Investors will be closely watching Chinese economic data this week

Crude futures recorded their fourth straight weekly gain last week after the International Energy Agency raised its 2023 global oil demand estimates.

Oil prices were steady on Monday amid expectations of tighter crude supply following Opec+ production cuts.

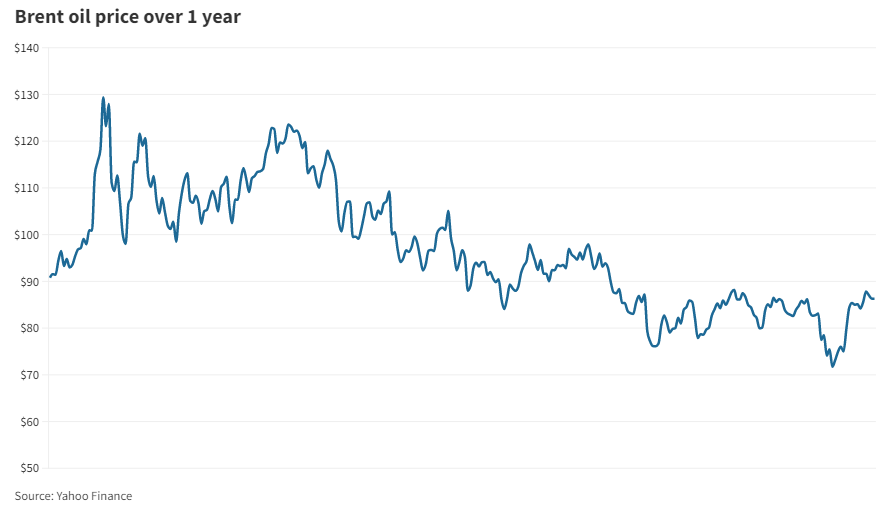

Brent, the benchmark for two thirds of the world’s oil, was trading 0.44 per cent lower at $85.93 a barrel at 3.52pm UAE time. West Texas Intermediate, the gauge that tracks US crude, was down 0.48 per cent at $82.42 a barrel.

Last week, crude futures recorded their fourth straight weekly gain after the International Energy Agency raised its 2023 global oil demand estimates.

Global oil demand is expected to rise by 2 million barrels per day to a record 101.9 million bpd this year, the Paris-based agency said in its monthly oil market report.

Investors will be closely following the release of China's first-quarter gross domestic product data this week, which should show an “impressive” recovery as the Asian country's economy recovers from Covid-19, Edward Moya, senior market analyst at Oanda, said.

China, the world’s second-largest economy and top crude importer, reopened its borders in January after following a strict zero-Covid policy for nearly three years.

Last week, Opec stuck to its 2023 growth projection for oil demand in its monthly oil report, despite lowering its forecast in North America and Europe amid a slowing global economy.

The oil producers' group said better crude demand in Organisation for Economic Co-operation and Development countries, led by China, was balancing out the market.

Earlier this month, Opec+ producers said they would make voluntary oil production cuts of 1.16 million bpd from May until the end of December to support oil market stability.

Russia, a part of the 23-member alliance of producers, also said it would extend its output cut of 500,000 bpd until the end of this year.

Moscow had previously pledged to curb its production until June in response to the price caps imposed by the West on exports of its crude oil and refined products.

Brent, which has surged about 8 per cent since the announcements, fell to 15-month lows last month after a banking crisis in the US and Europe rattled global financial markets.

Meanwhile, US consumers expect inflation to jump following the recent spike in energy prices.

A survey released by the Federal Reserve Bank of New York showed that American consumers' inflation expectations rose for the first time since October last year.

The median one-year-ahead inflation expectation rose by 0.5 percentage points to 4.7 per cent in March, according to the survey.

"Despite the easing inflation pressures on the CPI [consumer price index] figures, the positive pressure building on energy prices and the surging inflation expectations boost the Federal Reserve hawks," said Ipek Ozkardeskaya, senior analyst at Swissquote Bank.