Workers on an oil drilling rig in Stanton, Texas. US crude stocks increased by 2.4 million barrels last week, the US Energy Information Administration said. AFP

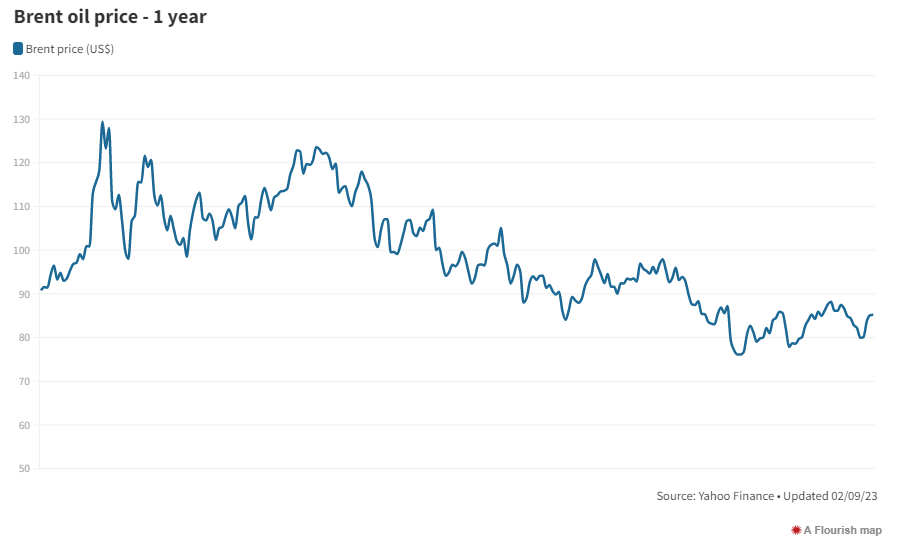

Oil prices were steady in morning trade on Thursday, as a large increase in US crude stocks offset supply concerns.

Brent, the benchmark for two thirds of the world’s oil, was 0.14 per cent higher at $85.21 a barrel at 9.51am UAE time. West Texas Intermediate, the gauge that tracks US crude, was up 0.1 per cent at $78.55 a barrel.

On Wednesday, Brent settled 1.67 per cent higher at $85.09 a barrel and WTI was up 1.72 per cent at $78.47.

“The oil market will likely remain balanced over the short-term, but the risks are clearly to the upside,” said Edward Moya, senior market analyst at Oanda.

Oil did not “get any favours” from the latest US crude report, said Mr Moya.

US crude stocks — an indicator of petroleum demand — increased by 2.4 million barrels last week, the US Energy Information Administration said.

Total petroleum stocks rose by five million barrels and distillate fuel inventories increased by 2.9 million barrels last week.

US oil production rose by 100,000 barrels per day to 12.3 million bpd, its highest since April 2020.

Rising crude inventories in the US weighed on futures last week.

Oil prices fell more than 3 per cent on February 2 after US crude oil and fuel stocks — in the week to January 27 — rose to their highest level since June 2021.

Crude stocks climbed to 452.7 million barrels from 4.4 million barrels, much higher than market expectations of a rise of 400,000 barrels per day to one million bpd.

Oil prices have gained about 6 per cent this week after the closure of a one million bpd oil export terminal in Turkey stoked supply fears.

Turkey has ordered the resumption of oil flows to the Ceyhan terminal after it was found that pipelines and storage tanks were not damaged by a massive earthquake on Monday.

Investors are waiting for clear signs of a fuel demand recovery in China, the world’s second-largest economy and top crude importer, analysts said.

Jet fuel demand has surged since China reopened its borders last month after nearly three years of adhering to a strict zero-Covid policy.

“However, the property and construction segments likely see persisting softness, while other parts of the economy relevant for oil demand, including road travel and chemicals, did not show major activity setbacks last year,” said Norbert Rucker, head of economics and next generation research at Julius Baer.

“The catch-up potential seems more limited than perceived and China’s oil supplies anecdotally are ample.”

China's reopening and a full recovery in the country's domestic demand may raise global output by about 1 per cent this year and lead to a rally in oil prices, Goldman Sachs said in a report this week.

China's economy is forecast to expand 5.2 per cent in 2023 after beating expectations with a 3 per cent acceleration last year, the International Monetary Fund said.