MW of embedded generation – domestic solar panels, batteries and the like – off the system. That loss of generation would prove pivotal.

Seconds later, within a few miles of the lightning strike, a CCGT power station, named Little Barford and owned by European power giant RWE, came offline, taking around 700MW of generation with it. Within seconds of that occurring, Orsted’s Hornsea offshore wind farm also came offline, contributing to an event National Grid described as “rare and unusual”.

The reasons for two sizeable generators coming offline at once are the subject of continuing investigations. National Grid said it wanted to collaborate with both RWE and Orsted to better understand the respective power stations’ failure mechanisms, and both operators have remained fairly tight-lipped to date. What the system operator was almost immediately prepared to dismiss however was a previously held theory that the incidents were somehow connected to each other, or that a failure at one plant triggered a failure at the other.

Altogether, around 1,378MW of generation came off the UK’s transmission system within mere seconds, plunging grid frequency to an initial low of 49.1Hz, followed by a secondary dip which took frequency to 48.8Hz, far outside the safe operating limit. Attempts to use reserve capacity to restore the frequency failed, meaning that National Grid was forced to call on the UK’s regionalised distribution network operators to begin Low Frequency Demand Disconnection (LFDD); essentially switching customers’ power supply off.

Customers were left in the dark, but battery storage operators – 475MW worth, according to National Grid – stormed into action.

The blackout timeline

16:52:33.490 - National Grid Electricity Transmission (NGET) reports a phase to earth fault at the Eaton Socon - Wymondley circuit, caused by a lightning strike.

16:52:33.728 - Orsted’s Hornsea offshore wind farm starts to deload its generating capacity, having generated 799MW milliseconds before.

16:52:34 - A steam turbine trips at Little Barford, taking 244MW off the system.

16:52:34 - National Grid Electricity System Operator (ESO) initiates its frequency response in a bid to stabilise the grid frequency having seen it drop to 49.1Hz.

16:53:18 - The ESO reports that frequency response recovers to 49.2Hz, stemming the downward curve.

16:53:31 - Further units at Little Barford trip, meanwhile

all of National Grid’s frequency response units are being delivered in an attempt to restore the frequency. 16:53:49.398 - Grid frequency dips again, breaching the operationally safe 48.8Hz limit. Distribution network operators trigger LFDD protocols and disconnect 931MW of demand from the system.

16:53:58 - A further unit at Little Barford trips, complicating matters further. At this point, the cumulative infeed loss caps out at 1,878MW, totalling 1,378MW of transmission system-connected generation and ~500MW of embedded generation.

16:57:15 - Frequency returns to 50Hz after 1GW of DNO response and 1,240MW of control room actions taken by the ESO.

17:06 - DNOs are told they can begin to restore demand to consumers.

17:37 - All DNOs confirm that demand restoration is complete.

Batteries and bounces

Milliseconds after Little Barford came offline, National Grid signalled its reserve capacity to help offset the collapse. Batteries began to discharge and other generators sparked into life and, for a fleeting moment, it looked as if the worst had been averted. Hornsea’s fault, however, sent frequency falling again and National Grid’s reserve was insufficient.

National Grid has since clarified that its capacity reserves stand at around 1GW – the minimum amount approved under its Security and Quality of Supply Standards. This figure is designed to offset the collapse of its single largest generator of power, currently the 1.2GW Sizewell B nuclear reactor.

Losing closer to 1.4GW in seconds is an event, or rather a collection of separate, individual events, that was evidently something for which National Grid was not prepared. Whether or not the system operator should have a more significant reserve to dip into, especially as greater quantities of non-synchronous, renewable power comes onto the system, is something which is likely to end up a central element of forthcoming debates.

Nevertheless, battery storage operators discharged and other generators continued to chip away at the grid’s shortfall. As DNOs began to take up to 1GW of demand off the system – the actual, technical cause of customers experiencing blackouts – grid frequency began to return to normal.

It took just two minutes and 22 seconds for that combination of load shedding and frequency response – a not inconsiderable amount provided by batteries – to restore the frequency to safe levels, four-times faster than the last time such an incident occurred in 2008. Within four minutes – 3:47 to be precise – grid frequency had been restored to its usual operating limits, significantly quicker than the 11 minutes it took a decade ago.

The incident was made all the more interesting from an operational perspective when LFDD protocols kicked in. National Grid had already instructed flexible assets to discharge in a bid to make up for the lost capacity, but the moment DNOs started shedding load, National Grid quickly felt a bounce in the frequency and battery instructions were just as quickly instructed to respond. “When National Grid cut off the power, the frequency bounced back very quickly, sending the system the other way and meaning our battery sites were then called on to balance the grid by taking power out,” Anesco asset management director Mike Ryan said.

Within four minutes, the UK’s electricity system – widely regarded as one of the most secure in the world – tripped, recovered and was restored to within safe operational limits. Batteries played a pivotal role, but the fact the system tripped altogether has been an event contentious enough to trigger two separate official investigations.

Could more batteries have been used to greater effect?

What the future holds

Limejump chief executive Erik Nygard has called for a significant increase in firm frequency response (FFR) styled products which can procure the kind of fast-acting response necessary to offset such sharp drops in grid frequency.

National Grid’s 200MW-strong portfolio of enhanced frequency response (EFR) batteries, which respond to frequency events in 0.5 seconds, have indeed helped the system operator’s response, but a drop off in the rate of FFR procurement in 2017 has meant that fewer batteries and less DSR – the kind of non-synchronous generation that’s vital during periods of low inertia – are being supported.

Nygard says that National Grid could effectively double its FFR-ready fleet, possibly mitigating for circumstances like Friday 9 August, at a cost of around £100 million per year. Given that cost would effectively be passed onto consumers via levies, and how sensitive a subject energy bills have become in the UK, what equates to roughly a few pounds extra per year could be a small price to pay for energy security.

Jonathan Ainley, head of public affairs and UK programme manager at KiWi Power, meanwhile, has said that National Grid must do more to open up the Balancing Mechanism (BM) to more significant quantities of distributed generation, arguing that it is currently “dominated” by large-scale, centralised generators of a dirtier heritage.

Indeed, the UK is experiencing a grid-scale battery boom at present. The aforementioned 200MW of EFR-backed batteries provided the industry a stable base to build upon, and developers and financiers alike are now driving a not insignificant amount of activity. Solar Media’s in-house market research team has previously guided that as much as 500MW of utility-scale battery storage could be built this year alone, and that’s without even considering the nascent C&I and residential markets.

The areas impacting battery storage and its ability to help the UK’s grid security lie elsewhere. While it’s true that National Grid’s distributed energy resource (DER) desk – set up by the energy system operator last year to help operators of smaller, more flexible assets gain access to new markets – has led to a boon in the DER capacity bidding into such markets, some rather sizeable barriers to entry remain, chiefly the need for an energy supply licence which is a particularly prohibitive obstacle for smaller companies.

“With the right markets, flexibility providers can rapidly bring forward fast-acting, flexible capacity to help National Grid avoid a repeat of [August’s blackout] and create a smarter, cleaner, more resilient energy system for everyone,” Ainley said.

Meanwhile, there’s also the not-insignificant problem created by inertia, or indeed the lack of it. Friday 9 August witnessed considerable wind generation and, having produced as much as 50% earlier in the day, the UK’s wind fleet was providing around 33% at the time of the frequency event. As a result, the amount of inertia on the system is expected to have been low.

Inertia’s role on the system and whether or not it had much of an impact on the events of that day have appeared to divide opinion in the energy sector so far, and will inevitably be a line of inquiry in both Ofgem and the BEIS’ investigations. Nygard says the UK would do well to create a system which produced more inertia as non-synchronous generation grows, either by adding more batteries and DSR or synthetically by forcing such generators to do so via their inverters.

Tinkering with the energy market itself may also elicit a response. Given the entire incident took just under four minutes from trip to recovery, energy markets – which trade in 30-minute settlement periods – were all but unaware of what was happening and unless they were actively looking, traders would have been none the wiser. Bringing those markets to settle more frequently – a technical challenge, but not an impossibility – may have allowed price signals to act as the first canary down the mine so to speak, and the market could have responded in kind.

The incident itself, while perhaps alarming at the time, has arguably demonstrated the efficacy of National Grid’s systems and protocols. If it weren’t for the “rare and unusual” event of ~1.4GW of capacity collapsing in seconds, consumers would have been none the wiser. What is evident is that grid security is fragile and the margin at which National Grid operates is perhaps no longer fit for a system changing at rapid pace.

National Grid’s interim report has provided a skeleton that will inevitably be fleshed out when the final report is published in mid-September. Alternative investigations, led by both Ofgem and the government’s official Energy Emergencies Executive Committee (E3C) will establish if any of the parties involved were at fault and, if they were, fines are likely to be issued. National Grid itself could be fined as much as 10% of its annual turnover if it is found to have breached its licence conditions.

The chapters in the final report crucial to the sector will lie somewhere towards the back. Those will establish not just recommendations to prevent similar events from happening in the future, but a timeline for those to be enacted. Flexibility providers consider it highly likely that National Grid’s reserve capacity will simply have to increase in the wake of 9 August 2019, something which could see more batteries land reserve contracts and, thus, become bankable.

Battery storage came to the UK’s rescue on 9 August 2019, demonstrating – as if it was needed – the role the asset class has to play in grid stability. In the aftermath of that event, that role only looks like increasing.