Carbon capture, utilisation and storage (CCUS) may be defined as the capture, use and secure storage of carbon that would otherwise be emitted to, or remain, in the atmosphere. The rationale for carbon capture and storage is to enable the use of fossil fuels while reducing the emissions of carbon-di-oxide (CO2) into the atmosphere, thereby mitigating global climate change. The storage period for CO2 exceeds the estimated peak periods of fossil fuel exploitation so if CO2 re-emerges into the atmosphere, it will occur past the predicted peak in atmospheric CO2 concentrations. Removing CO2 from the atmosphere by increasing its uptake in soils and vegetation (e.g., afforestation) or in the ocean (e.g., iron fertilisation), is also a form of carbon sequestration through natural sinks.

Mainstream opinion (official) in India is in favour of the use. Hyper-scale gasification of domestic coal along with CCUS is seen as a means for large-scale carbon-neutral industrialisation with domestic production of methanol, ammonia (fertiliser), olefins, steel, and power that will also enhance India’s oil production from its depleting oilfields. Methanol-based chemicals and olefins can be used for plastics and as a substitute for petrol, diesel and LPG (liquified petroleum gas). With domestic coal as feedstock for the production of these chemicals, the Indian economy could potentially save billions of dollars and generate domestic activity and jobs through reduced import of crude oil. At the margins, there is some reservation over the use of CCUS to reduce carbon emissions. CCUS is seen merely as a means to extend fossil fuel use, particularly coal use in India that will delay or even prevent India from leapfrogging into the future with low-carbon renewable energy (RE) technologies such as solar and wind. CCUS technology is seen as unproven, dangerous (especially in the context of storage) and expensive.

With domestic coal as feedstock for the production of these chemicals, the Indian economy could potentially save billions of dollars and generate domestic activity and jobs through reduced import of crude oil.Globally, even the most climate-sensitive institutions favour CCUS as a critical means for decarbonisation. CCUS is one of the four pillars of a net-zero carbon world along with renewable energy-based electrification, bioenergy and hydrogen by the International Energy Agency (IEA). In September 2019, the UN climate change executive secretary observed that “CCUS is not a destination, but a transition from current fossil fuel dependent reality to a climate-neutral future by 2050”.

Carbon Sources

Indian power plants account for most of the CO2 emissions. Natural gas ensuing from production wells often contains a significant fraction of CO2 that could be captured and stored. Other industrial processes that lend themselves to carbon capture are steel, ammonia & cement manufacturing, fermentation and hydrogen production (e.g., in oil refining). Future opportunities for CO2 capture may arise from producing hydrogen fuels from carbon-rich feedstocks, such as natural gas, coal, and biomass. The CO2 by-product would be relatively pure and the hydrogen could be used in fuel cells and other hydrogen fuel-based technologies, but there are major costs involved in developing a mass market and infrastructure for these new fuels.

Capture, Transport, and Storage

There are many pre-combustion and post-combustion methods for CO2 capture. In the chemical absorption process, CO2 is absorbed in a liquid solvent by the formation of a chemically bonded compound. When used in a power plant to capture CO2, the flue gas (post-combustion) is bubbled through the solvent in a packed absorber column, where the solvent preferentially removes the CO2 from the flue gas. Afterward, the solvent passes through a regenerator unit where the absorbed CO2 is stripped from the solvent. The most commonly used absorbent for CO2 absorption is mono-ethanolamine (MEA). This is the most advanced and widely used CO2 separation technique currently applied in a number of small and large-scale projects worldwide in power generation, fuel transformation and industrial production.

Physical separation is based on either adsorption (adhesion of atoms, ions or molecules from a gas, liquid or dissolved solid to a surface), absorption, cryogenic separation, or dehydration and compression. Physical adsorption makes use of a solid surface, while physical absorption makes use of a liquid solvent. After capture by means of an adsorbent, CO2 is released by increasing temperature or pressure. This method of CO2 removal is used mainly in natural gas processing and ethanol, methanol and hydrogen production.

Oxy-fuel separation method involves the combustion of a fuel using nearly pure oxygen and the subsequent capture of the CO2 emitted. Because the flue gas is composed almost exclusively of CO2 and water vapour, the latter is removed by means of dehydration to obtain a high-purity CO2 stream. Globally, a number of prototype/ pre‑demonstration projects using this method have been completed in coal-based power generation and in cement production.

The membrane separation method is based on polymeric or inorganic membranes with high CO2 selectivity, which let CO2 pass through but act as barriers to retain the other gases in the gas stream. Membranes for CO2 removal from syngas and biogas are already commercially available, while membranes for flue gas treatment are currently under development.

Oxy-fuel separation method involves the combustion of a fuel using nearly pure oxygen and the subsequent capture of the CO2 emitted.Calcium and chemical looping technologies involve CO2 capture at a high temperature using two main reactors. In calcium looping, the first reactor uses lime (calcium oxide, CaO) as a sorbent (material used to absorb or adsorb liquids or gases) to capture CO2 from a gas stream to form calcium carbonate (CaCO3). The CaCO3 is subsequently transported to the second reactor where it is regenerated, resulting in lime and a pure stream of CO2. The lime is then looped back to the first reactor. In chemical looping, the first reactor uses small particles of metal (iron or manganese) to bind oxygen from the air to form a metal oxide, which is then transported to the second reactor where it reacts with fuel, producing energy and a concentrated stream of CO2, regenerating the reduced form of the metal. The metal is then looped back to the first reactor. This technology is at a pilot / pre-commercial stage.

Direct separation involves the capture of CO2 process emissions from cement production by indirectly heating the limestone using a special calciner. This technology strips CO2 directly from the limestone, without mixing it with other combustion gases, thus considerably reducing energy costs related to gas separation. This technology is currently being tested in pilot projects.

In super critical CO2 power cycles, supercritical CO2 (CO2 above its critical temperature and pressure) is used instead of flue gas or steam to drive one or multiple turbines. Supercritical CO2 turbines typically use nearly pure oxygen to combust the fuel, in order to obtain a flue gas composed of CO2 and water vapour only. Prototype and demonstration projects using this technology are currently in operation.

For transport of CO₂, the two main options are via pipeline and ship, although for short distances and small volumes CO2 can also be transported by truck or rail but at a higher cost. Pipelines are the cheapest way of transporting CO2 in large quantities onshore and, depending on the distance and volumes, offshore. Transport of CO2 by pipeline is already deployed at a large scale globally.

For storage of CO2, coalfields and oil & gas fields are being studied in India. The potential for storage in coal fields at depths greater than 1,200 metres is thought to be quite high. Onshore and offshore CO2 storage potential in India is estimated to be between a low of 99 giga tonnes (Gt) and a high of 697 Gt located mainly in geological formations such as coal fields, oil and gas fields, sedimentary basins and saline aquifers. The CO2 storage potential in India is just over 1 percent of total global CO2 storage potential but this is not necessarily a problem as even low case storage potential far exceeds India’s potential CO2 emissions in the future. India’s total carbon emissions was 2.648 Gt in 2021 and by 2050 India’s CO2 emissions are expected to increase to 3.325 Gt under the stated policy scenario of the IEA. To meet carbon reduction pledges made by India these emissions have to fall to less than 900 million tonnes

Energy and Economic Penalty

Each of these technologies carries both an energy and economic penalty. The economic penalty of CCUS can be considered in terms of four components: separation, compression, transport and injection. These costs depend on many factors, including the source of the CO2, transportation distance, and the type and characteristics of the storage reservoir. The energy and economic cost vary depending on capturing CO2 for commercial use or for storage.

The primary difference in capturing CO2 for commercial markets versus capturing CO2 for storage is the role of energy. In the former case, energy is a commodity, and all we care about is its price. In the latter case, using energy generates more CO2 emissions, which is precisely what we want to avoid.

India’s total carbon emissions was 2.648 Gt in 2021 and by 2050 India’s CO2 emissions are expected to increase to 3.325 Gt under the stated policy scenario of the IEA.We can account for the energy penalty by calculating costs on a CO2-avoided basis. Due to the extra energy required to capture CO2, the amount of CO2 emissions avoided is always less than the amount of CO2 captured. Therefore, capturing CO2 for purposes of storage requires more emphasis on reducing energy inputs than in traditional commercial processes.

In the case of CO2 capture for commercial use, captured CO2 is used for various industrial and commercial processes such as in the production of urea, foam blowing, carbonated beverages, and dry ice production. Because the captured CO2 is used as a commercial commodity, the absorption process, while expensive, is profitable because of the price realised for the commercial CO2.

According to the IEA, the cost of CCUS can vary greatly by CO2 source, from a range of US$15-25/tonne of CO2 (tCO2) for industrial processes producing “pure” or highly concentrated CO2 streams (such as ethanol production or natural gas processing) to US$40-120/t CO2 for processes with “dilute” gas streams, such as cement production and power generation. Capturing CO2 directly from the air is currently the most expensive approach.

Transport of CO2 and storage costs can also vary greatly on a case-by-case basis, depending mainly on CO2 volumes, transport distances and storage conditions. The cost of onshore pipeline transport is estimated at US$2-14/tCO2. Currently, more than half of onshore storage capacity is estimated to be available below US$10/tCO2. The cost of storage can even be negative if the CO2 is injected into (and permanently stored in) oilfields to enhance production and thus generate more revenue from oil sales.

Indian initiatives

In India, heavy industries such as cement, steel, chemicals, and aluminium manufacturing and heavy-duty transport such as shipping, trucking, and aviation are responsible for more than a third of the CO2 emissions. These CO2 emissions are considered ‘hard to abate’ because it is difficult to replicate fossil fuel based high temperature high pressure production processes with low carbon electricity. Efficiency improvement and fuel shifts in existing production processes across industries could potentially reduce about 22 percent (600 million tonnes of CO2) emissions in 2050 compared to a scenario without efficiency measures. But this is not adequate for achieving a substantial reduction in emissions.

Given the difficulty in finding alternatives to fossil fuels in heavy industries and in some sectors of transport, the Government of India has launched ‘mission innovation challenge’ on CCUS through the department of science and technology (DST), to develop technologies that address high capital costs, safety, logistics and high auxiliary power consumption in CCUS so that emission from thermal power plants and carbon-intensive industries can be reduced to near-zero levels at reasonable cost. The DST along with the department of biotechnology (DBT) jointly launched an initiative in 2018 to undertake joint research & development (R&D) with member countries France, Germany, Greece, Norway, Romania, Switzerland, The Netherlands, Türkiye, the United Kingdom and the United States to identify and prioritise breakthrough technologies in the field of CO2 capture, separation, storage and CO2 value addition. The accelerating CCS technologies (ACT) initiative of the DST aims to facilitate R&D and innovation that can lead to development of safe and cost-effective CCUS technologies. In July 2020, India agreed to accept US assistance to introduce CCUS technology in coal-based power generation units in India. The Oil and Natural Gas Corporation Limited (ONGC) and Indian Oil Corporation (IOC) have joined hands for launching a CCUS project in IOC’s Koyali refinery in Gujarat, where the captured CO2 will be used for enhanced oil recovery (EOR).

There are some private initiatives as well. Since October 2016, Tuticorin Alkali Chemicals and Fertilisers Limited (TACFL), in partnership with Carbon Clean, a UK-based private company has been operating the world’s first industrial-scale carbon capture and utilisation (CCU) plant near Chennai. Installed on a coal-fed boiler, the plant is designed to capture 60,000 tonnes of CO2 per year and convert it to soda ash. The project is privately financed and the cost is estimated to be just US$30/tCO2, much lower than the US$60-90/t CO2 typically observed in the global power sector.

The Oil and Natural Gas Corporation Limited (ONGC) and Indian Oil Corporation (IOC) have joined hands for launching a CCUS project in IOC’s Koyali refinery in Gujarat, where the captured CO2 will be used for enhanced oil recovery (EOR).According to advocates of CCUS technology, coal gasification combined with CCUS in India could reduce CO2 emissions by over 90 percent, reduce India’s oil imports, and also offer a range of economic goods and revenue streams in the energy and core sectors. They highlight the CCUS investments by China and the USA.

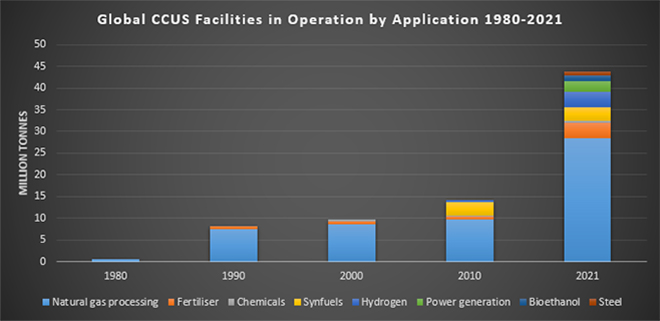

There are 55 CCUS-related policies and around 40 CCUS projects of varying sizes and stages of development in China. China is now at the stage of demonstrating integrated CCUS projects at commercial scale. In 2022, 2 million tonnes of CO2 were stored in China, with an annual capture capacity of 3 million tonnes. Section 45Q of the U.S. tax code provides a performance-based tax credit to power plants and industrial facilities that capture and store CO2 that would otherwise be emitted into the atmosphere. The credit is linked to the installation and use of carbon capture equipment on industrial sources, gas or coal power plants, or facilities that would directly remove CO2 from the atmosphere. In all cases, to receive the credit, the CO2 must be stored geologically or be utilised as a feedstock or component of products.

For India, coal is not only the primary source of energy but also a source of revenue and means of social support. Coal India Limited (CIL) provides employment for millions for whom there is no alternative eschewing efficient technology which will improve productivity and profitability of the company; all coal mining companies contribute to local area development through royalty and development levies; expensive transport of coal subsidies passenger rail travel connecting the poor with distant employment opportunities; coal cess is a major part of GST (goods and services tax) compensation fund and coal mining companies pay taxes; dividend and other revenue streams to the government. Ironically, coal-based power generation also supports its nemesis (intermittent renewable energy) with ramping capacity whenever needed absorbing additional economic and technical costs. This complex and elaborate coal network that underpins energy provision and social support in India could be complemented with CCUS for decarbonisation without major economic and social disruption.