In recent years, the capital cost of lithium-ion battery energy storage systems (BESS) has fallen significantly, while expected lifetime has increased. The result is that the business case for battery projects has improved across many applications.

The business case remains strongest in remote areas where alternative dispatchable energy sources are costly, but grid-connected battery projects are increasingly attractive.

In light of this, ITP’s Analytics & Engineering teams recently combined forces to develop a simulation and optimisation model to identify the behind-the-meter BESS capacity that would maximise return-on-investment for a large industrial electricity user.

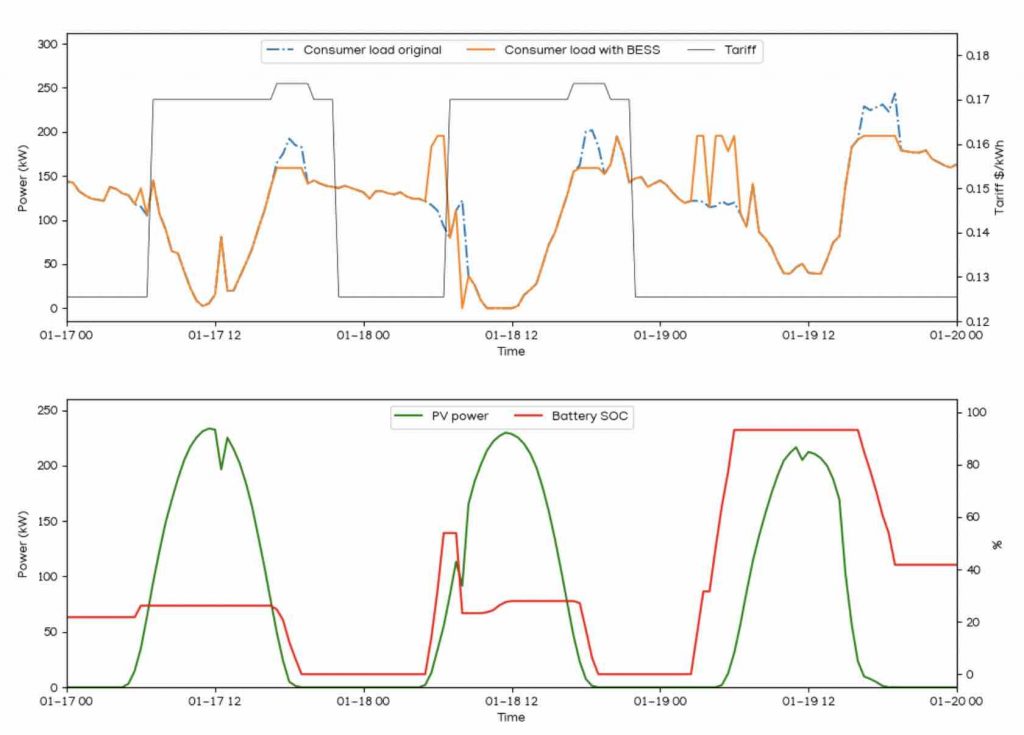

The model runs a linear program to find and simulate the optimal BESS capacity and control strategy based on the energy flows and tariffs during each half hour of a 15-year analysis period.

The model returns half-hourly energy flows and key financial statistics that summarise the business case.

BESS capacity optimisation is far from straightforward and must consider BESS capital costs, operating costs, round-trip efficiency, degradation and lifetime.

It must consider the costs of grid electricity, which may comprise retail time-of-use (TOU) energy charges, network TOU energy charges, network peak demand charges, and environmental/market charges, and the value of grid feed-in tariffs.

It must consider electricity demand at the site, generation from any embedded generators, and, because a BESS is a long-term investment, it should also consider future demand, future embedded generation, and future tariffs.

For this client, the embedded generation consisted of variable solar PV, meaning both the load and the embedded generation could be treated as exogenous variables (ie. originating outside the model).

However, a BESS is a dispatchable resource, meaning decisions regarding charge/discharge must be made by the model.

In commercial and industrial behind-the-meter applications, a ‘smart’ BESS generally conducts both tariff arbitrage and peak shaving.

Tariff arbitrage involves charging from low cost energy (generally off-peak grid energy or embedded generation that would otherwise be exported) and discharging to offset high cost energy (generally peak/shoulder grid energy).

Peak shaving involves discharging so as to reduce peak demand and the associated charges. To simulate the decision-making of a smart BESS, the model must be similarly smart.

For this client, ITP’s model found that a small BESS was optimal and that the majority of the returns would arise from peak shaving.

The result is consistent with the site’s tariff structure, which includes three peak demand charges per month (for each of the peak, shoulder, and off-peak network TOU periods), but has only a small spread between peak, shoulder, and off-peak import/feed-in tariffs.

In general, larger BESS will benefit from economies-of-scale, but suffer diminishing returns in behind-the-meter applications as opportunities for peak demand shaving and energy arbitrage are exhausted. ITP’s model allows for such a trade-off to be rigorously studied, and the result of the study suggests that there are already some cases where investment in behind-the-meter BESS can deliver attractive returns.

Falling BESS costs, longer BESS lifetime, and increasing ability to derive credit/revenue from other value streams (eg. FCAS, Demand Response, etc.) should all contribute to increasing opportunities for behind-the-meter BESS in the near future.