Strong US jobs report last week allayed concerns of a recession in world's largest economy

A sign posted on the window of a business looking to hire workers in Miami, Florida. Employers in the US hired more workers in April. AFP

Oil prices surged on Monday as concerns about an economic slowdown eased following three consecutive weeks of losses on signs of weakening global crude demand.

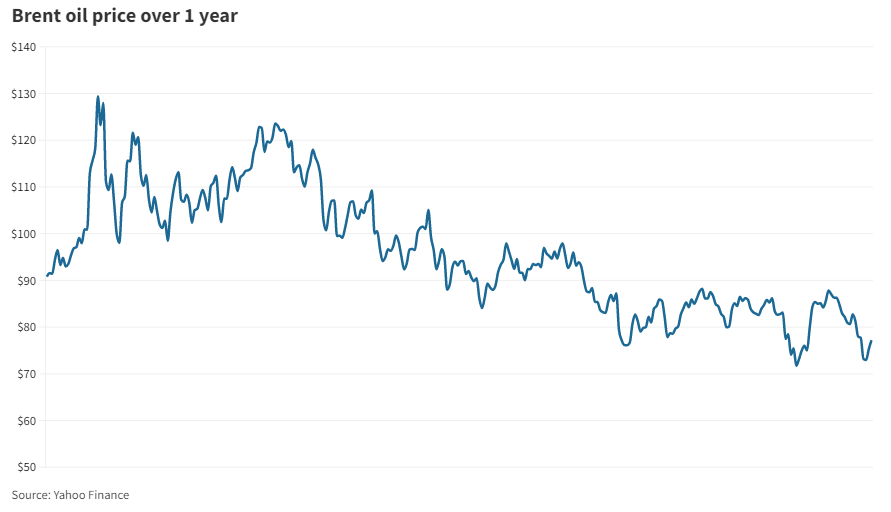

Brent, the benchmark for two thirds of the world’s oil, was up 2.18 per cent at $76.94 a barrel at 7.41pm UAE time. West Texas Intermediate, the gauge that tracks US crude, was trading 2.52 per cent higher at $73.14 a barrel.

Although both benchmarks gained on Friday, for the week, Brent lost 5.3 per cent, while WTI, whose price had dropped to lows last seen in late 2021 after four straight sessions of losses, slipped 7.1 per cent.

The decline came because "the market is strongly concerned about the deteriorating growth outlook that weighs on oil demand outlook", said Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

However, a strong US jobs report for April boosted crude prices on Friday, easing concerns about a recession in the world's largest economy.

Employers in the US took on more workers in April, with non-farm payrolls rising by 253,000 last month, the Labour Department's employment report showed on Friday.

That was well above the 180,000 consensus forecast from a survey of analysts conducted by Reuters.

The US unemployment rate inched down to 3.4 per cent in April, from 3.5 per cent the month before. March data was also revised lower to 165,000 jobs, from a previous figure of 236,000.

Last week, UBS said it was retaining a positive outlook on the oil market and expected it to tighten as Opec+ members implemented production cuts and oil demand rises over the coming months.

“Flight activity has rebounded strongly this year, with activity around 2019 levels. Generally, we see oil demand holding up and look for even higher demand over the coming months,” UBS strategist Giovanni Staunovo said in a research note.

“The lower potential Opec+ crude production and exports should help the oil market tighten, supporting our view that oil inventories will begin to decline and support prices."

Brent crossed $85 a barrel last month after Opec+ producers announced voluntary output cuts of 1.16 million barrels per day to ensure oil market stability.

Opec is due to release its latest monthly oil market report on Thursday.