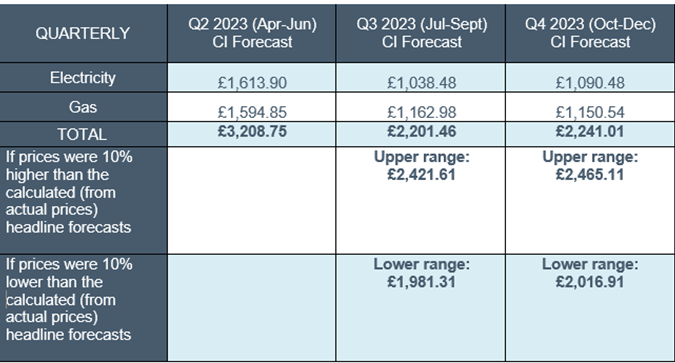

The latest forecasts for the Default Tariff Cap (price cap) released by Cornwall Insight, have shown energy bill predictions for a typical household1 have fallen to £3,208 from April, decreasing further to approximately £2,200 for July-August (Q3 2023) and September-December (Q4 2023). These forecasts are around £300/year lower than our previous forecasts issued on 4 January due to the recent slide in wholesale energy markets.

Our forecasts show prices in the second half of 2023 remaining below the Energy Price Guarantee (EPG) level, and therefore will not cost the government any money from July. With wholesale prices still well above pre-pandemic levels, the lower cost of the scheme is likely to spark conversation on the additional energy bill support the government may now be able to offer households. First and foremost, in the period April to June (Q2 2023) not only does the Energy Price Guarantee (EPG) threshold rise from £2,500 to £3,000 for a typical household, but the £400 Energy Bill Support Scheme ends – both doing so at a time when our forecasts indicate that the Default Tariff Cap will be £3,200.

Thereafter, the political debate is likely to centre on household bills remaining about double the level that they were prior to the recent crisis, but with much less support available. We anticipate a particular emphasis on what this means for lower income and lower middle-income households. Of course, by this stage the government may have developed more enduring reforms to tariffs to address these challenges.

While the energy market outlook has improved markedly from last year, with a mild winter and higher storage levels in Europe causing substantial falls in wholesale rates, prices remain very volatile. The price cap setting for beyond the summer of 2023 is still a fair distance away, and we would expect wholesale prices to move daily before those cap levels are set, so any forecasts should be viewed in that context.

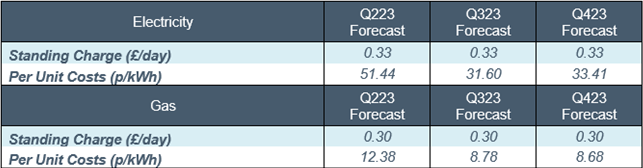

Given the volatility in the wholesale power and gas markets we have seen over the recent period since the Autumn, we are now also including a +/- 10% upper and lower range to the calculated (from actual prices) headline forecasts for the periods beyond March. Unit rates are shown only for the calculated forecasts.

Figure 1: Cornwall Insight’s Default tariff cap forecasts

Source: Cornwall Insight analysis

Figure 2: Default Tariff Price cap forecasts, Per Unit Cost and Standing Charge including VAT (dual fuel, direct debit customer, national average figures

Source: Cornwall Insight analysis

Dr Craig Lowrey, Principal Consultant at Cornwall Insight:

“As our price cap forecasts fall yet again, it is only natural that people will begin to assume our predictions will stay on a downward trajectory. But we really don’t have a precedent to look at to work out how the market will evolve in 2023. Wholesale gas prices in particular are searching out a floor and a ceiling level in novel circumstances where we in the UK and Europe are going to be more dependent on Liquified Natural Gas than ever before.

“Right now, positive gas storage and demand reductions in Europe mean the key winter period of concern is looking better. But, whilst today it is “steady as she goes” it is practically inevitable that forecasts will at some point change again as the market wanders about in search of its equilibrium, probably with lower peaks than last year, but not necessarily prices returning to what we define as normal range. The futures market is still showing historically elevated gas prices, both today even with the good fortune of mild winter weather, but also for the summer when European storage refilling season begins.

“So, some perspective must be maintained. The cap predictions for April remain nearly three times what a typical household was paying pre-pandemic, and as the Energy Price Guarantee rises, some households could be left with hundreds of pounds added to their April bills.

“We do not know what will happen over the coming months and there is a long way to go before anyone can be certain what the true unit rates will be beyond the summer. So, while declining wholesale markets and cap forecasts may be a reason to feel cheerful, nothing is guaranteed in this new European energy market. Reading too much, too early, into prices falling, could be just as risky as reading too much, too early into prices rising. Policy really needs to be “on notice” of sudden changes, and both elastic and responsive in such an environment.”