The full text of the paper can be accessed via this link.

The current state of geothermal in Kenya

Kenya currently has a total installed geothermal power generation of about 950 MWe which accounts for about 30% of the country’s total installed electricity capacity. The Olkaria field remains the most productive geothermal site in Kenya. A 35-MW power plant will soon be operational in Menengai, with development of further power plants already in progress.

The Kenyan government has recognized the potential part that private investors can play in developing the country’s geothermal sector. This model is already in practice in Menengai, where the steam field was developed by state-owned Geothermal Development Company (GDC) but the power plants are to be developed by independent power producers (IPPs).

PPPs allow the Kenyan government to tap into the expertise, innovativeness, financial efficiency, and quality assurance of the private sector. The mechanism of PPPs in Kenya is governed by the PPP Act of 2021 which seeks to expand the scope of arrangement to facilitate the greater participation of private parties through Annuity-based Design, Build, Finance, and Operate, Strategic Partnerships, and Joint Venture Partnerships.

So far, 13 IPPs have been licensed to undertake greenfield geothermal projects at the following prospects – Barrier, Longonot, Akiira, Elementaita, Homa Hills, Menengai North, Lake Magadi, Arus, Baringo, Emuruangogolak, Namarunu, and Emuruapoli

PPP as a risk transfer mechanism

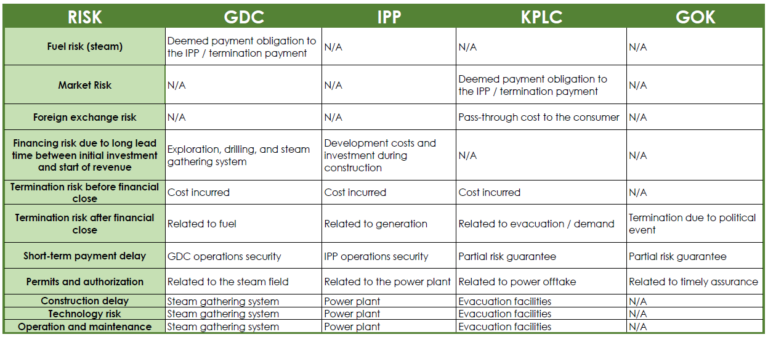

The PPP model allows for the distribution of project risks among the different stakeholders. Aside from the private developer and the Kenyan government, state-owned developers such as GDC and KenGen also share in the risks. Also included in this risk-sharing mechanism are Kenya Power and Lighting Company PLC (Kenya Power) and the Kenya Electricity Transmission Company (KETRACO) as the parties responsible for the electricity transmission system and high-voltage transmission grid.

In the case of the 105-MW Menengai geothermal project, the risk transfer is summarized as below:

Risk allocation for Menengai 105 MW geothermal power project (adapted from Mwai, 2016)

Financing models of Kenyan PPP projects

The PPP model has been noted to be particularly effective for geothermal projects – the public sector concentrates its resources in the riskier upstream development phases (test drilling and field development) while the private partner finances the capital costs of the more advanced phases (power plant construction, operations, and maintenance).

In Kenya, the 155-MW Olkaria III was the first privately funded and developed geothermal power plant. Exploration of Olkaria was undertaken by the government of Kenya before the power plant was then developed by Ormat Technologies Inc. under a Build-Own-Operate contract. The project was funded by Ormat with a combination of equity financing and debt financing, the latter of which was facilitated by a PPA with KPLC and a government security package and a Political Risk Insurance (PRI).

A similar model has been used for the Menengai project. GDC supplies steam to the power plants owned and operated by the IPPs. The IPPs have signed a PPA with KPLC as the single off-taker of electricity. Critical risks were identified with this model, namely:

Payment risk by KPLC as the single off-taker

Steam supply risk by GDC

To help private developers obtain debt financing, the African Development Fund provided a partial risk guarantee of USD 11.27 million which lenders can draw upon in the event of the aforementioned risks materializing. Two of the projects also receiving concessional financing of USD 15 million through the Dedicate Private Sector Program of the Clean Investment Facility Clean Technology Fund. This allowed the projects to have a more attractive return on investment.

Government Letters of Support issued by the Government of Kenya to the IPPs further increase the bankability of the projects by providing some mitigation against political and national risks.

Existing challenges in financing geothermal PPPs in Kenya

The paper goes on to describe challenges that are still being encountered by geothermal developers in securing project financing for Kenyan geothermal projects. A major challenge is the lack of a developed financial market in Kenya that will allow for sustainable and long-term project financing. Commercial banks in Kenya remain hesitant to lend for tenures of more than 10 years, forcing private firms to resort to offshore borrowing.

Kenya also continues to deal with negative publicity that can erode investor confidence and limit private sector interest in geothermal projects. This can be countered by adequate transparency in the procurement process and consistent decision-making process by government officials in the energy sector. An example of such negative publicity was the recent push by the government to renegotiate PPAs for contracts that had already been signed between the government and the IPPs.

Overall, the study concludes that the adoption of PPPs has been a positive development to accelerate geothermal development in Kenya. However, there are still multiple opportunities for this model to be improved.