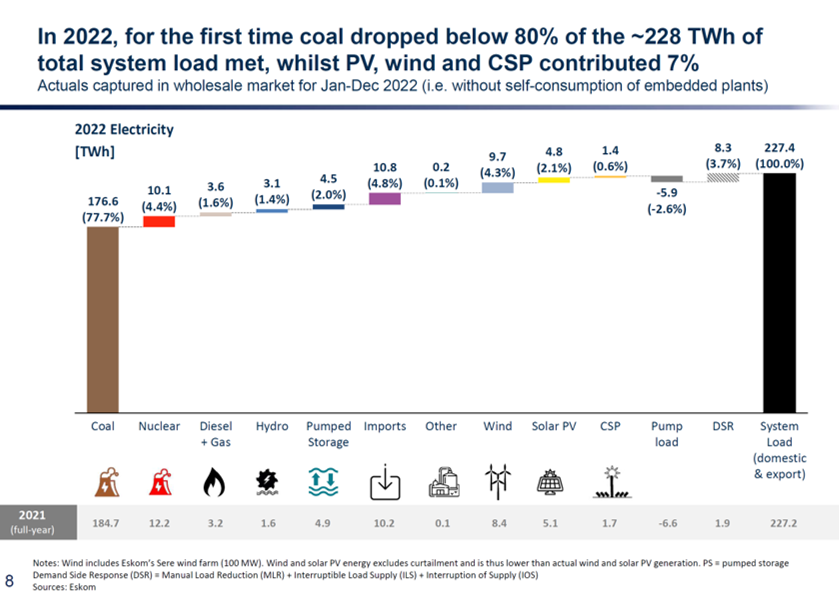

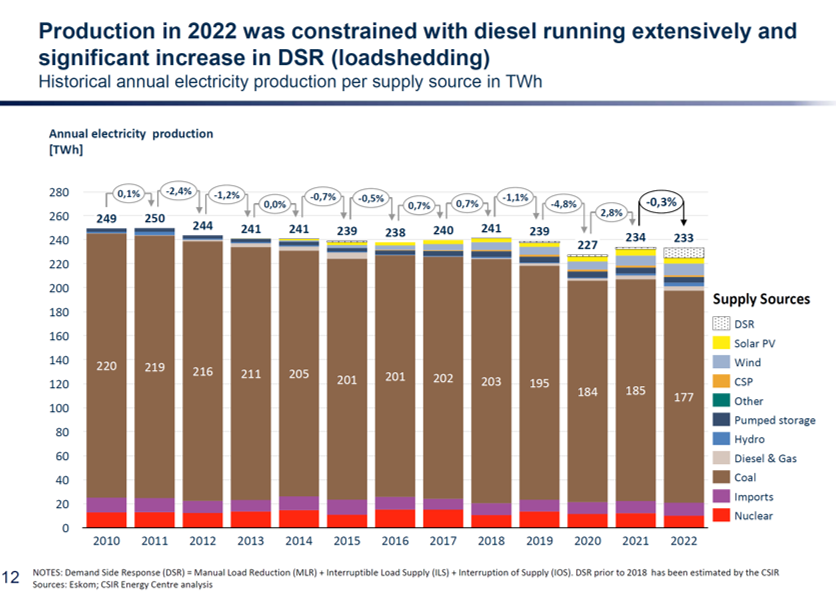

In 2022, 77.7% of the 228 TWh was met by South Africa’s coal plants. South Africa’s coal power plants provided 176.6 TWh of electricity in 2022. Nuclear energy contributed 10.1 TWh (4.4%) and for the third time running, while solar PV, wind, and CSP surpassed nuclear, contributing 15.9 TWh (7%). The rest was met by other sources, including diesel, hydro, and pumped storage plants.

The Koeberg plant in Cape Town is the only operational nuclear power station in Africa (Egypt has started construction of nuclear power plants, and other nations are at various stages of exploration). It is a pressurised water reactor (PWR). According to Eskom, Koeberg has the largest turbine generators in the Southern Hemisphere and is the most southerly-situated nuclear power station in the world. It has two 970-MW units giving an installed capacity of 1,940 MW.

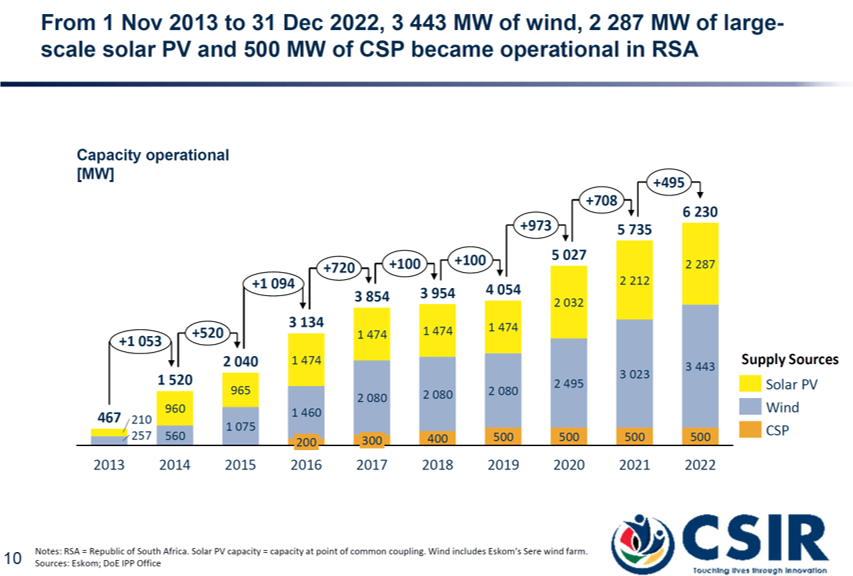

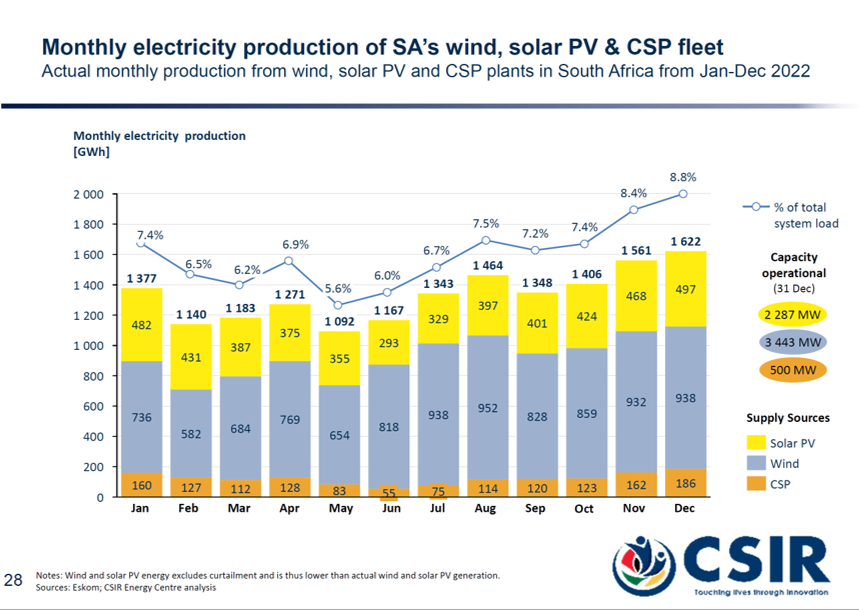

South Africa has been gradually adding utility-scale wind, solar PV, and concentrating solar power (CSP), increasing the installed capacity from 467 MW in 2013 to 6,230 MW as at the end of 2022. However, South Africa’s electricity production has been dropping since 2011, from 250 TWh to 233 TWh in 2022. Eskom plants’ average annual Energy Availability Factor (EAF) dropped to 58.1% in 2022. It had been 66.9% in 2019 and 71.9% in 2018.

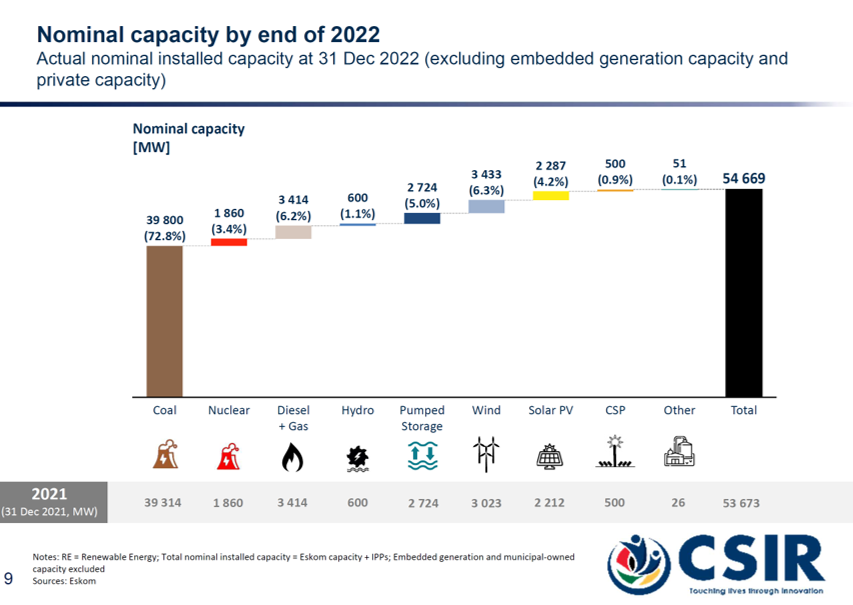

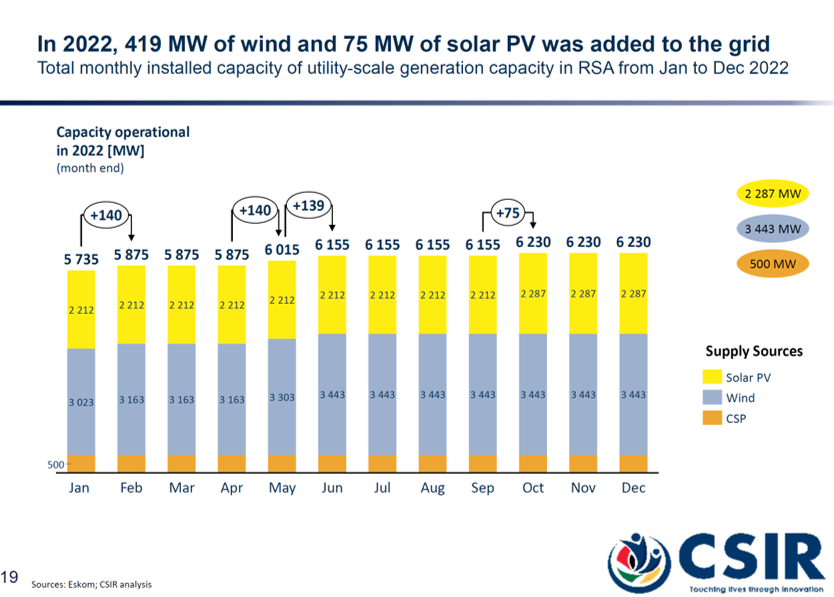

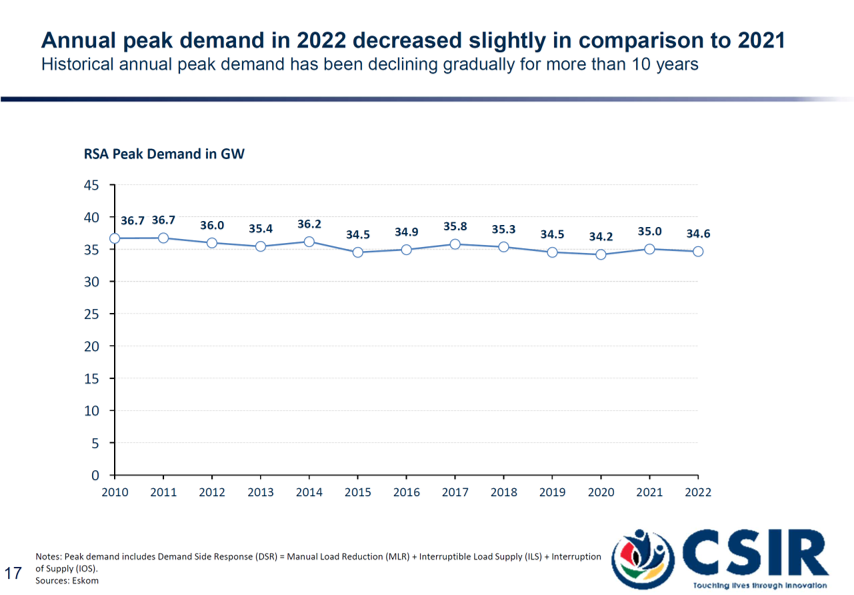

South Africa’s nominal installed capacity increased from 53,673 MW in 2021 to 54,669 MW in 2022 thanks to new capacity from 720 MW of coal, 419 MW of wind, and 75 MW of solar PV that became operational in 2022. Below is a summary of the installed capacity.

54 GW of wholesale/public nominal capacity is made up of:

Coal — 39.8 GW (increased)

Nuclear — 1.9 GW (unchanged)

Diesel (OCGT) — 3.4 GW (unchanged)

Hydro is 0.6 GW hydro and pumped storage — 2.7 GW (unchanged)

Wind — 3.4 GW (unchanged)

Solar PV — 2.3 GW (increased)

CSP — 0.5 GW (unchanged)

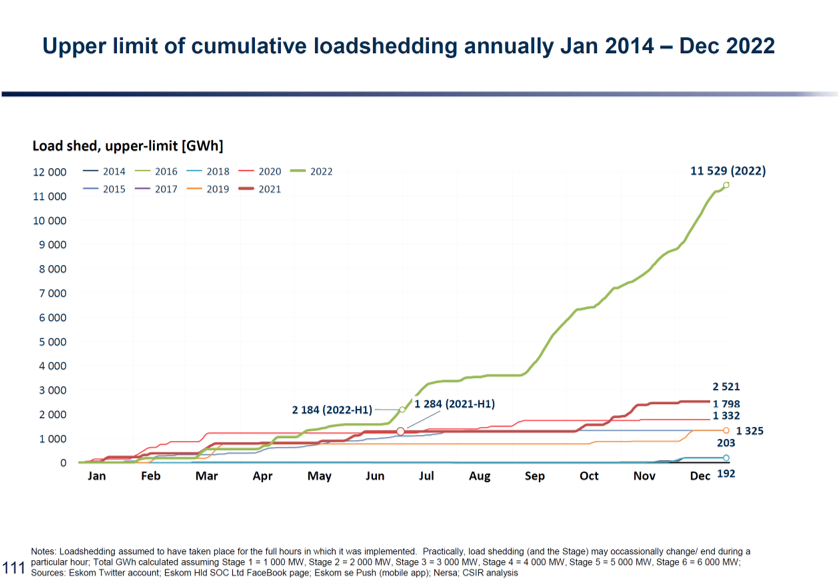

The CSIR’s report shows that despite this increase in installed generation capacity, Eskom’s fleet Energy Availability Factor (EAF) continues to fall and this led to record loadshedding events in 2022, with specific concerns surrounding UCLF (Unplanned Capability Loss Factor) — aka unplanned outages. In 2022, there were 3 773 hours of loadshedding. This was the most intensive year of loadshedding in South Africa’s history.

Loadshedding in 2022 was mostly in Stage 4. This was also the first year that Stage 2 had not been the dominant stage of loadshedding implemented by Eskom since loadshedding started. Eskom’s electricity rationing (loadshedding programme) is structured in “Stages” where Eskom sheds a certain quantum of load from the grid to stabilise the grid. So, depending on the severity of the crisis, loadshedding is implemented in stages from Stage 1 to Stage 8, where Stage 1 sheds 1,000 MW of load from the grid and in a Stage 8 scenario, Eskom takes out 8,000 MW of load from the grid. Loadshedding is implemented over 2-hour or 4-hour blocks on a rotational basis depending on the severity of the crises.

The C&I solar sector in South Africa appears to be moving faster now since the government raised the threshold for companies in South Africa to produce their own electricity without a licence was increased from 1MW to 100MW. In fact, the government has recently removed this upper threshold all together. Due to this progressive policy, in 2022, 1,659 MW of distributed renewable energy capacity was registered with the energy regulator. There were 38 projects registered, including 14 projects above 50 MW. Most of this was registered from the end of Q2. If you compare with just 86 MW registered in 2021, the impact of such progressive policies is crystal clear.

The effects of loadshedding on homes and businesses have been brutal, and the South African Reserve Bank says that during the higher stages of loadshedding, where consumers can experience 12 hours of loadshedding per day, South Africa loses up to R900 million ($50 million) per day. Urgent solutions are needed to stop loadshedding.

In a bid to cushion homes and businesses, South Africa will introduce solar panel tax incentives for homes and will also add new incentives for businesses to adopt renewables from 1 March 2022. Individuals who pay personal income tax can claim the rebate against their tax liability. Individuals will be able to claim a rebate to the value of 25% of the cost of new and unused solar photovoltaic (PV) panels, up to a maximum of R15000 per individual. From 1 March 2023, businesses will be able to reduce their taxable income by 125% of the cost of an investment in renewables. There will be no thresholds on the size of the projects that qualify, and the incentive will be available for two years to stimulate investment in the short term.

South Africa needs to work on all fronts. Boosting Eskom’s fleet Energy Availability Factor (EAF) should be complemented by increasing the pace of installation of utility-scale solar and wind whilst prioritising solving the grid constraints in certain areas to facilitate the integration of these variable renewables. Additionally, they need to increase utility-scale battery storage as well as continue to encourage growth in the C&I and residential solar sectors. These should all be areas to focus on simultaneously.