Global oil demand is set to surge to record levels this year as China's economy recovers. Getty

Oil prices were steady in morning trade on Monday as the prospects of a rebound in fuel demand in China offset concerns about a recession.

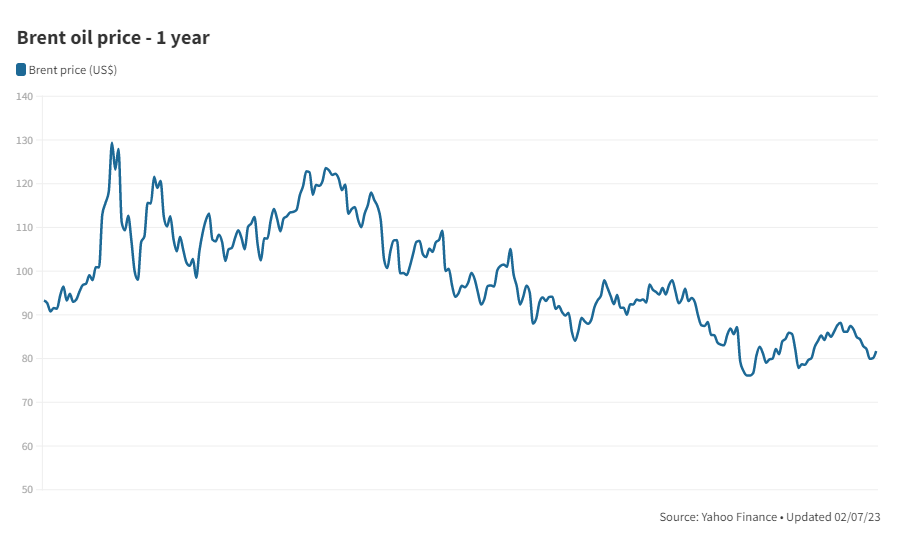

Brent, the benchmark for two thirds of the world’s oil, was 0.33 per cent higher at $80.20 a barrel at 10.48am UAE time.

West Texas Intermediate, the gauge that tracks US crude, was up 0.19 per cent at $73.53 a barrel.

Oil prices fell by about 8 per cent last week after interest rate increases by global central banks and a large build-up in US crude stocks.

“The short-term crude demand outlook should be looking a bit healthier, so this weakness might not last much longer,” said Edward Moya, a senior market analyst at Oanda.

“Brent crude does not belong below the $80 level as the global economic outlook looks like it will be OK for the rest of the quarter.”

The reopening of China, the world's second-largest economy and top crude importer, and a full recovery in the country's domestic demand may raise global output by about 1 per cent in 2023 and lead to a rally in oil prices, according to a report by Goldman Sachs.

The investment bank said the current recovery would add about $15 to the price of Brent, while a more “aggressive” reopening could result in prices increasing by up to $21.

Energy companies may have to reconsider their crude output policies following a demand recovery in China, Fatih Birol, executive director of the International Energy Agency, told Reuters on Sunday.

Global oil demand is set to surge to record levels this year following the end of coronavirus restrictions in the Asian country, according to the agency.

Oil demand will rise by 1.9 million barrels a day to 101.7 million bpd in 2023, compared with the agency's previous forecast of a growth of 1.7 million bpd.

Meanwhile, the Group of Seven advanced economies and the EU agreed to set the price cap at $100 a barrel for products that trade at a premium to crude, such as diesel, and $45 a barrel for products that trade at a discount, such as naphtha and fuel oil.

The price cap comes along with an EU ban on Russian diesel and other refined products.

Diesel is the backbone of global economic activity and markets were already in a deficit before Russia’s invasion of Ukraine began in February last year.

This was due to the closure of 3.5 million bpd of refinery distillation capacity since the start of the Covid-19 pandemic, resulting in a net decline of 1 million bpd, the agency said in a report last year.

Russian oil exports fell by 200,000 bpd in December after an EU crude embargo and a G7 price cap on the country’s crude shipments came into effect, the Paris-based agency said.

At the same time, Russian diesel exports surged to a multiyear high of 1.2 million bpd, of which 720,000 bpd were destined for the EU.