The expansion of green hydrogen is predicted to create value of approximately 500 billion euros globally by 2030 / Europe has the opportunity to seize 40 % of this volume / Market participants still need to clearly define their roles

The expansion of green hydrogen is predicted to create value of approximately 500 billion euros globally by 2030 / Europe has the opportunity to seize 40 % of this volume / Market participants still need to clearly define their rolesMany companies see green hydrogen as crucial for achieving climate-neutral operations. The raw material produced with renewable energy can be used in all sectors with high CO2 emissions such as chemicals and steel or for the production of synthetic fuels for aviation or shipping. Roland Berger estimates a substantial growth in green hydrogen production in the coming years, projecting a global value creation of around 500 billion euros by 2030. That is according to the latest study "How to capture value in the emerging hydrogen market.”

"This industry will develop in two phases. Initially, regulatory incentives will drive early growth. After 2030, the sector is expected to become self-sustaining," says Uwe Weichenhain, Partner at Roland Berger. "Europe's robust industrial infrastructure will ensure a consistent demand for clean hydrogen, making the continent a key production hub while also still requiring significant imports."

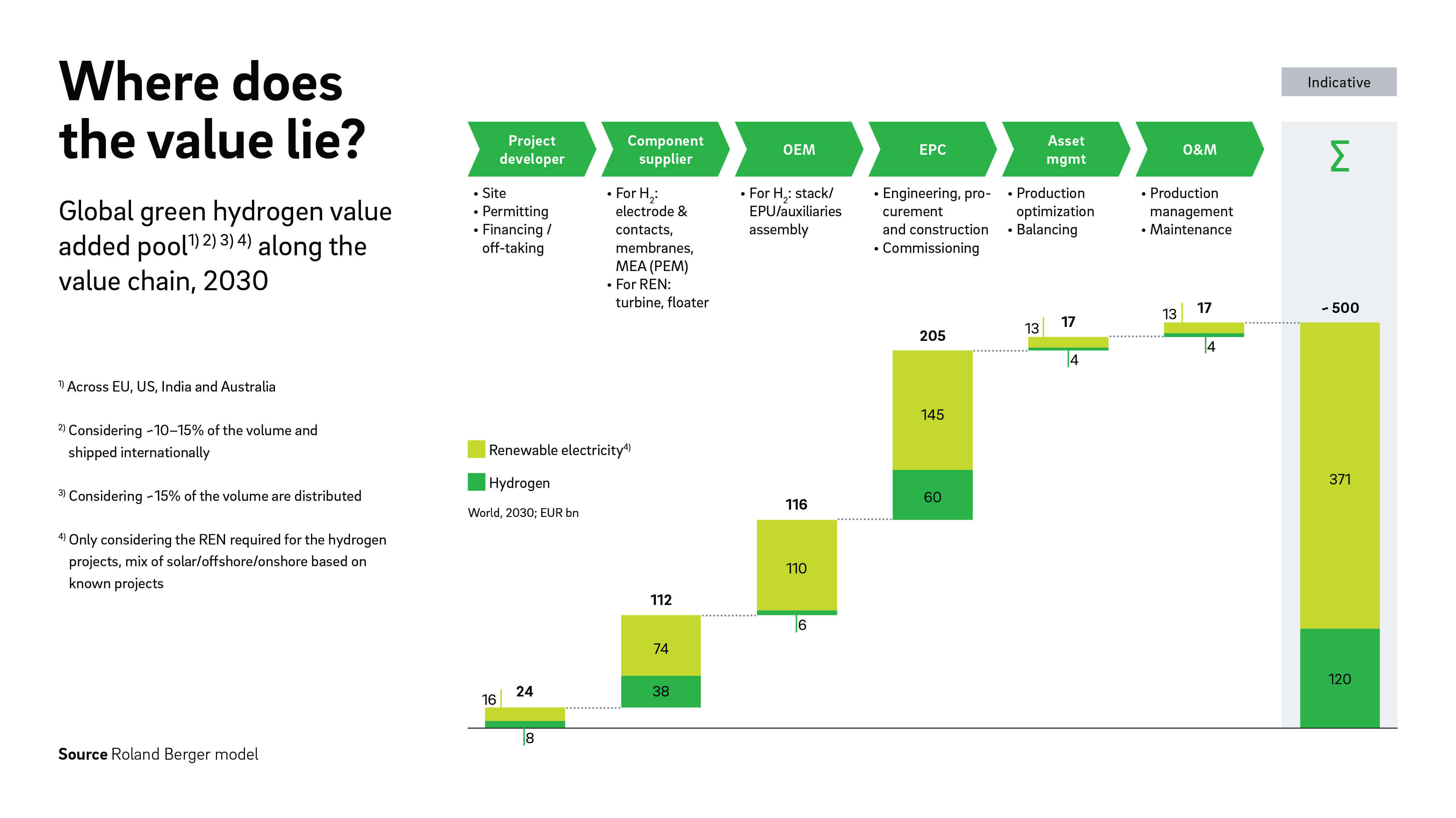

The value generated is divided between two areas: The infrastructure for the production of green hydrogen will reach a volume of 120 billion euros by 2030. To generate the renewable electricity, another 371 billion euros are incurred. Europe accounts for 40 percent of this volume.

"Europe has set ambitious targets for green hydrogen. As a result, that is where the greatest momentum will unfold by 2030," says Weichenhain. "Clusters of different sizes are emerging across the continent. Production plants are built in regions that already currently have access to solar or wind energy."

Business models of the green hydrogen market

The value chain for green hydrogen projects is not yet clearly structured and market participants still have to clearly define their roles. There are currently three business approaches in the market: In Europe, project developers, technology providers and engineering, procurement, and construction companies (EPCs) operate as separate entities. A second model, which is preferred by companies in the United States, shows a combined approach of technology and plant construction. Meanwhile, Asian companies commonly opt for a model in which diversified groups of companies cover all roles along the value chain.

Green hydrogen projects can also be divided in three categories: The first group are export-oriented giga projects for the cost-effective production of green hydrogen. The second group are medium-sized projects where hydrogen is produced near large industrial demand centers. Lastly there are small-scale projects focusing on mobility and decentralized heat and power supply systems.

"We anticipate market participants’ business models to align with their traditional roles. The project structures and preferences of the market players resemble those of traditional infrastructure projects in the energy sector. However, they must develop new competencies to thrive in the hydrogen economy. Proven technical expertise with electrons and molecules, such as hydrogen and its derivatives, is vital for success in project acquisition and execution. Consequently, partnerships and M&A activities are currently a prominent focus in the industry," Weichenhain added.